Silver Trades $80, China Takes Cover, And LBMA Worsens

China, London, and the Breakdown of the Physical Market

Framing the Problem

Authored by GoldFix

Silver’s advance is being mischaracterized as another speculative cycle. The more important signal is not the magnitude of the move, but where stress is emerging. Regional price dislocations, product failures, and abnormal behavior in London’s bullion plumbing all point to a market struggling to intermediate physical demand.

What follows is a convergence. China’s futures premiums, official signaling against hoarding, distortions in a major silver ETF, and widening stress in London’s inter-dealer market are all expressions of the same underlying constraint.

That constraint is physical.

China’s Price Signal Comes First

On Christmas Day, silver futures in Shanghai traded roughly eight dollars per ounce above Western reference prices. The premium widened relative to COMEX and persisted despite limited liquidity elsewhere.

Silver is Currently Trading $79/ounce in Shanghai Futures off its Highs

Such pricing is not incidental. Persistent domestic premiums reflect difficulty sourcing physical silver at prevailing global prices. They indicate demand outpacing availability within the local system.

China’s official explanation has focused on retail hoarding interfering with industrial demand. While that narrative is partially accurate, it does not explain the persistence of the dislocation. China has accumulated commodities strategically for decades. The distinguishing feature of the current episode is that private citizens are participating directly and taking delivery.

That matters in a market where physical buffers are thin.

Signaling, Capital Controls, and a Familiar Pattern

Public messaging in China has shifted. Influential market voices who were previously supportive of silver accumulation are now warning against speculation and hoarding. This shift has occurred alongside rising global attention to silver as a strategic material.

Exclusive: Don't Blame China for Silver Shortage

China Wants to Quell Rumors it is Causing the Problem…

The CCP PRESS RELEASE

Translation:

I. Scope of Matters Accepted by the Discipline Inspection and Supervision Reporting Website:

Reports and accusations regarding violations of Party discipline by Party organizations or Party members, including violations of political discipline, organizational discipline, integrity discipline, mass discipline, work discipline, and life discipline.

Silver has been designated critical by the United States. Russia has increased accumulation. India has discouraged selling while encouraging the use of silver as collateral. The Middle East is preparing silver-linked tokenized instruments. Demand is rising across jurisdictions.

China’s response should be viewed less as reversal and more as signaling. Historically, Chinese commodity cycles follow a consistent pattern. State interest is signaled. Banks accumulate. Prices rise. Public participation accelerates. Once markets overheat, capital controls are applied to cool retail demand. The cycle then resets at a higher level.

Silver is now being treated within this framework, but with a complication. Unlike base metals, silver is monetary, strategic, and already constrained.

Public discouragement of hoarding allows China to maintain international credibility while managing domestic participation. It does not imply an end to accumulation.

ETF Distortion as a Symptom, Not a Resolution

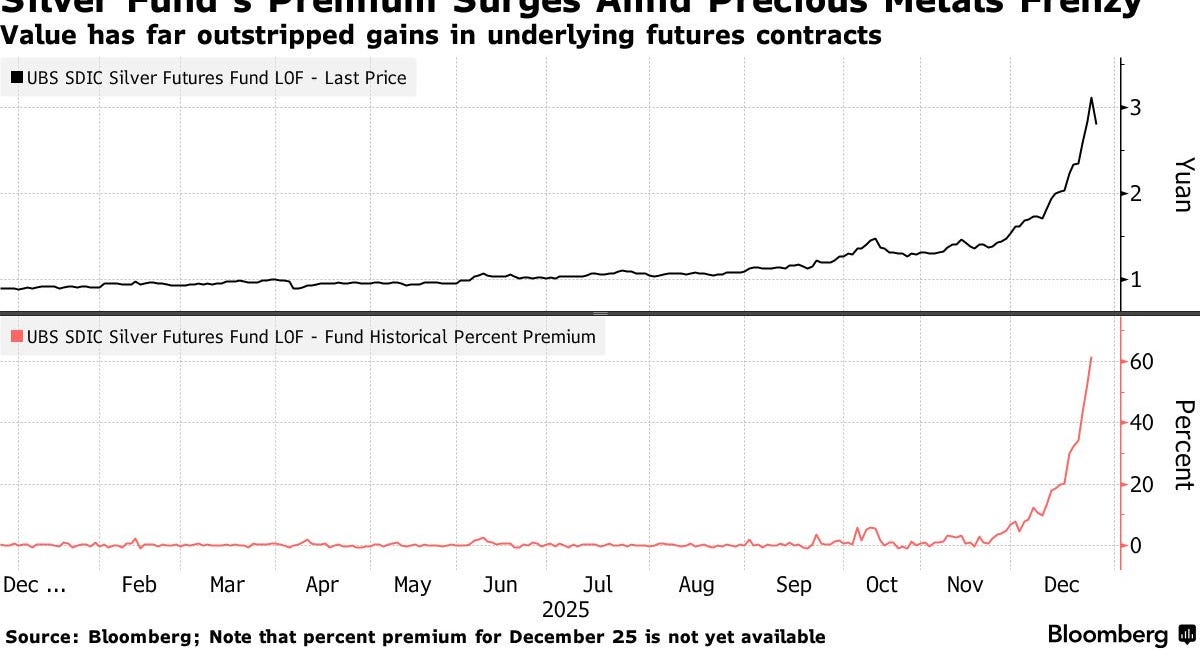

Those constraints are visible in Chinese investment products today. A UBS-managed silver ETF has seen demand surge far beyond the structure’s capacity. The fund does not maintain a one-to-one relationship between shares outstanding and allocated physical silver.

Silver Rises as China Silver ETF Plunges

GFN – SHANGHAI: The value of China’s only pure-play silver fund fell by its maximum daily limit on Thursday, abruptly halting a speculative surge that had prompted repeated warnings from its manager about excessive premiums and downside risk.

As demand increased, the fund’s market price detached from the value of its underlying metal. This dynamic is familiar. Early bitcoin funds exhibited similar distortions when investor demand overwhelmed product design.

Authorities have responded by discouraging additional purchases and pushing investors toward liquidation-only conditions. This is intended to compress the premium between the fund’s price and its underlying assets.

On paper, such measures appear bearish. In practice, they often redirect demand rather than eliminate it. Investors exiting the ETF but seeking continued silver exposure are likely to migrate into futures or physical markets. In the near term, this can intensify pressure on deliverable silver rather than relieve it.

The persistence of Shanghai futures premiums reflects this reallocation.

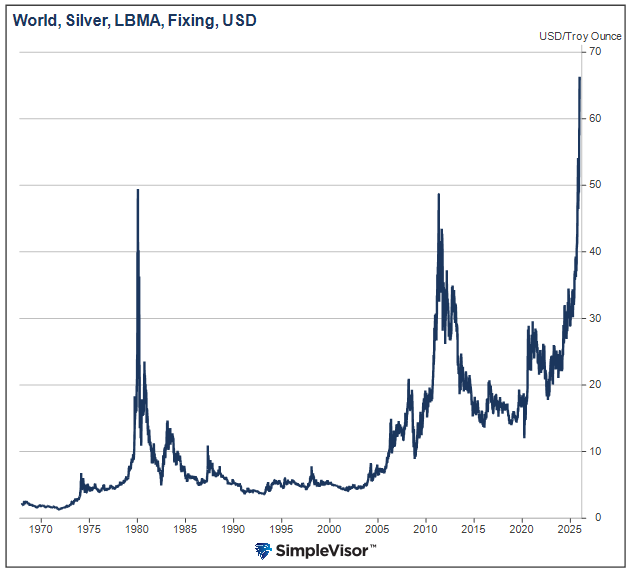

Why This Is Not 1980 or 2011

Historical analogies obscure more than they clarify.

The silver rallies of 1980 and 2011 were driven primarily by speculative positioning. Futures volumes expanded, leverage increased, and very little metal was demanded. Market infrastructure functioned because delivery remained rare.

How The Silver Rally Might End

ESSENTIALLY MARGIN RAISES SHAKE OUT FUTURES BUYERS ON A MARKET THAT IS INCREASINGLY PHYSICALLY DRIVEN WITH RECEDING INTEREST ON ALL FRONTS IN “PROMISES OF METAL” AS SURROGATES FOR PHYSICAL METAL ITSELF.

MARGIN RAISES WILL CONTINUE TO DRIVE OUT WEAKER LEVERAGED LONGS. AS THE SOVEREIGNS BID METALS OUT OF THE PUBLIC’S HANDS. FUTURES ARE DYING AS THEY ARE TOOLS OF GLOBAL TRADE. THIS IS THE POINT OF WHY YOU DO NOT SELL YOUR PHYSICAL..

The current environment is different. Stress is appearing in physical channels. Margin hikes and position limits can reduce leverage, but they do not create bars. They do not resolve scarcity.

The defining feature of this rally is insistence on delivery rather than expansion of leverage.

That distinction shifts attention away from positioning metrics and toward market structure.

London as the Structural Constraint

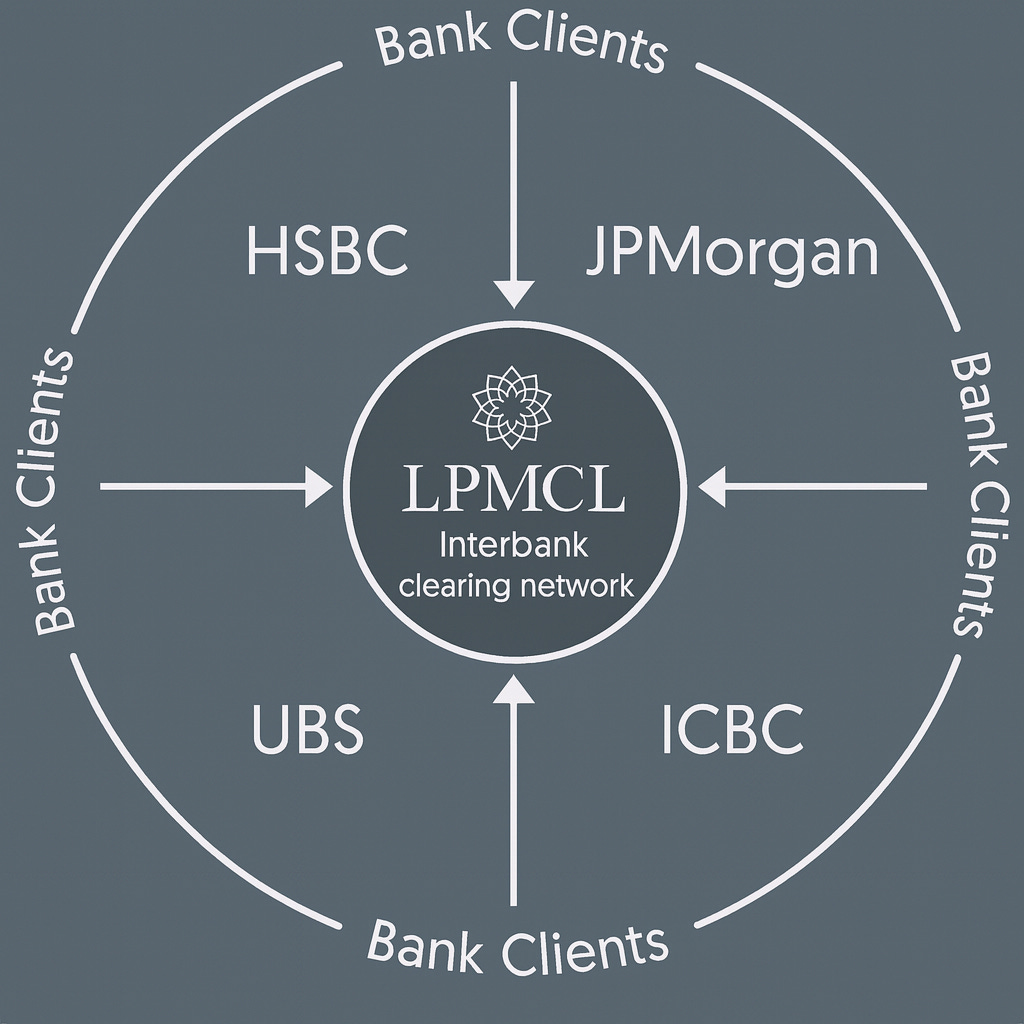

The global silver market ultimately clears through London. More precisely, it clears through a small inter-dealer network dominated by four major banks.

These institutions vault large quantities of silver and lend metal to one another through bilateral agreements. Physical metal rarely moves. Claims are netted through trust, credit lines, and rolling obligations.

The LBMA Scandal and the Exposure of London’s Precious-Metals Hub

Good Morning: Washington is restructuring its monetary base around gold, collateral, and selective devaluation. The emerging system resembles a managed trade network where the dollar remains central to exchange but no longer defines value, marking the quiet evolution of the global reserve framework.

This structure has functioned for decades because delivery demands were low and dispersed. It is not an exchange with centralized enforcement of inventories. It is a trust-based system coordinated by convention rather than physical verification.

The LBMA sets standards and facilitates coordination, but it does not enforce comprehensive physical accountability across dealers. As a result, multiple claims can exist on the same underlying metal.

That arrangement holds until claims are retired and delivery is requested.

Stress is now visible in the silver swap market.

“Swap pricing is signaling scarcity and delay, not abundance.”

Elevated swap costs indicate difficulty sourcing immediate physical silver. This is not a technical anomaly. It is a signal that the inter-dealer network is strained.

When one participant seeks physical metal rather than rolling an obligation, trust alone is insufficient. When multiple participants do so simultaneously, the abstraction fails. At that point, silver ceases to function as a financial instrument and reasserts itself as a physical commodity with discrete, countable inventory.

A Rolling Physical Squeeze

This is not a single short squeeze event. It is a rolling physical squeeze.

Pressure migrates across venues and products. ETF premiums distort. Futures reprice. Swaps widen. Physical premiums persist. No single market needs to fail outright for stress to compound.

Decades of financialization transformed silver into a paper asset optimized for balance-sheet efficiency and arbitrage. That system relied on the assumption that delivery would remain exceptional.

That assumption is now being challenged simultaneously from multiple directions.

China’s premiums, ETF instability, and official signaling are not the cause of the move. They are expressions of it. The constraint lies in London’s ability to intermediate physical demand at scale.

The can has been kicked for decades. The road it is rolling down is now visibly finite.

Continues here