Silver Ripping Faces The F**k Off

Submitted by QTR's Fringe Finance

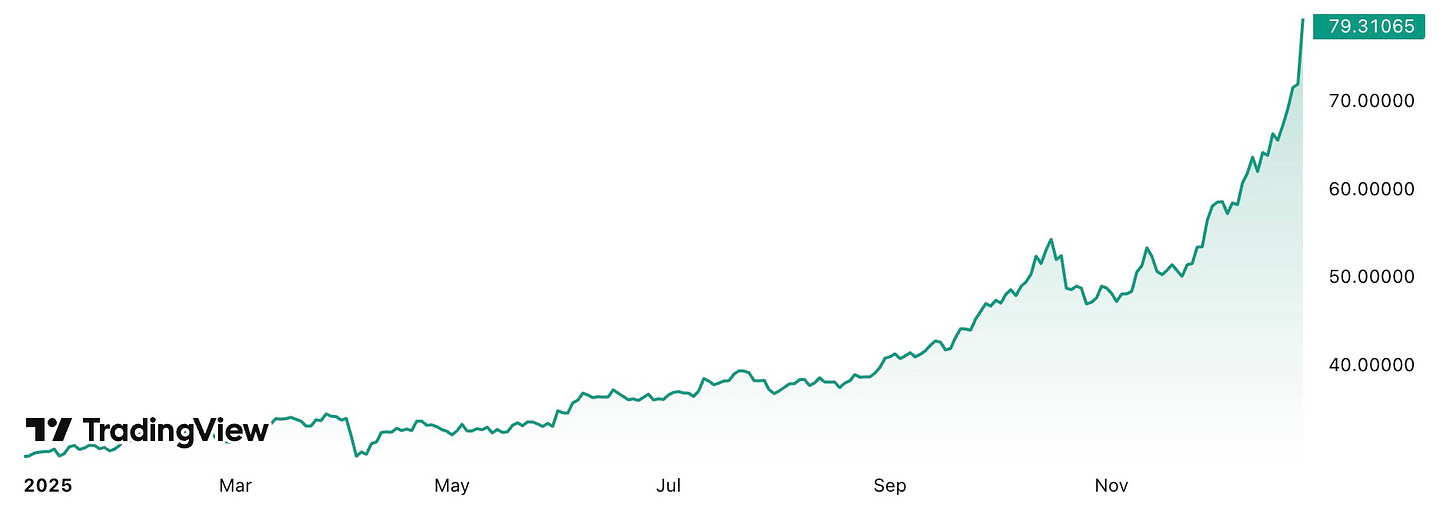

I want to take a walk down memory lane — but before I do, let’s start with Friday, because it was not just “a big day” for silver. It was a statement. It was the kind of violent, undeniable, face-ripping move that doesn’t just show up on a chart, it closes an argument.

Silver didn’t merely rally — it ripped higher in a way that perfectly wrapped up a year where the precious-metals markets have done nothing but confirm what some of us have been warning about for a very long time: the global financial system is fundamentally broken, monetary policy is a farce, and the theoretical scaffolding holding modern finance together is rotting at the seams. I’ve been yammering about this for the better part of 7 years now.

As Zero Hedge deduced on Friday, Silver’s explosive move was the result of a rare convergence of macro forces, market flows, and physical constraints all hitting at once: falling U.S. real yields and growing expectations for Fed cuts pulled investors back into precious metals just as central banks’ relentless gold buying encouraged rotation into silver. At the same time new demand from corporate treasuries and stablecoin firms broadened the buyer base further, silver’s already thin market was made even tighter by mining disruptions and deteriorating ore grades, and rising gold prices pushed retail jewelry buyers to trade down into silver, shrinking available supply.

There was bullish options positioning already in place, speculative derivatives activity accelerated the move and quickly forced a physical chase in a market with limited inventory, turning a strong rally into a squeeze and producing the kind of violent upside move that only occurs when macro tailwinds collide with structural scarcity.

Friday’s move happened after a year of gold making new highs, central banks hoarding metal, currencies quietly losing credibility, deficits exploding, and policymakers pretending they still control outcomes. Friday was the market’s way of saying what Austrian economists have been saying forever: the system can’t be fine if the money is broken — and the money is very clearly broken.

And that’s why this isn’t about being “right on a trade.” This is about being right about the system....(READ THIS FULL ARTICLE 100% FREE HERE).