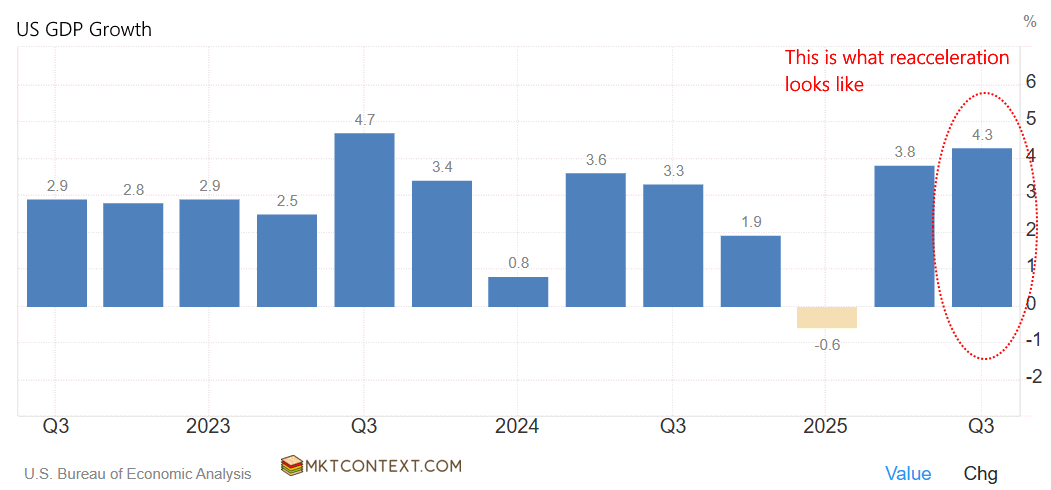

Runaway GDP Growth

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

Last week we got data that says the US economy grew at 4.3%, the strongest in 2 years. It was driven by consumer spending in services and recreational goods (mostly high income earners) and AI investments. This bodes well for our economic reacceleration thesis that we’ve been talking about ad nauseum.

2026 will be a story of strong fiscal spending continuing to boost economic growth. On the one hand you have the One Big Beautiful Bill which takes effect on Jan 1 and will add as much as 1% to GDP growth. This gives big tax breaks to the lowest income cohort of Americans, and also allows businesses to pay less taxes on capital expenses such as investments and R&D.

On the other hand, there are big fiscal spending plans coming. Trump has steered money towards AI, defense, space, critical minerals, energy, etc. There is a $1776 warrior dividend being paid to military members, and a potential $2000 tariff refund to low-income families.

Doubters say fiscal stimulus has been declining since Covid, but we think it’s only just begun. Politicians have come to understand fiscal spending is hugely popular, even if it collides with long-term austerity plans. As history has showed again and again, this will be a major tailwind for the economy and stock markets.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!