Silver Reckoning: US Squeezing China Out of LATAM?

Contents

- China’s Five-Year Offtake Strategy

- The U.S. Response Begins at the Refinery Level

- The Significance of Vanishing Hedges

- China’s Bid for Finished Metal

- Section 232 and the Mechanics of Price Before Policy

- Silver’s Role as Brics Collateral

- A Hemispheric Realignment

- Conclusion

- CHINA SILVER PRICE IS GLOBAL PRICE NOW

Follow up analysis to the podcast with Eric Yeung yesterday

Silver, Supply Chains, and the Reassertion of the Monroe Doctrine

Authored by GoldFix

Silver has been the most suppressed asset on earth, and it therefore has the most to gain. Below we explain what we believe is happening behind the price action and why it should continue for quite some time.

Executive Summary

Silver’s recent price behavior is not the result of speculative enthusiasm or retail excess. It reflects a structural contest over natural resources in the Western Hemisphere, as the United States moves to displace China from Latin American supply chains. What appears as volatility is the market registering a geopolitical realignment already underway.

Silver is not moving because of speculation. It is moving because control over supply chains is changing.

I. China’s Five-Year Offtake Strategy

For roughly the past five years, China has pursued a deliberate strategy of acquiring raw materials directly from source. In Latin America, this meant buying silver, precious metals, and base metals in concentrate or doré form directly from mines, bypassing traditional market channels.

This strategy concentrated heavily in Latin America. Producers were offered higher prices for raw material and long-term certainty. Many accepted. Over time, visible supply chains thinned, while price signals became increasingly detached from physical availability.

During this period, the United States failed to respond. Supply chain control eroded gradually, not through collapse, but through neglect.

China was not buying silver at market prices. It was buying supply before markets ever saw it.

“China’s Upstream Offtake Model”

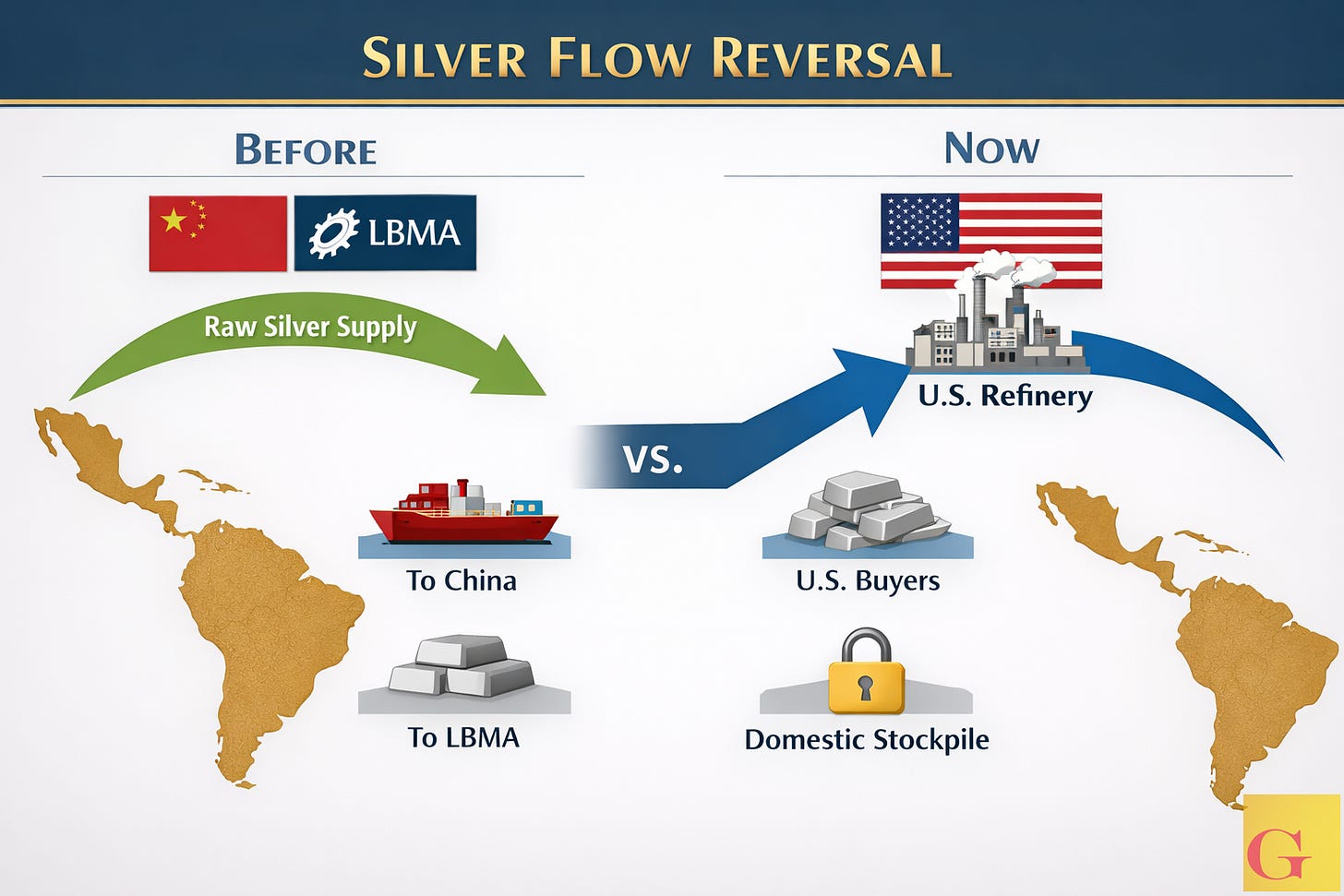

II. The U.S. Response Begins at the Refinery Level

The shift in U.S. posture did not begin with an executive order. It began with physical bottlenecks from as far back as last year

U.S. refiners are now receiving unusually large volumes of silver concentrate from Latin America, to the point where refining capacity is overwhelmed. Material is arriving faster than it can be processed. This is a meaningful change.

Historically, much of this metal would have been refined for delivery into London or shipped onward to Asia. Instead, it is remaining in the United States.

At the same time, large U.S. buyers are securing offtake directly from producers. The United States is now doing in Latin America what China had been doing for years, only at greater speed and with greater urgency.

Price is not leading this shift. Control is.

The metal is arriving faster than it can be refined. That is not a price signal. That is a supply signal.

“Silver Flow Reversal”

III. The Significance of Vanishing Hedges

One of the clearest indicators that the market structure has changed is the disappearance of hedging.

Under normal conditions, unrefined silver entering the system would be hedged. Price exposure would be transferred. Risk would be managed. That behavior has materially declined.

The absence of hedging signals that buyers do not want price protection. They want the metal itself.

This distinction matters. Commercial inventory behaves differently than strategic inventory. When hedging disappears, price becomes secondary to access.

Whether this accumulation is being done directly for government purposes or indirectly through systemically important intermediaries is beside the point. The effect is the same. Physical silver is being absorbed without regard to short-term volatility.

Markets register this long before policy becomes explicit.

When hedging disappears, price no longer matters. Access does.

IV. China’s Bid for Finished Metal

As access to raw offtake tightens, China’s behavior has begun to shift.

Reports of Chinese buyers seeking finished LATAM silver at elevated prices suggest concern over supply continuity. Finished metal reflects control over refining, logistics, and delivery, not just access to ore.

This matters because China historically relied on upstream control. Requests for finished product imply that upstream access is no longer sufficient.

At the same time, China has announced intentions to restrict silver exports beginning next year. This follows a familiar pattern. When supply security weakens, export controls appear.

This is not speculative behavior. It is defensive positioning.

A bid for finished silver is an admission that upstream control is no longer enough.

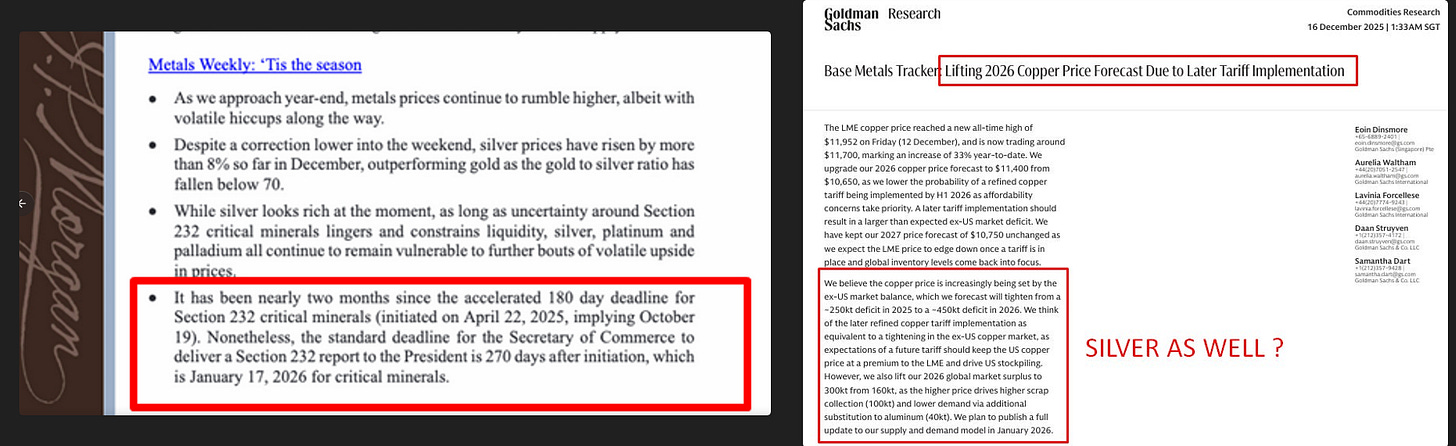

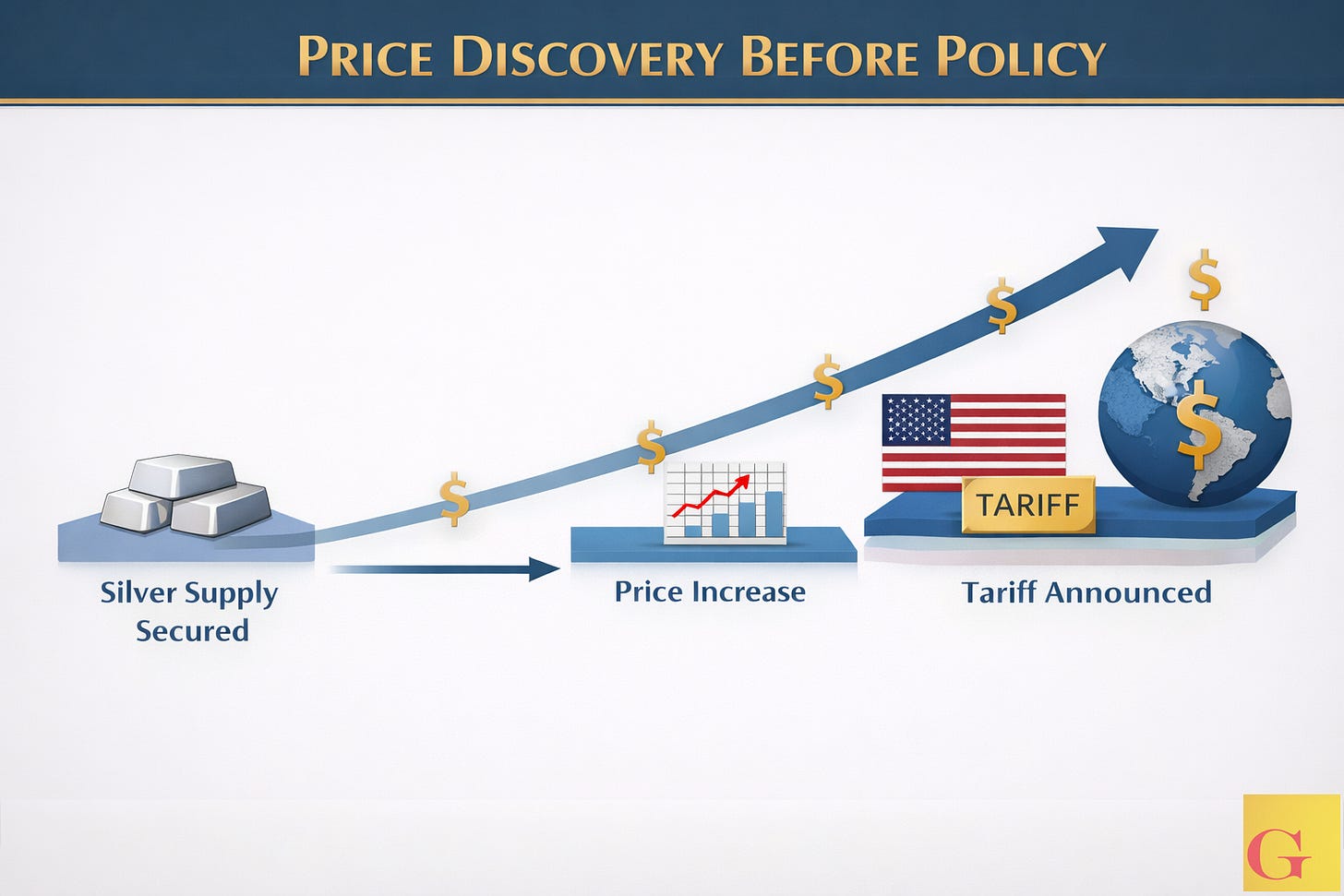

V. Section 232 and the Mechanics of Price Before Policy

Tariffs are often misunderstood as policy shocks. In reality, they tend to arrive after markets have already adjusted.

Under Section 232, the United States does not restrict commodities it still needs to accumulate. Tariffs follow supply security, not the other way around.

This explains why silver prices can rise sharply in the absence of explicit announcements. Markets front-run future constraints.

Once domestic and hemispheric supply chains are deemed sufficient, pricing mechanisms change. Tariffs need not target silver explicitly to reshape its price. Broad commodity measures are enough.

JPM and GS on 232 Risks 232…

Because the United States remains the marginal buyer at scale, its pricing decisions propagate globally. The tariff level becomes the reference price, as sellers rationally seek the highest available bid.

You do not tariff what you still need. You tariff what you already control.

“Price Discovery Before Policy”

VI. Silver’s Role as Brics Collateral

China’s interest in silver should not be mistaken for an attempt to remonetize it.

Silver is poorly suited to serve as circulating money (even though practically speaking its perfect) due to its industrial consumption. History demonstrates that attempts to remonetize silver invite massive pushback

Its role is different.

As global trade shifts away from dollar-based settlement, collateral becomes more important. Gold fulfills this function, but gold is finite and increasingly encumbered. Silver occupies the next tier.

It is tangible, widely accepted, and divisible, while remaining embedded in industrial supply chains. That dual role creates tension, but it also creates strategic value.

Silver is not money. It is balance sheet collateral in a de-dollarizing system.

Silver does not need to be money to matter. It needs to be collateral.

Silver: Someone Blew-Up Last Night.

— VBL’s Ghost (@Sorenthek) December 29, 2025

Good morning. Last night could have been possibly the most monumentally volatile evening in the history of silver trading for sure, and possibly in any market. Purported to be just a pet rock.https://t.co/GeIgV3cPL7

Remaining Sections:

- Silver’s Role as Brics Collateral

- A Hemispheric Realignment

- Conclusion

- CHINA SILVER PRICE IS GLOBAL PRICE NOW

Continues here with Podcast