These Are The Stocks I Love For 2026

Submitted by QTR's Fringe Finance

This past week I released Part 1 and Part 2 of my 26 Stocks I’m Watching For 2026.

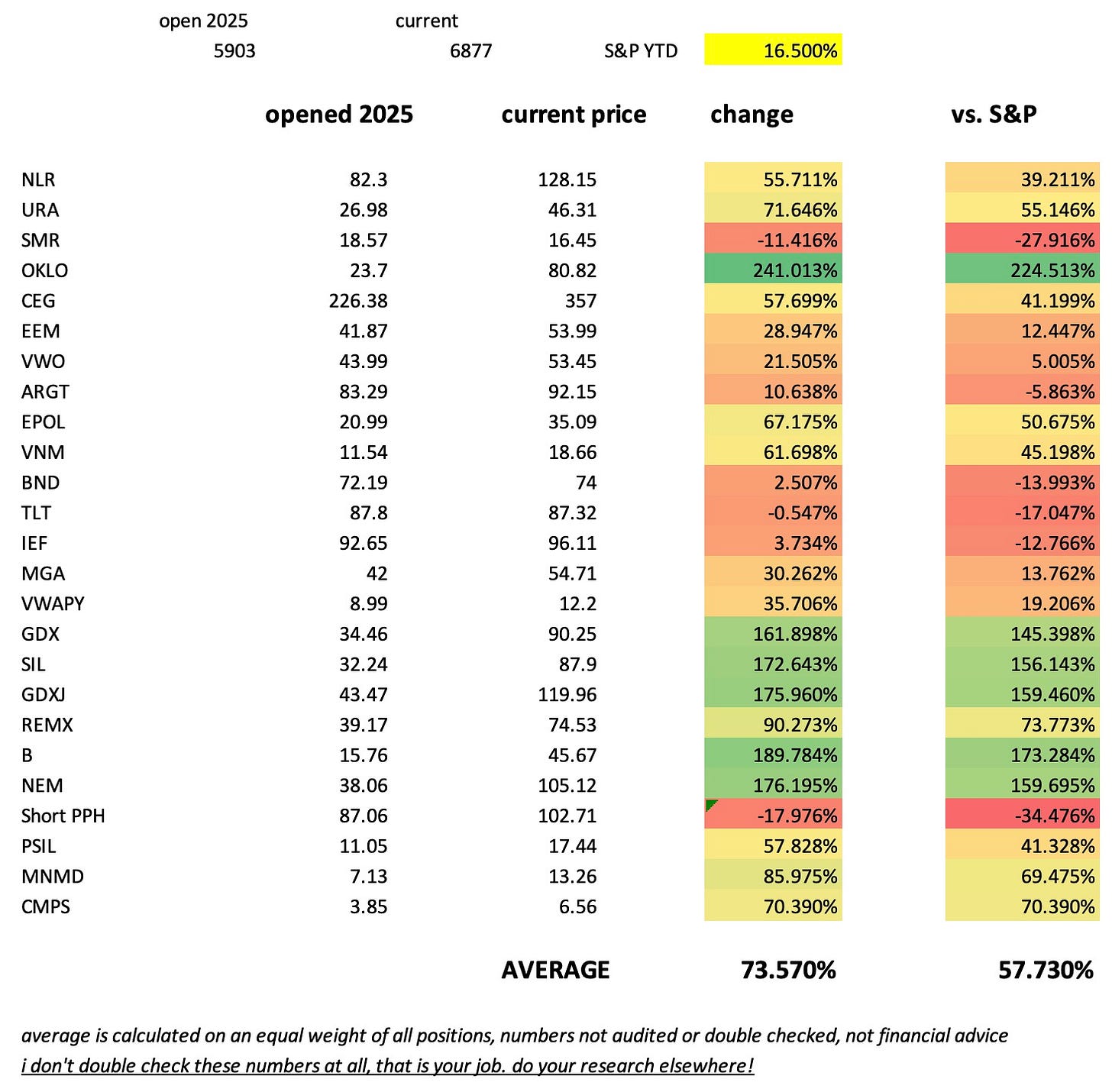

Both posts cover a wrap up of our 2025 stocks, my macro analysis and risks I see heading into the new year for free. As shown in those posts, my 25 Stocks I’m Watching for 2025 wound up beating the S&P 500 on a combined equal weighted basis by about 57% this year*.

2026 already feels like one of those years where the market smiles at you while quietly reaching for your wallet. Everyone keeps pretending things are “fine,” valuations are in the f*cking stratosphere, and economic undercurrents keep suggesting to me that this isn’t a normal market anymore.

That’s why I just released my full 26 Stocks I’m Watching for 2026.

🔥 80% OFF IF YOU SUBSCRIBE TODAY: Get 80% off an annual subscription if you subscribe today — a discount you keep for as long as you wish to remain a subscriber. You get my full 26 Stocks I’m Watching for 2026 list and a wide array of toilet humor mixed with rudimentary equity analysis throughout the year: Get 80% off forever

Last year made one thing painfully clear: most market commentary is just people narrating price action after the fact. While the crowd obsessed over bullshit “analysis” on crypto, bowing at the altar of modern monetary theory and every type of cash burning turd of company one could find, the blog’s 2025 portfolio focused on where capital was actually moving, where supply was constrained, and where the setup was asymmetric. While in past years I’ve lagged the S&P, this year my approach didn’t just work — it embarrassed the benchmark. Can I continue in 2026? Who the hell knows.

Here’s how we did (as of mid-trading-day on December 22, 2025):

What I do know is that heading into 2026, the contradictions are even louder. The consumer is stretched thin, debt is everywhere, liquidity is drying up, and yet markets still price assets as if discomfort has been permanently removed from the system. Crypto is now wired directly into the financial bloodstream, geopolitics keeps rearranging incentives in the background, and passive flows look sturdy until the moment they aren’t…and we’re starting to see increasing job losses heading into 2026.

To me, this environment isn’t about calling crashes or chasing melt-ups. It’s about building a portfolio that can outperform while the rest of the market is busy arguing over which narrative is currently trending. The 26-stock 2026 list is built around that reality — not hype, not hope, and not the assumption that the old rules still apply. I don’t care what the S&P does, as long as I hopefully outperform it.

The objective is simple: beat the S&P over time, whether the market rips, stalls, or quietly comes apart at the seams. No hero calls, no promises, no fantasy forecasts.

Here’s what else is new on the blog:

The Dollar’s Death In 2026 Is Now A Mainstream Talking Point

Comex: Physical Silver Demand Keeps the Market in Backwardation

*numbers not double checked, price levels not total returns, was best effort as of 12/19/25 prior to the cash open, do your research elsewhere

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.