Financed by JPMorgan, Jointly Owned by US DoD

Under the plan, the U.S. Department of Defense will hold a 40% stake in the JPM Financed smelter joint-venture.

GFN – WASHINGTON: Korea Zinc plans a $7.4 billion investment to construct a large-scale non-ferrous metals smelter in Clarksville, Tennessee, a project U.S. officials say will materially expand domestic critical minerals processing capacity and strengthen supply chain security.1

The project, known as the “U.S. Smelter,” is expected to require approximately $6.6 billion in capital expenditures, with total investment reaching $7.4 billion including financing costs. It is being developed in coordination with the U.S. Department of War and the U.S. Department of Commerce, according to project materials and government statements.

Deputy Secretary of War Steve Feinberg said the investment reflects a strategic shift in U.S. industrial and defense priorities.

“President Trump has directed his Administration to prioritize critical minerals as essential to America’s defense and economic security,” Feinberg said.

“The Department of War’s conditional investment of $1.4 billion to build the first U.S.-based zinc smelter and critical minerals processing facility since the 1970s reverses decades of industrial decline. The new smelter in Tennessee creates 750 American jobs and expands access to strategic minerals across aerospace, defense, electronics, and advanced manufacturing.”

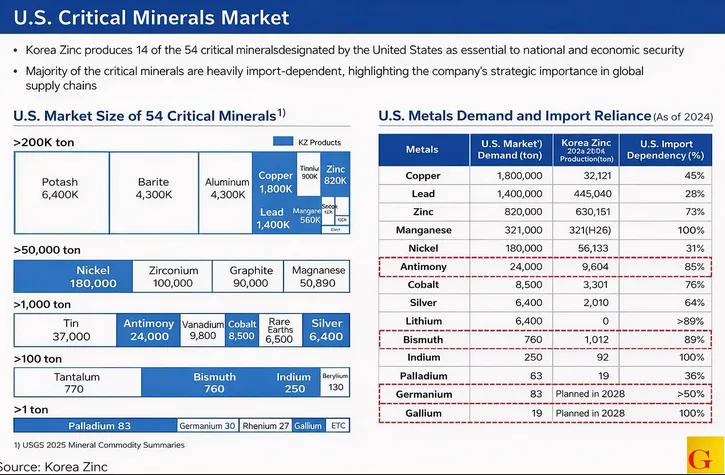

The Tennessee facility will be the first zinc refinery built in the United States in more than 50 years and will operate as an integrated smelter capable of producing 13 non-ferrous metals. Most of these materials are designated as critical minerals by the U.S. government due to their role in defense production, advanced electronics, and energy systems.

Under the current framework, the Department of War will arrange approximately $2.15 billion in financing alongside private investors. The Department of Commerce will provide $210 million in funding under the CHIPS Act to support domestically sourced equipment, with JPMorgan assisting in structuring the financing.

U.S. officials have described the project as an example of allied cooperation to secure supply chains amid rising competition for strategic resources. Josh Phair, founder and CEO of Scottsdale Mint, said in a recent Yahoo Finance interview, “We’re in a metals war’. and securing supply is crucial now

Secretary of Commerce Howard Lutnick said the investment would expand U.S. production of strategically important minerals.

“Korea Zinc’s critical minerals project in Tennessee is a transformational deal for America,” Lutnick said.

“The United States will produce, in volume, 13 critical and strategic minerals vital to aerospace and defense, semiconductors, AI, quantum computing, autos, industrials, and national security.”

Korea Zinc plans to deploy technical personnel and operational expertise from its Onsan Smelter in Ulsan, South Korea, during early project phases. Onsan is the world’s largest single-site non-ferrous smelting complex and is known for processing low-grade and complex materials, including scrap with high impurity content.

Silver: Dept. of War to Build Metals Refinery in Blow to China. pic.twitter.com/iBEHn8NDAZ

— VBL’s Ghost (@Sorenthek) January 5, 2026

Company officials said transferring this integrated zinc-lead-copper processing capability is intended to reduce commissioning risk and position the Clarksville facility among the most advanced smelters globally. Producing within the United States is also expected to reduce exposure to trade restrictions and logistics disruptions while enabling local sourcing of scrap and raw materials.

Despite government backing, the project has prompted shareholder resistance. An alliance led by MBK Partners and Young Poong has opposed the U.S.-backed joint venture, citing concerns over potential share dilution and governance control. The group has indicated it may seek legal action to block new share issuance.

Korea Zinc shares rose more than 26% following the project announcement before declining by over 13% as shareholder opposition became public.

Once fully operational, the U.S. Smelter is expected to process approximately 1.1 million tons of raw materials annually and roduce roughly 540,000 tons of finished products.

Planned output includes base metals such as zinc, lead, and copper; precious metals including gold and silver; strategic minerals such as antimony, indium, bismuth, tellurium, cadmium, gallium, germanium, and palladium; and chemical products including sulfuric acid and semiconductor-grade sulfuric acid.

According to project disclosures, 11 of the 13 metals qualify as critical minerals under the 2025 U.S. Geological Survey list. Several, including indium and gallium, are fully import-dependent in the United States.

Site preparation is scheduled to begin in 2026, followed by full construction in 2027. Phased commercial operations are expected to start in 2029, initially focused on zinc, lead, and copper production.

Clarksville was selected due to existing industrial infrastructure, including Nyrstar’s current zinc smelter, the only operating zinc refinery in the United States. Korea Zinc plans to acquire Nyrstar’s U.S. operations, subject to conditions, dismantle the existing facility, and replace it with a larger, modern plant.

Project planners also cited strong transportation links, favorable site conditions, a skilled local workforce with decades of smelting experience, and relatively low electricity costs, a key factor in smelting economics.

Chairman Yun B. Choi said the project aligns with long-term U.S. and South Korean economic security objectives.

“With its project in the United States, Korea Zinc will strengthen its role as a strategic supplier of essential minerals for aerospace and defense,” Choi said.

“This project will serve as a model for U.S.–ROK economic security cooperation at a time of heightened geopolitical risk.”

GoldFix Analysis: Why the Tennessee Smelter Matters

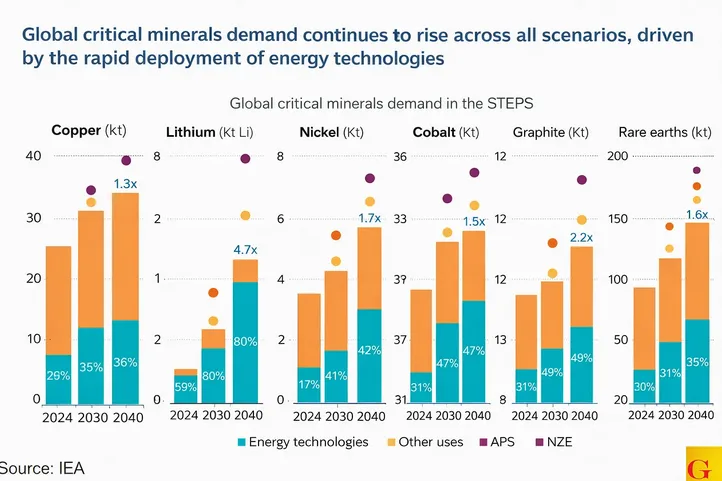

The Korea Zinc investment fits into a broader pattern across commodities, trade policy, and financial market structure. Recent developments point toward a renewed emphasis on supply security and domestic control over critical industrial inputs.

**Silver Reckoning: The US is Squeezing China Out

Silver’s recent price behavior is not the result of speculative enthusiasm or retail excess. It reflects a structural contest over natural resources in the Western Hemisphere, as the United States moves to displace China from Latin American supply chains. What appears as volatility is the market registering a geopolitical realignment already underway. Read full story

U.S. policy has increasingly focused on securing domestic processing capacity for materials already designated as critical. Mining location remains relevant, but refining and smelting capacity determines throughput control, resilience under stress, and bargaining leverage. The Tennessee project expands that capacity inside the United States for materials that have largely been processed offshore.