Consumer Conundrum

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

GDP data released last week showed the economy is growing at 4.3%. The driving force was personal consumption (i.e. household spending) which rose 3.5%; way above expectation. Good news right?

What’s unusual is that consumer sentiment is in the gutter. Sentiment surveys drawn from the University of Michigan and the Conference Board (chart below) show that consumers have never felt worse. Typically there should be a strong correlation between spending and sentiment. Makes sense — when people feel good about their financial situation, they buy stuff.

So why are people spending so much and still feeling bad? There are three main culprits at play here.

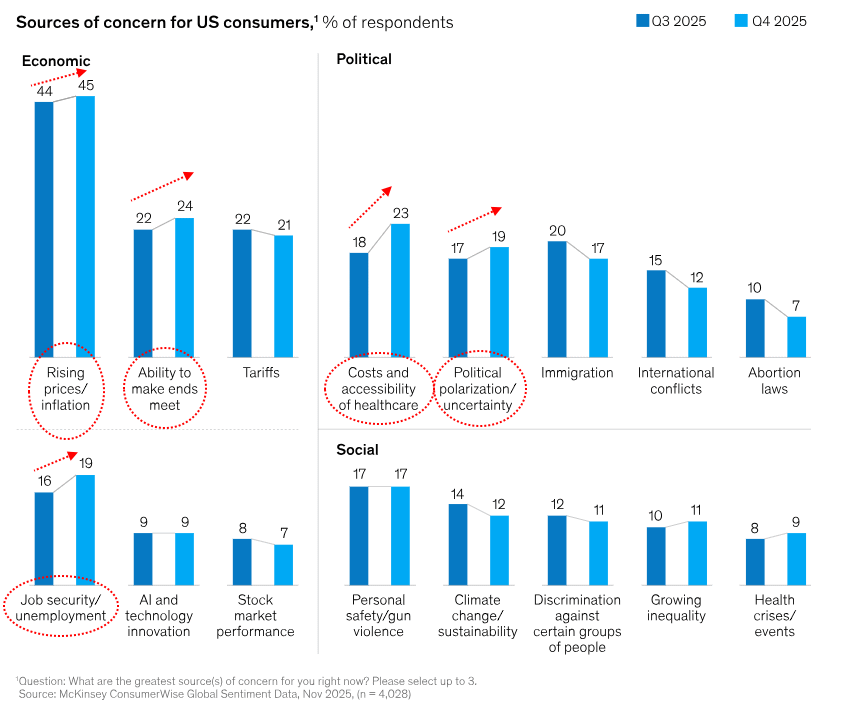

Inflation. Even though the inflation rate is slowing, the cumulative price increases over the past several years is drastic. Prices across the board have increased 30% since 2020.

Jobs. As we’ve covered ad nauseum in this blog, the labor market is weakening slowly but surely.

Political uncertainty. People are unsure of political leadership, though this is more of a “vibes” thing than economic fear.

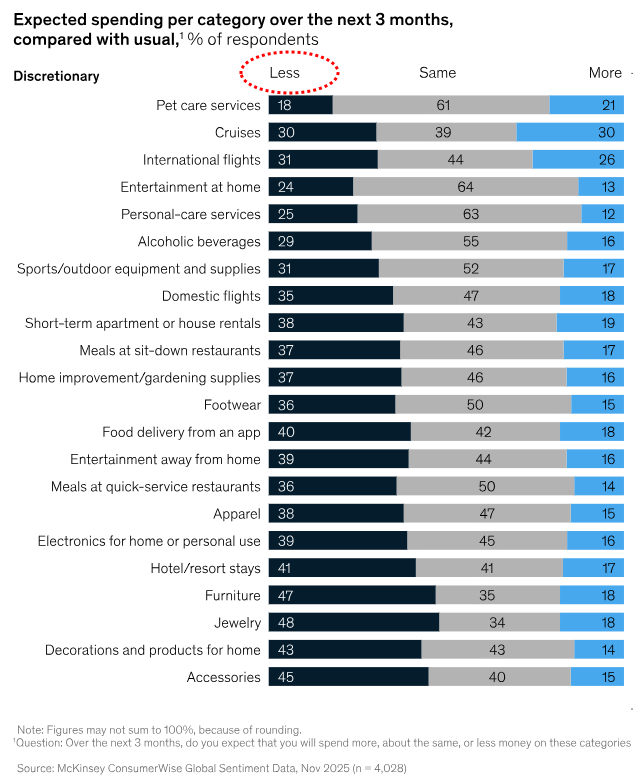

There are other effects as well. The mix of spending is leaning towards non-discretionary items like housing, healthcare, insurance, and basic groceries. These expenses are unavoidable, not confidence-driven buys. This chart from McKinsey shows that nearly all discretionary items are getting reduced:

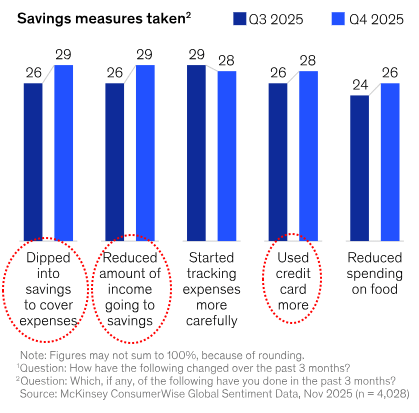

Household finances are changing. If jobs are weak but spending is high, the money has to come from somewhere — people are dipping into savings and pulling on credit cards. That’s precisely what we’re seeing in the data (below). Needless to say, these sources of funds don’t last forever.

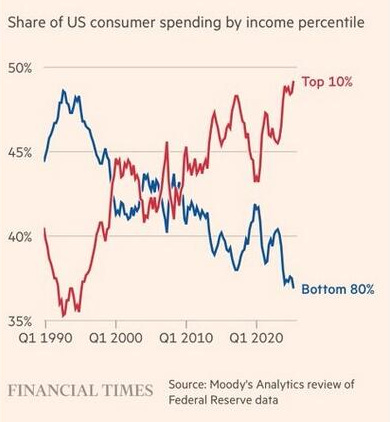

Lastly, the “K-shaped economy” is playing a role. Nearly half of the spending is done by the top 10% of earners, which has climbed steadily in recent years.

The devil is always in the details, and unfortunately this means the consumer sentiment survey (a form of “soft” data as opposed to hard quantifiable metrics) has lost its signal for predicting economic health.

The big question: Can consumer spending remain high while moods continue to sour? The picture we’ve painted thus far looks troublesome, but it’s not going to collapse immediately. We think it can still persist for some time, so long as the job market erodes slowly without falling off a cliff. Household debt levels in the US are still relatively low, so the draw on savings and debt can continue. Meanwhile, a rising stock market will support high-income spending for some time.