Will Index Rebalancing Kill Silver's Rally?

Rebalancing Noise(?) in a Physical Market

Authored by GoldFix

That note begins with:

Over a month ago, before its exponential year-end meltup and when silver was trading at about half its current spot price, we laid out the bullish case for silver in "No Longer Gold's Quiet Sidecar": Silver Surges To Record High As China Demand Exacerbates Squeeze, which materialized just days later, sparking the a record-breaking surge for the precious metal. However, after the move which also saw unprecedented retail and ETF, not to mention market maker euphoria, it may now be time to cash out some chips.

ZH then synthesizes three separate research notes.Their breakdown of the situation is perfect actually. The question is not whether selling pressure exists. It does. The question is whether that pressure is decisive, or merely mechanical. This podcast and write up aim to demystify these rebalancing acts such as they are

ZeroHedge Asks: Will Index Rebalancing Kill The Silver Rally? pic.twitter.com/n8igF1l5uQ

— VBL’s Ghost (@Sorenthek) January 8, 2026

The Bloomberg Commodity Index and Known Selling

The core of the bearish argument rests on the annual Bloomberg Commodity Index rebalancing, scheduled for the second week of January. One of the notes, from Dan Ghali, argues that roughly 13 percent of ETF longs will be sold as part of this process.

That statement is directionally correct. The index does rebalance every year. It does force selling. What makes this iteration louder than usual is tone.

“Ghali is alarmingly bearish. I should say alarmist bearish.”

The rebalancing is not a surprise. It never is. It happens every year between January 5 and January 15.Consider restructuring positioning around it and exit speculative longs by January 5 precisely because rebalancing and post-New Year position reversals create predictable friction.

“This may be new to you. It is not new to me. It happens every year.”

This is not a call that silver must fall until February. It is a recognition that the easy money in buy season is made between November and January 1. Beyond that, price action becomes less forgiving, with wider swings in both directions.

Historical Context Matters

The second note referenced by Zero Hedge comes from Deutsche Bank. It is materially different in tone. It is a historical back-test of Bloomberg rebalancing effects, not a directional call.

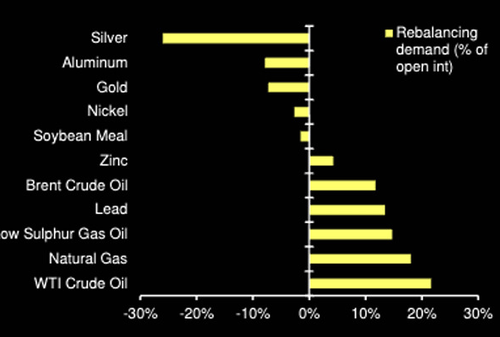

The mechanics are straightforward. Commodities that have outperformed are trimmed. Capital is rotated into laggards. This year, silver and gold are sold. Oil and natural gas are bought.

“They do not tell you the market’s going down. They say, this is the data. Be aware of it.”

This distinction matters. Rebalancing is not a death sentence for a market. Last year provides a clean example. Gold was the top-performing commodity in 2024. Gold was rebalanced. Gold went higher anyway

“Rebalancing is not a death knell for a market. It can be an accelerant if people believe in it.”

Because the rebalancing is known in advance, it tends to behave like any other widely anticipated event. The move happens into the announcement, not after it. By the time the selling actually hits, much of the adjustment has already been discounted.

Mechanical Interventions Do Not Set Direction

There is an axiom we return to whenever market commentary starts to feel destabilizing.

“Interventions do not determine direction of a market. Interventions can only speed up or slow down.”

A mechanical rollover can dampen a rally or accelerate a selloff, but only in the direction the market was already traveling. In a bull market, it creates noise and volatility. In a bear market, it deepens weakness. It does not reverse structural forces.

Technically, silver has pulled back from recent highs. It failed to break into a new measured move. That tells us sellers are present. It does not tell us why.

“As a technician, you look at it and say, I don’t give a shit about the news item. You’re still in the range.”

The selling could be gamma-related. It could be index-related. It could be desk-driven. The explanation matters less than the structure.

The Physical Counterweight

The third report referenced, from Goldman Sachs, addresses the part most flow-based analyses omit.

“This is not about futures/ ETF flows. This is about physical flows.”

Goldman’s conclusion is simple. Any selloff driven by rebalancing would be temporary because physical demand for both gold and silver remains intact. If price drops, the market will discover who is willing to buy it.

This is where desk behavior matters. When banks were structurally short, they leaned into weakness. Those days are gone.

“How much lower will we let it go before we buy it? That’s the question.”

There are not many speculative futures longs left in the U.S. They have migrated to ETFs. China, meanwhile, is seeing growing participation. The rebalancing will force ETF selling, but it will not eliminate underlying demand.

Continues here with full podcast