China Competing With India for LatAm Solar-Silver

China Is Soaking Up All The Silver & Making It Difficult For India To Get What They Need For Manufacturing'

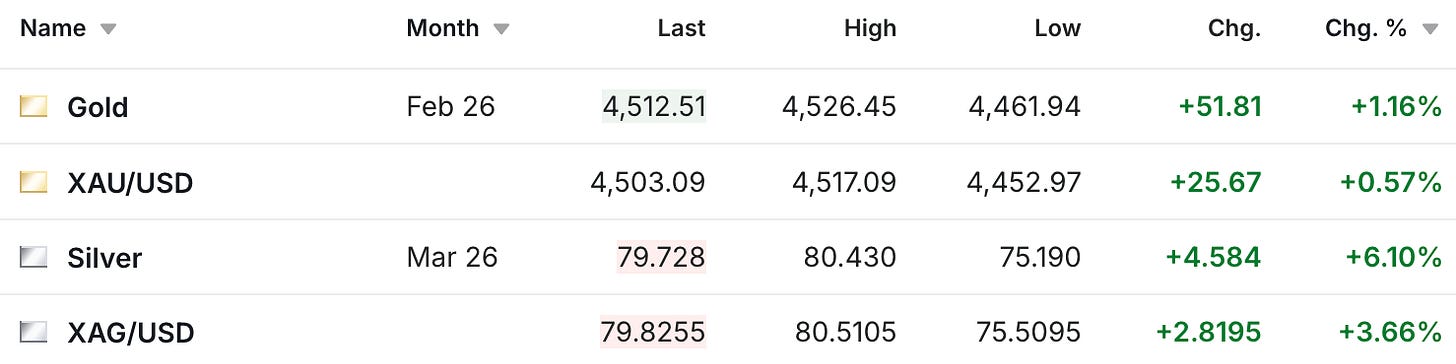

The gold and silver prices are up on another volatile Friday, with silver even trading back over $80 per ounce earlier in the session.

It feels like it’s been a while since we’ve seen a calm week in the precious metals markets, yet given the current conditions in the world, I’m personally expecting the volatility to continue. Although even with that said, it’s still rather stunning to see that a regular daily move in the silver price is now up or down $3-$5.

The December labor report was released this morning, and the payroll number came in lower than expected.

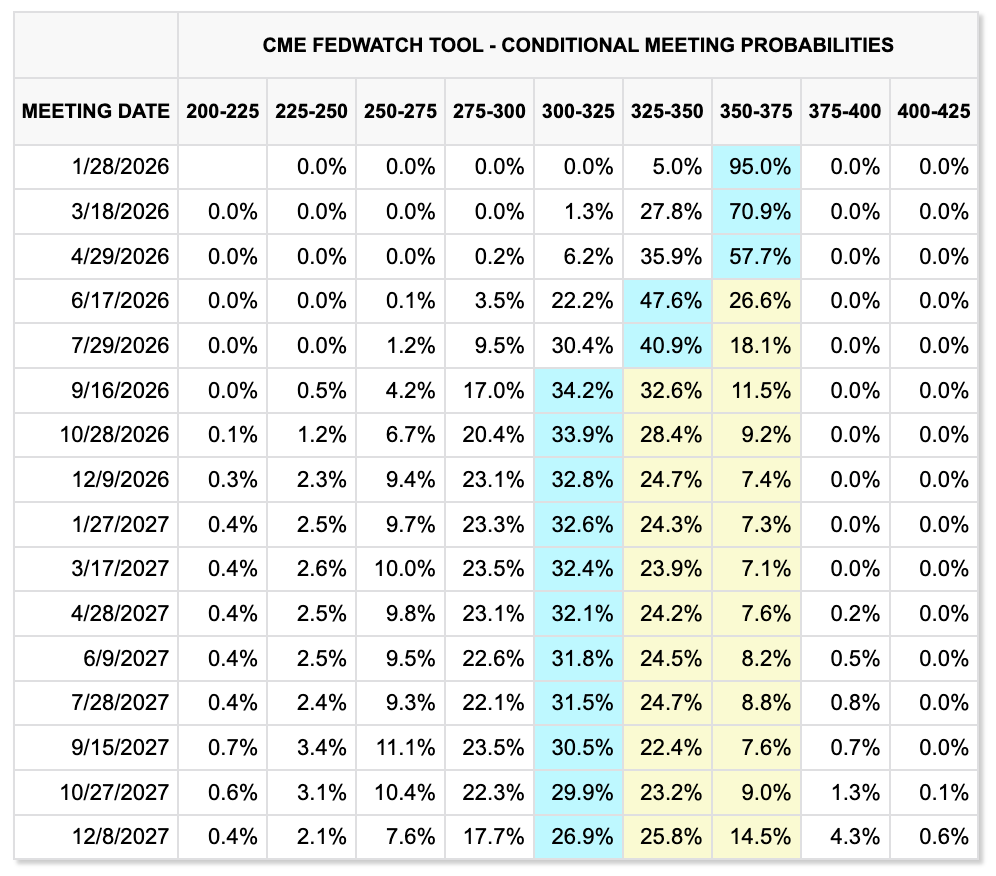

In one sense, that would theoretically lead to a higher probability of future Federal Reserve rate cuts. Although as of about 12:30 p.m. on Friday, there hasn’t been a substantial change in what the futures are currently pricing in.

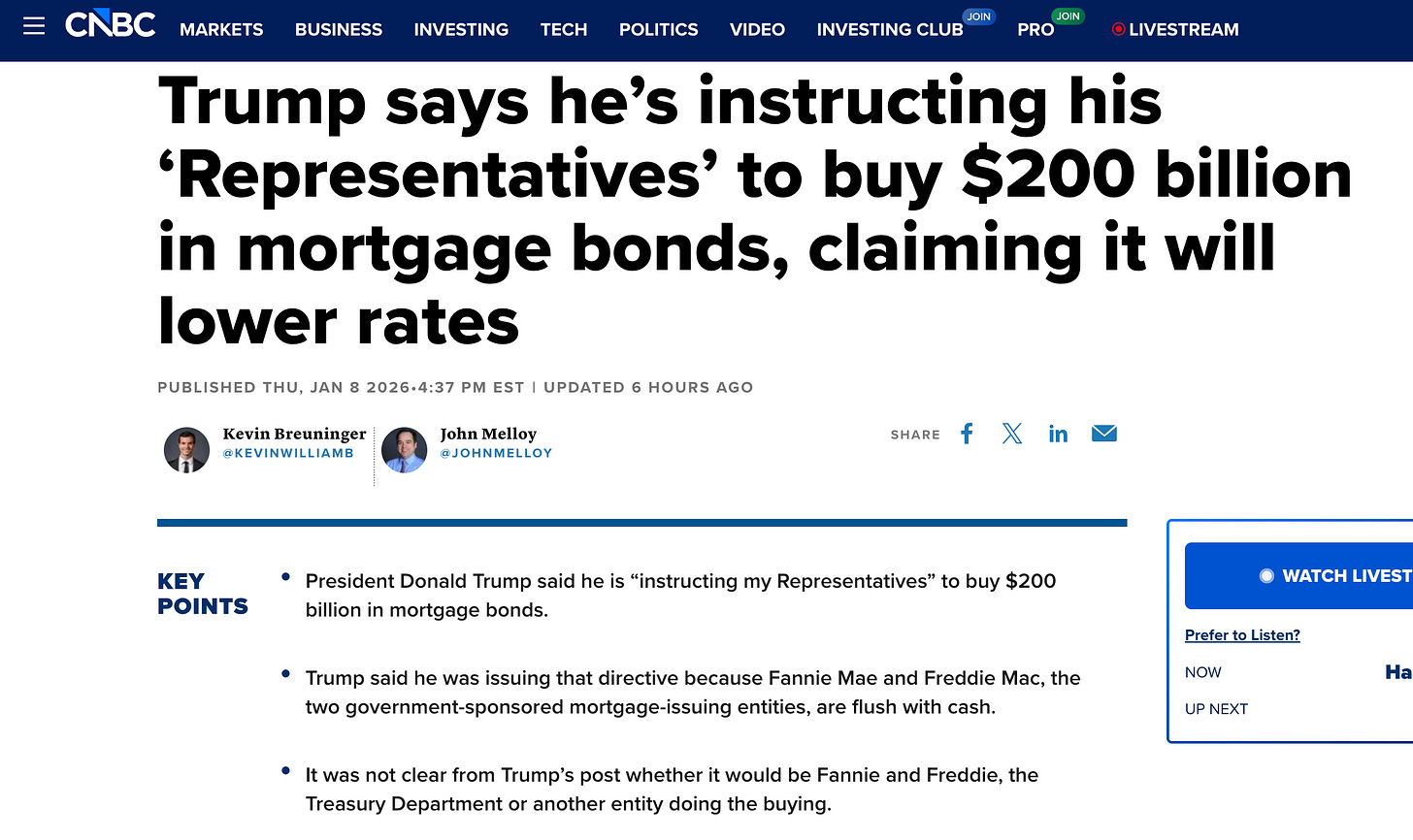

I maintain my belief that the futures pricing is a bit behind the curve here given that Trump is now another month closer to having his new Fed chair in office. Although we did get news on Thursday of another market-impacting decision by the Trump administration, as they announced that they’re going to be buying $200 billion worth of mortgage bonds in order to get mortgage rates lower.

We’ve heard rumblings for years about an integration of the Federal Reserve and the Treasury, and while I wouldn’t go as far as to say that’s what’s happening here, it is interesting to see the Trump administration taking on a role that has traditionally been the domain of the Federal Reserve.

Given the above, it’s fascinating how the Trump administration is already taking action to impact rates, even prior to the implementation of their new Fed chair.

In terms of silver-specific news, Bank of America put out a report where they referenced a range of scenarios that could result in a silver price between $135 and $309.

When I first saw that headline, it made me think about the chain of events that has occurred in the past few years, and I wondered if their underlying reason was related to the supply issues that have popped up in China, and previously in London and India.

It turns out that their range was predicated upon historical comparisons of the gold-to-silver ratio, and not specific to the ongoing supply issues.

Within the Bank of America framework, silver is positioned as a higher-risk, higher-reward extension of the gold thesis rather than a standalone driver. The bank highlights the current gold-to-silver ratio near 59 as historically elevated, implying potential outperformance if the ratio compresses.

Using prior cycle lows as reference points, the bank outlines a wide but structured range of upside scenarios. A reversion toward the 2011 ratio low of 32 would imply a silver price near $135 per ounce, while a return to the 1980 ratio low of 14 would suggest prices approaching $309 per ounce.

However, while their target wasn’t based on the supply concerns, I did have an update that does help form a map of what we could really be looking at in terms of the current silver outlook.

I’ve mentioned over the past week how parties from both China and India have been contacting Latin American junior silver producers to try and buy their production at $8-$10 premiums over the Comex price. It was stunning enough to hear that groups in China were making those calls, but when I heard that similar calls were coming out of India, I wanted to understand whether the groups in India were just watching what was going on in China and trying to be proactive, or if there were legitimate concerns that they might be going back into a shortage like they did this past October.

Fortunately, I received an update, and it turns out that the buyer from India was from the solar panel industry, and that the problem is that ‘China is soaking up all the silver and making it difficult for India to get the raw materials they need for manufacturing.’

So it’s not a shortage in India yet, but it sounds like things are tight. I’ll continue to see if I can get more color on the situation, but I did want to pass that along for now.

Now, how that relates to what I thought might have been behind Bank of America’s report, is that their headline made me think back to the time period between 2022 and 2024, when despite the ongoing deficit, silver even dropped below $20 per ounce. The deficit was still ongoing back then, but it just took the time that it took for it to become a bigger problem.

Continue reading here

Free Posts To Your Mailbox