Wall Street Sophism: Preserving Narratives, Not Wealth

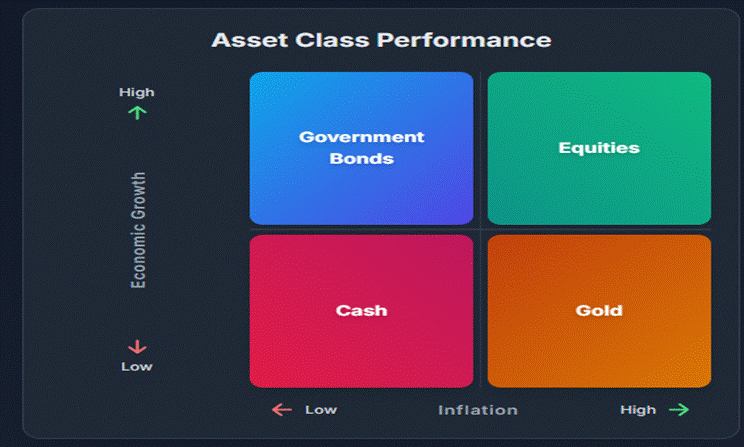

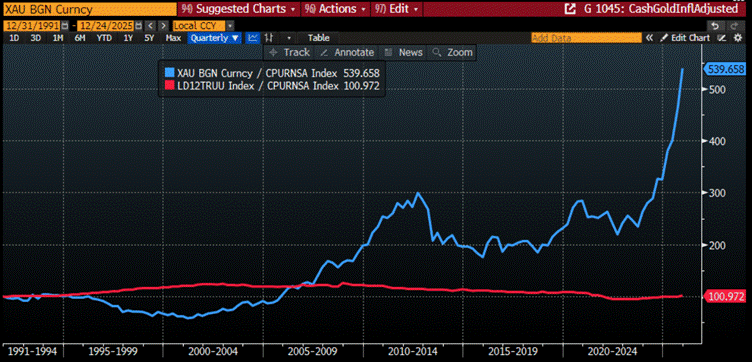

In the Permanent Portfolio taught by Harry Browne, gold occupies its place not by ambition, but by necessity. When currency is governed wisely, gold is patient and silent; when currency is abused, gold speaks. It is not the servant of any state, nor the promise of any institution, and therefore it endures when confidence in paper, policy, and authority fades. Gold does not seek to outshine stocks in times of prosperity, nor to rival bonds in periods of calm deflation. Its purpose is humbler and more profound: to stand firm when rulers err, currencies weaken, and order gives way to uncertainty. Within the quiet balance of the portfolio—where each asset accepts its own season—gold guards purchasing power through inflation, disorder, and regime change, reminding the prudent investor that wealth is preserved not by prediction, but by preparation.

Cash appears calm, but its nature is impermanent. Though it offers convenience and short-term shelter, time quietly works against it, as inflation erodes its worth without sound or spectacle. This decay accelerates when governance falls into the hands of ‘Educated Yet Idiots’—those rich in credentials yet poor in judgment, who trust elegant models more than lived reality. In such periods, rulers favor expedient remedies over lasting balance, expanding deficits and debasing money to postpone consequence. Thus, currency multiplies while real goods do not, and purchasing power slips away like water through open fingers. Cash still has its season—for readiness and flexibility—but wisdom teaches that to cling to it for too long, under persistent misrule, is not prudence but a quiet acceptance of loss.

“CP-Lie’ adjsuted Performance of $100 invested in Gold (blue line); US Bloomberg T-Bills 1-3 Months Index (red line) since 1991.

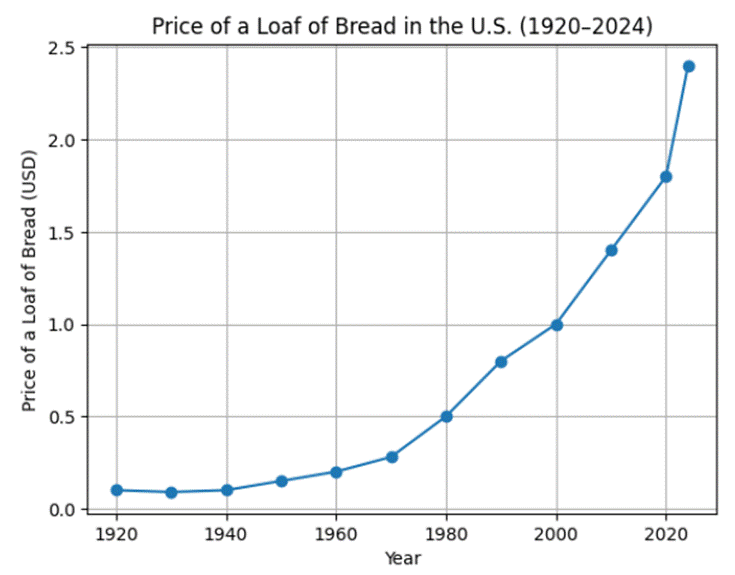

Over the past 100 years, the humble loaf of bread has done a better job tracking currency debasement than most economists, central bankers, and policy committees combined. In the early 1920s, you could buy a respectable loaf for about nine or ten cents—cheap enough that no one wrote academic papers about it. By the 1950s, bread had crept up to around fifteen cents, politely adjusting to postwar “transitory” inflation. Then came the 1970s, when monetary discipline took a long vacation and bread followed suit, jumping to roughly 25–30 cents by decade’s end. The 1980s didn’t fix bread so much as slow its rebellion, pushing prices toward 50 cents, while the calm, well-behaved 1990s lulled everyone into thinking inflation had been defeated, with loaves hovering around 70–90 cents. By the 2010s, bread broke the $1 barrier, landing comfortably at $1.30–$1.50, and after the post-COVID money-printing marathon, the mid-2020s now ask you for $2.00–$2.50—or more if the bread has aspirations and a backstory. Over a century, bread didn’t get 20 times tastier; the dollar simply went on a long diet. If you want an honest inflation chart, skip the CPI—just follow the bread.

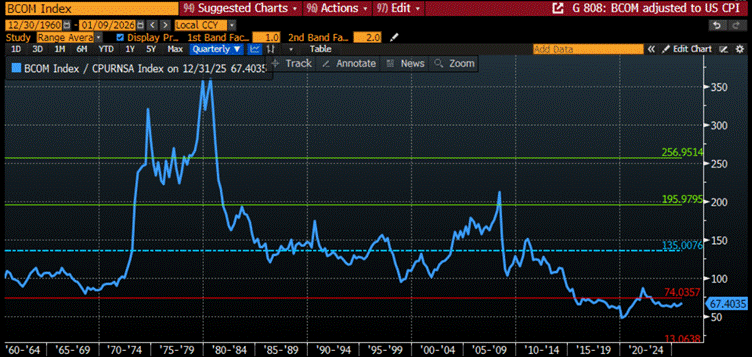

Real assets have long served as a hedge against inflation because they derive their value from scarcity, usefulness, and real-world demand—not from political promises or institutional credibility. When trust in public institutions erodes—like under the stewardship of Educated Yet Idiots fluent in theory but blind to consequences—paper assets and fiat currencies begin to decay from the inside. Inflation, at its core, is not just a monetary event; it is a crisis of confidence. In such conditions, capital naturally migrates toward gold, commodities, productive land, and infrastructure, assets that reprice higher as investors seek refuge from policy error, fiscal excess, and monetary experimentation. These assets do not depend on competence, credibility, or good intentions to hold value. They simply exist, are essential, and cannot be printed. When governance weakens, reality reasserts control—and real assets become the market’s blunt verdict on failed policy.

“CP-Lie’ adjsuted Performance of $100 invested in Bloomberg Commodity (blue line); since 1960.

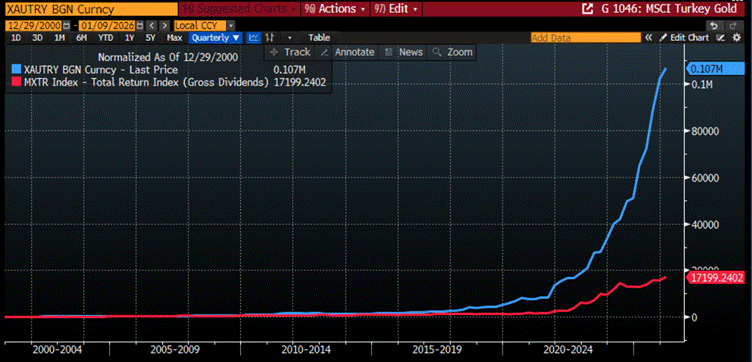

Turkey offers a masterclass in how to lose a currency while insisting you’ve discovered a bold new economic theory. By repeatedly meddling with monetary policy, firing central bank governors like seasonal interns, and publicly rejecting the nuisance of basic inflation economics, policymakers engineered a spectacular collapse in confidence in the lira. As real interest rates plunged deep into negative territory—apparently by design—citizens responded with shocking disloyalty to fiat money, sprinting instead toward gold, foreign currencies, real estate, and anything solid enough not to be reprinted overnight. Prices didn’t merely rise; they escaped. Inflation became less an economic statistic than a public opinion poll on governance, and the verdict was unanimous. Deprived of trust, Turks behaved exactly as rational people always do in such circumstances: they ignored official reassurances, abandoned paper promises, and hid their savings in assets immune to economic experiments conducted by decree.

Performance of TRY100 invesed in Gold (blue line) and MSCI Turkey Dividend Reinvested (red line) since 2000.

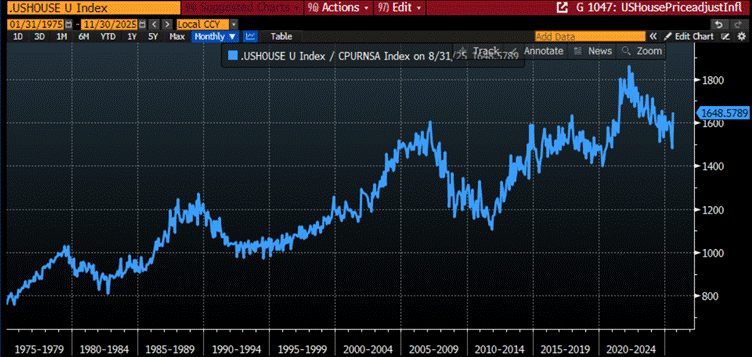

Residential real estate has long been the inflation hedge of choice for many because, unlike spreadsheets, houses are hard to argue with. Bricks, land, and roofs have this inconvenient habit of becoming more expensive as currencies are debased, and rents tend to rise right on cue, allowing owners to keep up with inflation while repaying mortgages in ever-cheaper currency. So far, so sensible. The trouble begins when inflation is the result of policy failure rather than bad luck. At that point, real estate suddenly transforms—from “essential housing” into “convenient villain.” Enter the Educated Yet Idiots: technocrats armed with elegant models, zero intuition, and a strong belief that landlords are responsible for macroeconomics. Rent controls appear, property taxes swell, capital gains are “revisited,” energy retrofits become mandatory, and ownership itself starts to feel conditional. Returns aren’t lost—they’re gently, bureaucratically confiscated. In such climates, residential real estate can still preserve wealth, but only if the owner remembers one crucial lesson: the biggest risk is no longer inflation, but the people trying to fix it.

Price of an Average American House adjusted to CP-Lie since 1975.

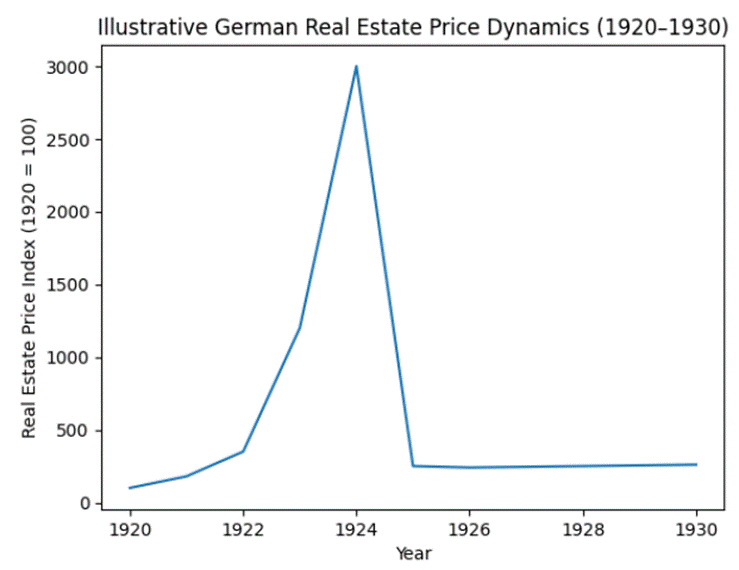

For example, during Germany’s hyperinflation, currency died but furniture survived. As the mark collapsed, anything tangible—houses, land, factories, even pianos—soared in price, not because it became more valuable, but because paper money became a joke. Wealth fled instantly into things that couldn’t be printed. The lesson was so obvious that when order was restored, policymakers quietly rediscovered common sense: the new currency was anchored to real assets, especially land and real estate. Prices then stopped behaving like escape artists and went back to normal. The pattern is simple and eternal—when currency is abused, reality reprices; when currency is sound, real assets stop being lifeboats and go back to being productive.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/wall-street-sophism-preserving-na…

Visit The Macro Butler Website here: https://themacrobutler.com/

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence