US Housing Reform

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

Trump has been fixated on fixing the housing market. The US is currently facing an affordability crisis as home prices and mortgage rates have pushed young buyers out of the market. Remember, we are living in a populist era, which drives political and economic change.

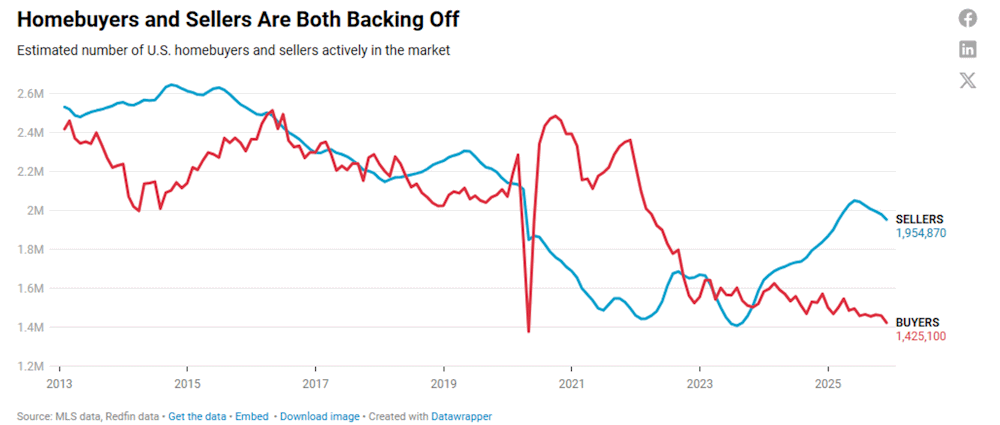

The current situation is one of fewer buyers AND fewer sellers:

Trump has previously floated ideas about portable mortgages, a 50-year mortgage, as well as deregulating banks which should in theory ease borrowing requirements. He has talked about releasing Fannie Mae and Freddie Mac (government sponsored mortgage backers) to expand lending capacity while speeding housing development. These demonstrate his priority to boost housing affordability and availability.

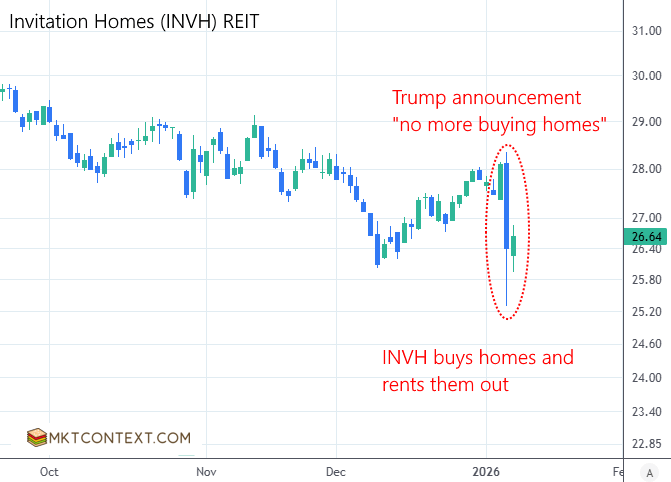

The newest idea is to ban institutions from owning houses. Over the last decade, big firms (like private equity) have bought tens of thousands of homes to rent out, tying up housing supply. It’s a very “Main Street over Wall Street” move and precisely the type of change that populism brings about.

The move had an immediate effect on stocks like Blackstone (private equity firm), Opendoor (real estate flipper) and Invitation Homes/American Homes 4 Rent (public REITs that own homes).

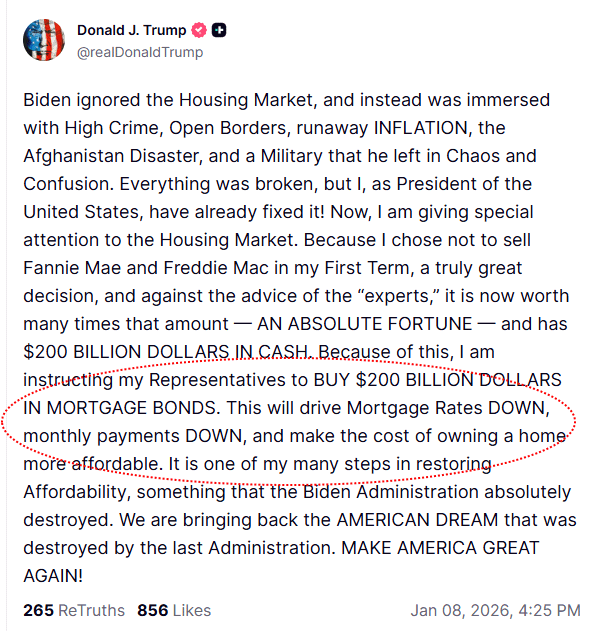

The next day, Trump ordered Fannie Mae and Freddie Mac to buy $200B in mortgage bonds. You can tell from the ALL CAPS he uses below, that this is an important issue! Jokes aside, this should tighten spreads on mortgage bonds and help lower borrowing costs slightly, without the Fed directly cutting rates.

Here's what it means for the economy and stock markets...

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!