Silver: Goldman Flags Renewed LBMA Liquidity Trap

- A Market Moving on Liquidity, Not Just Demand

- US Policy Risk and the COMEX Dislocation

- Leasing Stress Signals Physical Tightness

- Investor Positioning Is Not Yet Extreme

- The Fragile Exit Path

- China and the Fragmentation of the Silver Market

- Structural Conclusion

- Comment/Caveat

Silver’s Liquidity Trap and the Return of Structural Volatility

Illiquidity, left unresolved, always becomes insolvency. The only difference is time.

Intro:

We view this as an important development. It closely mirrors what the bank wrote about gold in 2024. At that time, after we highlighted that gold’s beta was changing and traditional correlations were temporarily suspended, Goldman stated that “the beta of gold is resetting higher.” That language validated what we had observed.1 2

The same framework is now being applied to silver. The old neo-Keynesian correlation structure is resetting at higher levels. Business as usual is no longer operating under the old assumptions. Structural change is now expressing itself in silver, just as it previously did in gold. We maintain our standard caveats and list them at bottom. The beta-reset pattern is spreading, and monetary metals will never be viewed the same way again

Silver entered 2026 after one of the most extreme price years in modern history. Prices rose 138 percent in 2025, the strongest annual gain since 1979, when the Hunt brothers attempted to corner the market. The rally pushed silver into the high $70s and reintroduced a structural feature that has largely been absent from precious-metal markets for decades: persistent liquidity stress at the benchmark center of price discovery.

This analysis is based on research by Lina Thomas and Daan Struyven of Goldman Sachs, who examine silver through the lens of market plumbing rather than sentiment or macro narrative.

Their core argument is simple: silver’s volatility is no longer being driven primarily by speculative positioning. It is being driven by inventory dislocation, leasing stress, and geopolitical fragmentation of supply

A Market Moving on Liquidity, Not Just Demand

The analysts observe that recent price action reflects investor inflows tied to expectations of Federal Reserve easing and portfolio diversification. However, those inflows would not normally produce such violent price behavior without a parallel deterioration in market liquidity.

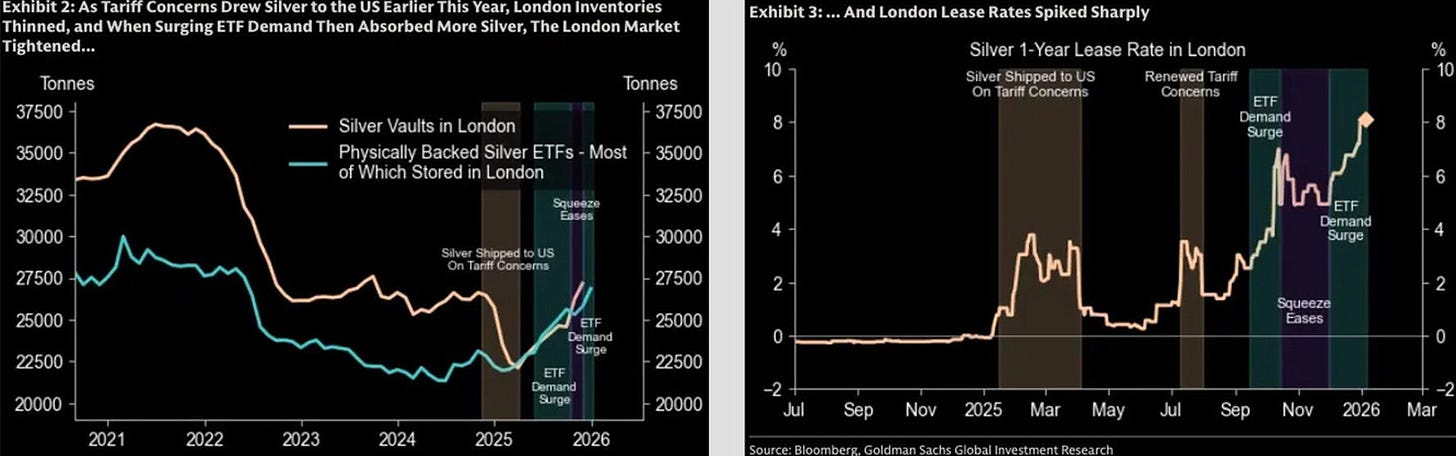

London, which remains the primary benchmark pricing center for silver, has experienced a sharp contraction in available deliverable inventories. This contraction has amplified price sensitivity to flows.

“While 1,000 tonnes of weekly net silver demand typically lifts prices by about 2 percent, that beta has surged to 7 percent amid tightness.”

As inventories thin, price moves accelerate when metal is absorbed and reverse sharply when availability improves. This creates a squeeze-like dynamic even in the absence of coordinated speculation.

Housekeeping. ***Buy a hat please and support Independent Media**

US Policy Risk and the COMEX Dislocation

A major contributor to London’s liquidity stress has been the migration of silver into the United States. Although silver was exempted from tariffs in April 2025, its inclusion on the US Critical Minerals List kept policy uncertainty elevated. Market participants responded by pre-positioning metal into COMEX vaults.

ETF demand, which requires physical backing, intensified this drain.

“The London market is temporarily running short of deliverable silver.”

This inventory migration has created a geographic dislocation. Silver is physically abundant, but unevenly distributed. Price discovery, however, remains anchored to London.

As long as metal remains concentrated in US vaults, London liquidity remains impaired, and volatility remains structurally elevated.

Leasing Stress Signals Physical Tightness

When physical availability declines, traders turn to the leasing market. Lease rates represent the cost of borrowing silver for short-term delivery needs. In recent months, those rates spiked sharply.

“The cost of borrowing silver spiked, signaling near-term tightness.”

Rising lease rates confirm that the tightness is not theoretical. It is operational.

This reinforces the squeeze mechanism. Flows do not merely move price through futures positioning. They physically absorb metal that the market needs to function.

Investor Positioning Is Not Yet Extreme

Despite the historic rally, the analysts argue that positioning does not yet reflect a saturated trade. ETF holdings remain below their 2021 peak. Managed money positioning on COMEX remains below historical averages.

“Investor demand is not overstretched despite the 138 percent rally.”

This suggests that volatility is being driven more by market structure than by speculative excess.

Market Rundown | MONDAY pic.twitter.com/jlfXav1aTm

— VBL’s Ghost (@Sorenthek) January 12, 2026

The Fragile Exit Path

Downside risk exists. If silver currently stored in US vaults returns to London, liquidity would normalize and prices could retreat sharply. The analysts still view US tariffs on silver as unlikely.

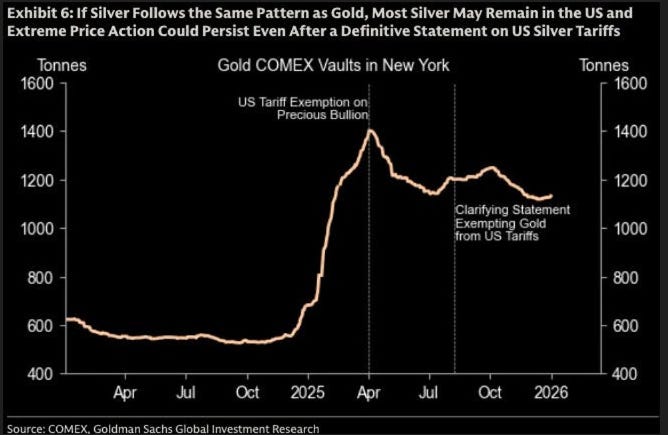

However, the gold market provides a cautionary parallel. Despite formal tariff exemption in August, most gold remains in New York vaults due to lingering policy risk.

If silver follows the same pattern, structural tightness may persist even after official clarification.

China and the Fragmentation of the Silver Market

China introduced export controls on silver beginning January 1, requiring permission for outbound shipments. While not an outright restriction, the policy introduces a new layer of uncertainty.

“The mere prospect could fragment the silver market further, reduce liquidity, and amplify price volatility.”

Continues here