Uranium Enrichment trade

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

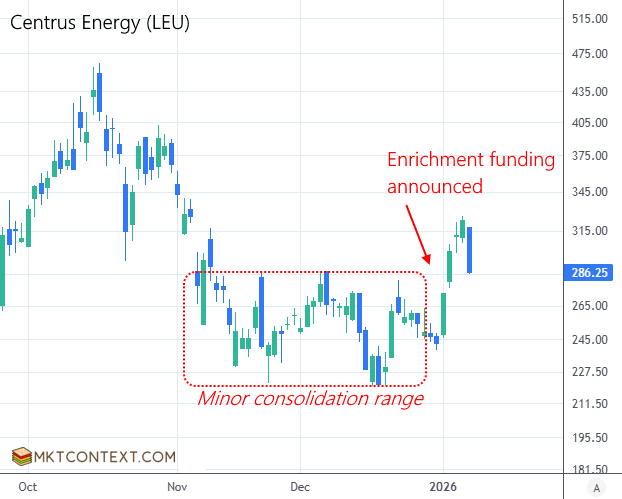

Last Tuesday, the Department of Energy backed $2.7B of deals to boost domestic Uranium enrichment. 3 companies received the funding: Orano (a French-government-owned nuclear firm), Urenco (owned by UK, Dutch, and German governments), and Centrus (ticker: LEU, a small US operator of enrichment plants). All have facilities in the US.

The US wants energy security. Right now it runs 94 reactors generating 20% of the nation’s power. But most of its enriched uranium is imported, with Russia supplying 35% before sanctions.

Most of the world’s enrichment capacity resides in Russia (44%) and Europe (30%). Having its energy supply chain controlled by foreign countries is untenable to the US from a security standpoint. It risks price spikes or shortages if relations sour or wars break out. At least, that’s how the administration views it.

The new DOE deals aim to grow US enrichment capacity to roughly a third of the world. Trump recognizes that AI and military leadership is synonymous with energy leadership. All energy sources (coal, oil, gas, solar, wind, nuclear, fusion, hydrogen) will be needed to power the US’ needs - not just green energy.

Related stocks received a huge boost on the day, with LEU leading the pack. Uranium producers (UUUU, UEC) and nuclear companies (OKLO, NNE, SMR) are all breaking trend higher after a deep three-month selloff. We think dips are buyable for a tactical trade as energy dominance remains a core theme.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!