Inflation Is What Chaos Looks Like in Prices

What’s behind the numbers?

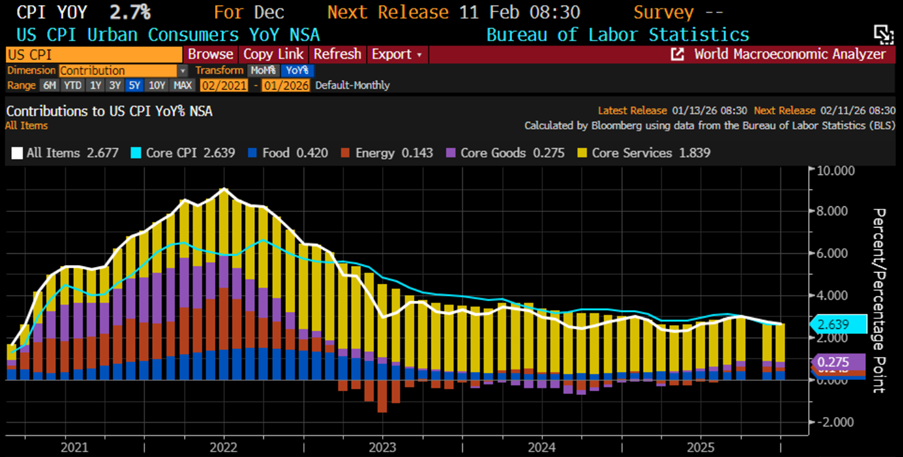

The final CPI print of the Jubilee Year delivered exactly what the consensus ordered: a neat +0.3% MoM and a perfectly obedient +2.7% YoY—unchanged from last month, because why surprise anyone? Beneath the calm headline, food inflation decided to wake up and post its fastest annual gain since August, while core goods followed suit with their quickest rise since August as well—apparently the “tariff tax” is no longer stuck in customs and has started showing up on grocery receipts. The lone good news? Energy continues its heroic disinflation cameo, with annual price gains slowing to their lowest level since last August. Even inflation, it seems, enjoys a well-timed plot twist.

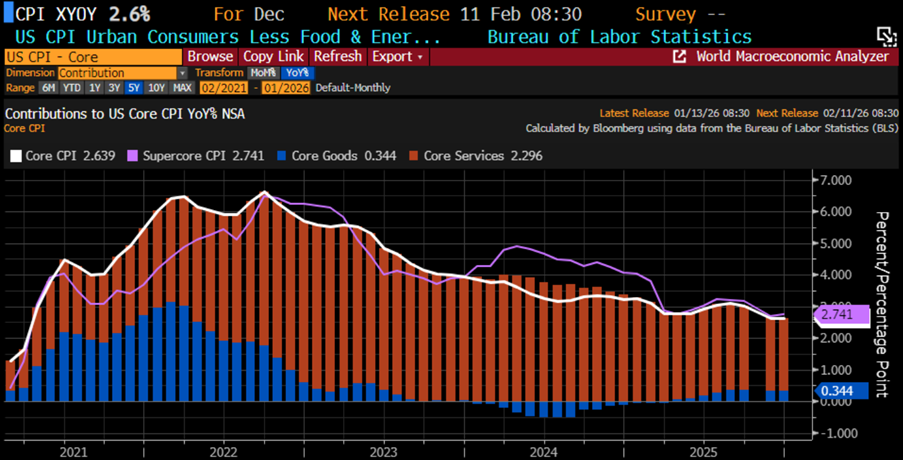

Core CPI in December tiptoed in at +0.2% MoM, a polite step below the +0.3% forecast. Year over year, it printed +2.6%, also a hair under the +2.7% consensus and perfectly aligned with November’s “see, it’s cooling” +2.6%. Meanwhile, core services—the heavyweight champion, accounting for a hefty 76% of the inflation buffet—finally put down the fork, easing to +2.29% YoY, its chilliest annual reading since September 2021. Even the biggest guest at the table seems to be pretending the party is winding down.

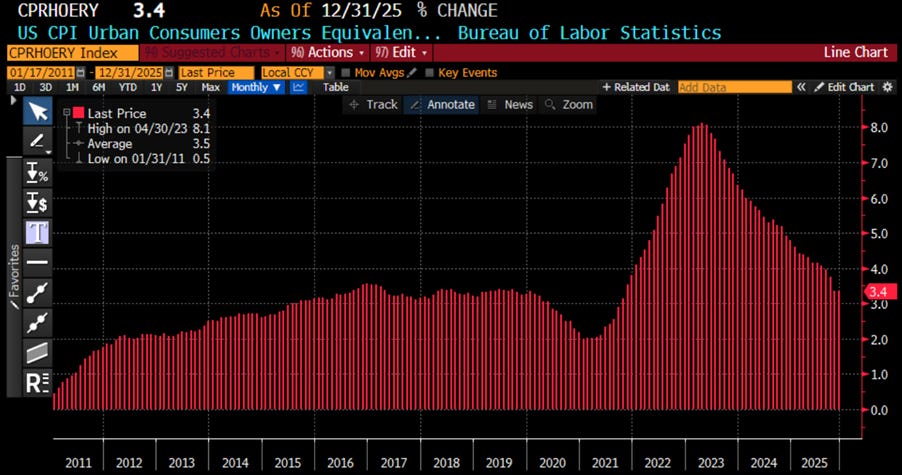

Cue another standing ovation from the “Inflation Is Dead” fan club: Owners’ Equivalent Rent—the CPI’s favourite zombie—held steady at +3.4% YoY in December, unchanged from November, and proudly delivered its “coolest” print since November 2021. Proof once again that even the undead can shuffle a bit slower without ever actually dying.

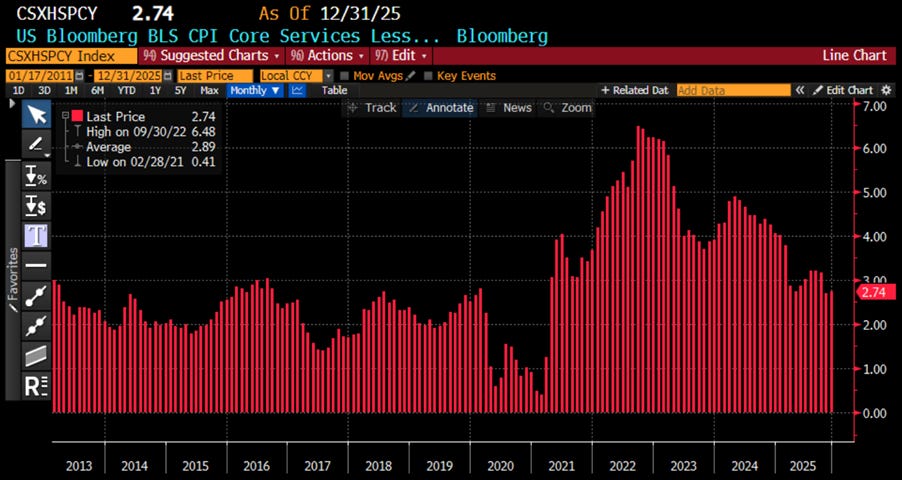

Adding to the inconvenient truth that inflation is very much alive, SuperCore CPI—core services ex-housing, aka the Fed’s favorite vanity mirror—reaccelerated to +2.74% YoY, up from November’s “cooling” +2.7% and back in line with the April 2025 pace. Translation: no victory lap, just another short smoke break. But sure, inflation is totally dead—just squint hard enough, ignore rent, goods, food, and reality, and keep refilling that daily dose of ‘hopium’.

Thoughts.

December’s CPI will be hailed across Truth Social as a historic victory for the Ministry of Plenty: banners raised, graphs waved, and tweets declaring inflation “defeated.” Meanwhile, in the untelevised reality of the grocery store, prices continue their upward march—slower, perhaps, but still very much marching. Inflation, after all, is not dead. It has merely learned to walk instead of run, strolling confidently atop four years of accumulated price increases. While plutocrats clink glasses to celebrate “cooling data,” the average citizen pays more for less and is instructed to call this progress. As the Manipulator-in-Chief leans on the Just Us Department to subpoena the Central Banker-in-Chief for insufficient obedience to the approved monetary narrative—one required to finance an ever-expanding Ministry of War and its Malthusian dream merchants—the Trump Reflation Express keeps chugging along. Because in true Orwellian fashion, inflation and collapsing trust in institutions always ride first class together, smiling for the cameras while insisting everything has never been better.

US Umbrella inflation Index (Average of CPI; Core CPI; PPI; Core PPI; Core PCE, 1-year consumer inflation expectations)

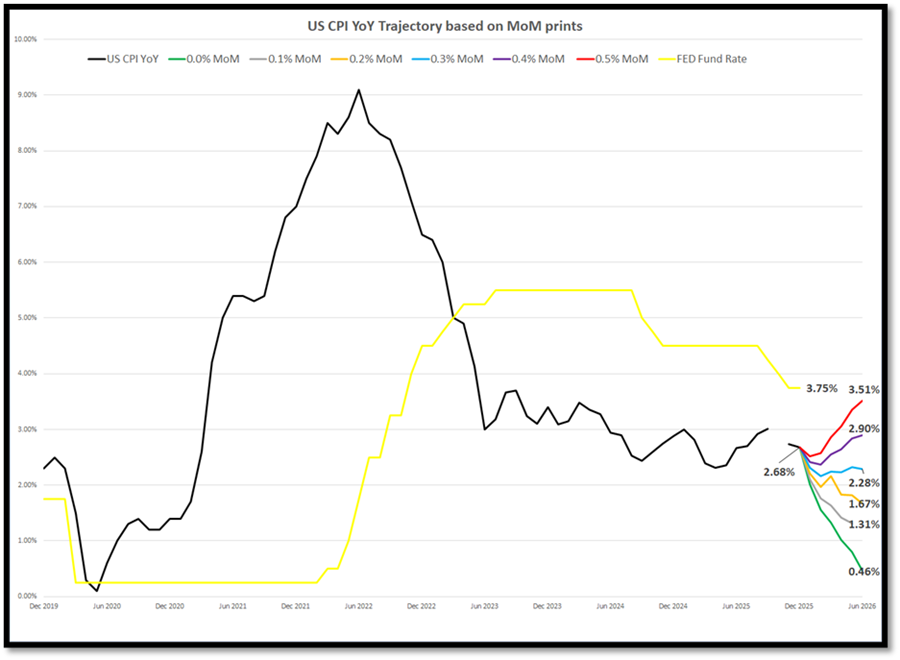

Instead of fantasizing about 2% inflation like a Disney fairy tale, seasoned investors—unlike the propagandistic Wall Street bankers—can still do basic math.

For that miracle to arrive before mid-2026, CPI would need to moonwalk below 0.2% every single month—good luck with a newly politicized Fed chair being enthroned and wars spreading like winter flu.

At more realistic 0.3%+ prints, we’re cruising toward 2.3%–3.5% CPI by mid-2026.

And when that reality check lands, not even Donald Copperfield pulling a “Central Banker-in-Chief” out of a hat will disguise the fact that cutting rates into an inflationary boom may go down as one of the Fed’s dumber magic tricks.

Inflation isn’t born in spreadsheets; it shows up when shortages meet a loss of trust. Prices rise not just because money is printed, but because real goods get scarce and confidence in institutions evaporates. Supply chains crack, energy tightens, labour thins—and governments respond with controls, denial, or creative accounting. Once trust fades, money is spent faster, questioned more, and respected less. Every cycle insists “this time is different.” It never is. Scarcity lifts costs, mistrust hits the accelerator, and policy error does the rest. Inflation isn’t a bug in the system—it’s what happens when the system stops being believed.

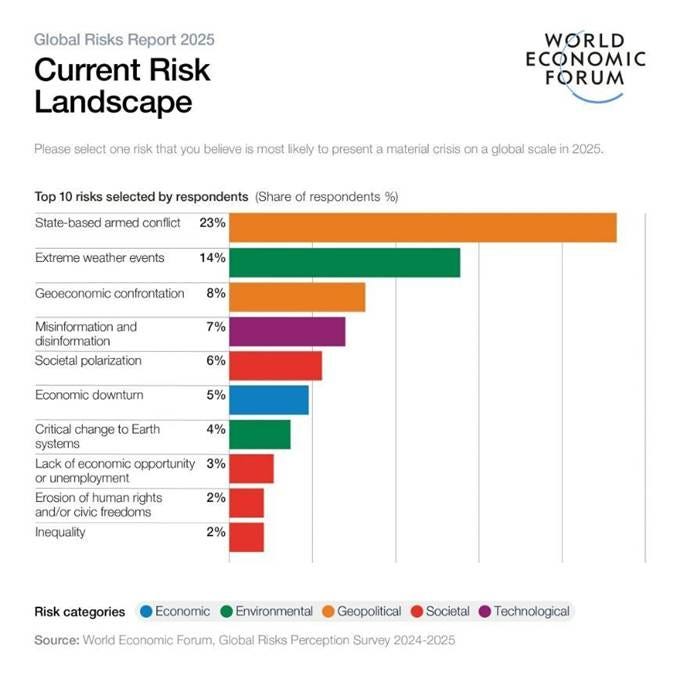

2025 was not shaped by a single shock, but by a collapse in confidence. Governments and central banks repositioned, quietly admitting they could no longer stop the cycle they set in motion. Trust—in monetary policy, fiscal discipline, and leadership itself—became the defining casualty of the year. War drums grew louder: conflict raged in the Middle East, Europe rearmed under the assumption that peace was no longer an option, and Russia openly framed its struggle as one against NATO, reinforcing its nuclear posture. Debt piled up everywhere as nations prepared for what they now treat as inevitable. Economic warfare intensified—April’s tariffs and market correction forced a global rethink of trade—and tensions over Taiwan kept markets on edge. Meanwhile, the US and China remained locked in a contest for financial dominance, even as China’s middle class and technological momentum continued to accelerate. In 2025, the world didn’t break suddenly—it simply stopped believing.

Donald Copperfield’s return to office pulled off a political vanishing act: the globalist agenda supposedly disappeared. He flipped Sleepy Joe’s policies on energy, borders, trade, and especially war in a clean 180. As warned, he didn’t stop the cycle, just hit the snooze button. The opposition responded predictably—by opposing everything—delivering the longest government shutdown in US history. Confidence cracked again when it emerged that ‘Sleepy Joe’ hadn’t exactly been the author of his own presidency, leaving voters to ask who’d been driving the world’s largest economy for four years. Build Back Better quietly broke down, and voters worldwide began “building back nationalism” instead. The surprise exit of the WEF ‘Darth Vader’ signalled that even the Davos crowd sensed the script was no longer selling. Climate slogans lost their grip, the mission stayed the same, and the messaging got a facelift.

https://www.weforum.org/press/2025/04/world-economic-forum-announces-governance-transition/

Meanwhile, the AI age arrived on schedule. Chips and rare earths became the new oil, automation replaced workers, and businesses stopped hiring—not because money was expensive, but because confidence was. In this cycle, cheap capital isn’t enough. You also need faith in tomorrow—and that’s still in short supply.

Food prices are the economy’s smoke alarm. Because food depends on energy, transport, labour, and trust, it’s the first thing to panic when chaos rises. Geopolitics snaps supply chains, energy costs jump, governments “help” with bans and controls, and suddenly a small shock becomes a supermarket crisis. Add climate swings and policy distortions, and shortages go from unlikely to inevitable. When systems stop working together, bread notices first. History is consistent: more chaos means pricier food—and expensive food has a habit of making societies lose their appetite for stability.

US Chaos Index (blue line); UN Food & Agriculture Food Prices Index (red line)

Electricity prices are chaos with a meter attached. Modern economies run on cheap, boring, reliable power—until geopolitics, bad policy, or forced transitions make it exciting. Shut down baseload, cap prices, underinvest in grids, and the system loses resilience just as demand stops being optional. Power can’t be stockpiled, it must balance in real time, and it has zero patience for political theatre. So, when governance frays, electricity doesn’t whisper—it spikes, reminding everyone that chaos has reached the economy’s central nervous system.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/inflation-is-what-chaos-looks-like

Visit The Macro Butler Website here: https://themacrobutler.com/

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence