Big Breakout In Indexes

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

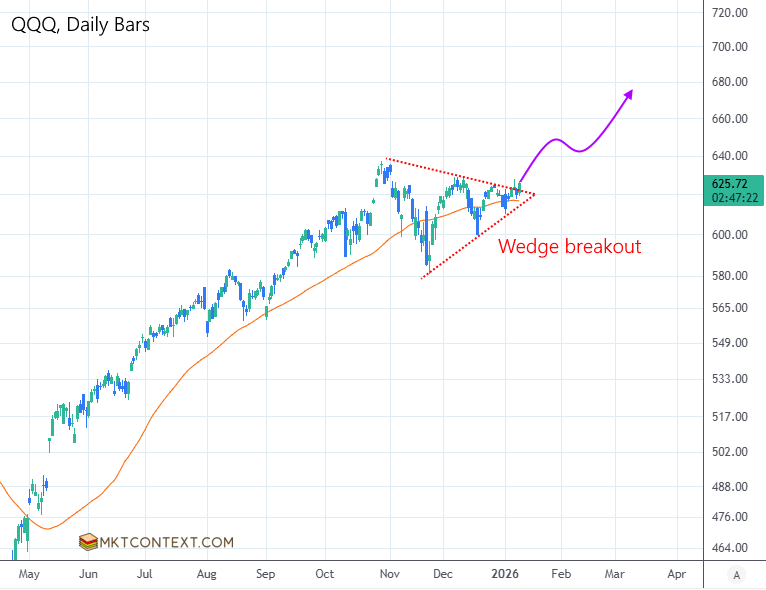

QQQ is breaking out of this wedge after nearly 4 months and several fake breakouts. We said to be patient, and it is finally paying off. If successful, the target is the 680-700 range based on a measured move as well as options interest up there. Options tend to create resistance due to hedging activity that must occur at those levels.

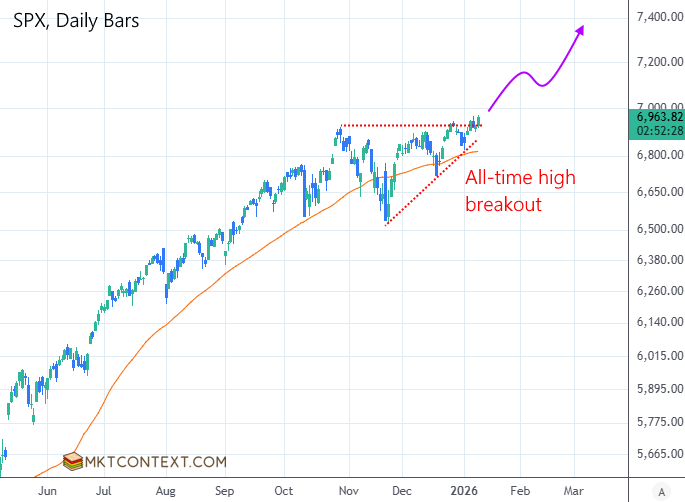

SPX is making an even stronger breakout, breaking this horizontal all-time-high resistance. A rudimentary trendline shows us reaching 7400 at least. Remember that all-time-high breaks tend to be bullish, even though people instinctively get scared of highs (scared of heights?) and feel the need to fade it. In bull markets, SPX will make dozens of successive highs in the span of a year.

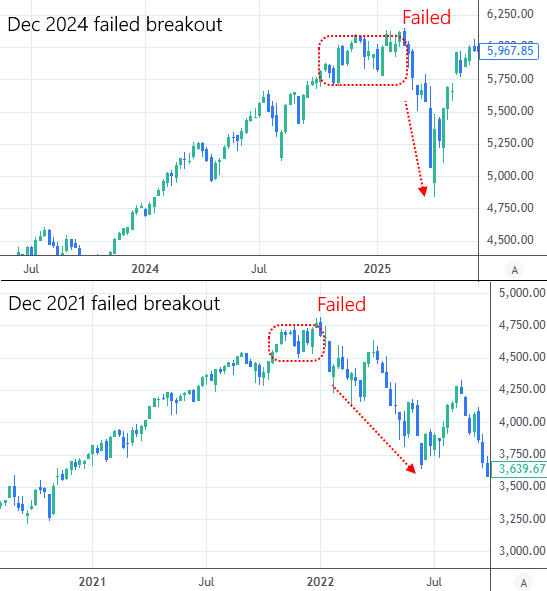

However, we’re not out of the woods yet. If we fail the breakout and fall back under the range, then we are setting up for a repeat of early 2022 or 2025, both of which led to major bear markets.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!