Silver: This Presidential Proclamation is Why Metals Rallied

GFN – WASHINGTON, Jan. 15, 2026 — President Donald J. Trump signed a presidential proclamation directing the U.S. government to negotiate adjustments to imports of processed critical minerals and their derivative products, a move aimed at reducing strategic vulnerabilities in America’s supply chains and shoring up national security.

The administration’s action stems from a Section 232 investigation by the Department of Commerce, which concluded that imports of processed critical minerals and derivative products (PCMDPs) — including rare earths, lithium, nickel, cobalt and others vital to defense, energy infrastructure, telecommunications and consumer technology — are being brought into the U.S. in such quantities and under circumstances that “threaten to impair national security.”

National Security and Supply Chain Vulnerabilities

The Commerce report found that the U.S. is heavily dependent on foreign sources for critical minerals, with 12 minerals entirely import-reliant and another 29 over 50 % reliant as of 2024. Even where raw mining occurs domestically, a lack of domestic processing capacity leaves the U.S. exposed to foreign bottlenecks, notably in China, which dominates refining and advanced materials production. This structural dependence, combined with price volatility in global critical mineral markets, was judged a strategic risk.

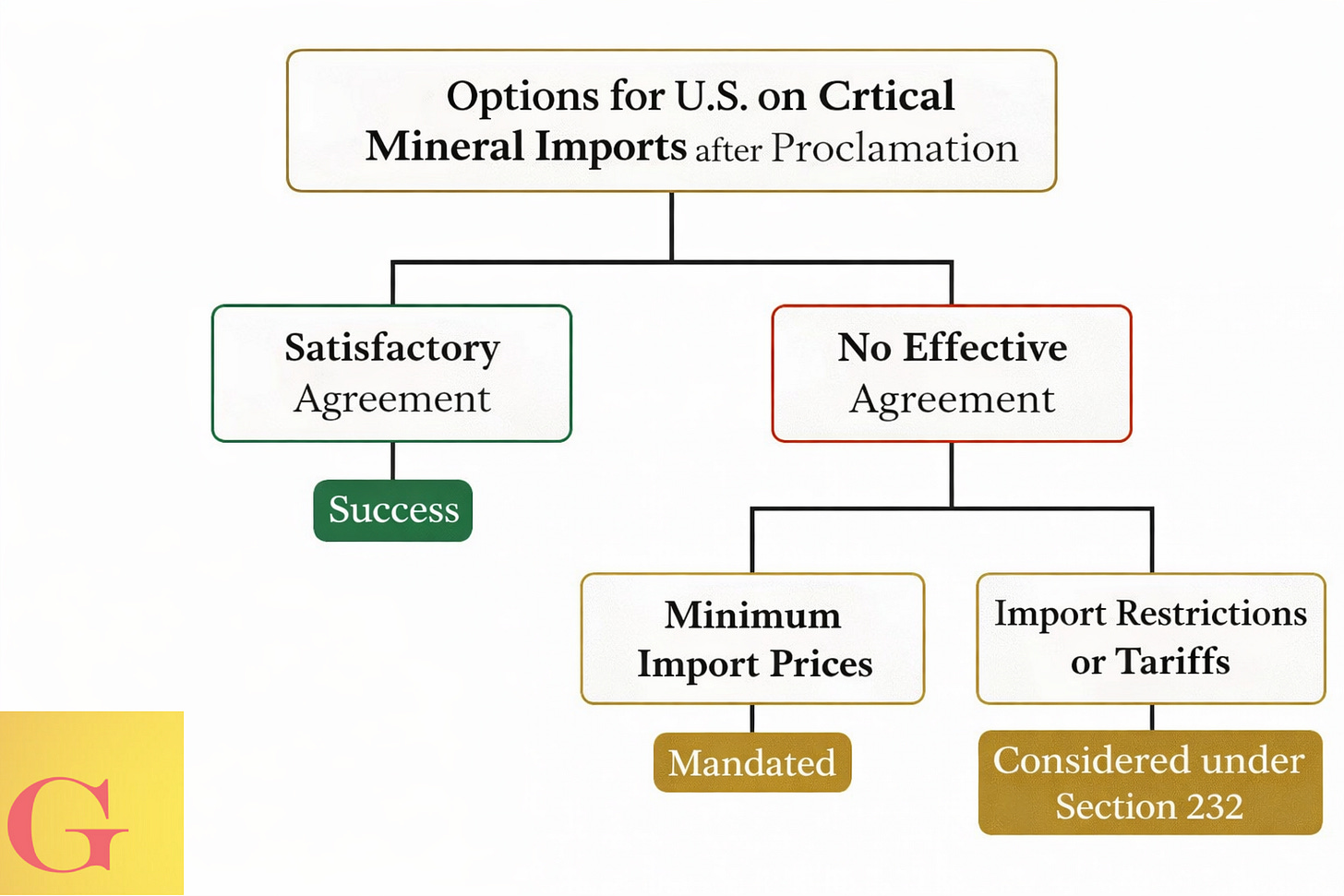

In response, the proclamation directs the Secretary of Commerce and U.S. Trade Representative to jointly pursue negotiations with trading partners to “adjust imports so that such imports will not threaten to impair the national security” of the United States, laying out a 180-day window to secure binding agreements or face potential alternative actions.

Price Floors and Other Potential Measures

A central feature of the strategy is the promotion of price floors for critical mineral trade as part of negotiations with allies and trade partners, a mechanism intended to stabilize global pricing and support resilient supply chains. Price floors would aim to prevent predatory pricing and market distortions that can undermine domestic production and investment — a point long advocated by Western mining interests and discussed among G7 finance ministers.

Importantly, the proclamation stops short of immediate tariff impositions. President Trump signaled that tariffs or other import restrictions are not being imposed at this time, instead opting to seek negotiated frameworks. However, the proclamation makes clear that if agreements are not reached within the 180-day negotiation period, are ineffective, or not implemented, the administration “may consider alternative remedies” — including minimum import prices and potential trade restrictions under Section 232 authority.

Industry and Policy Implications

The framework reflects a broader pivot toward securing supply chains for materials increasingly essential to defense, renewable energy technologies, and high-tech manufacturing. Industry participants will be closely watching the negotiation process, the structure of any price floor arrangements and how U.S. trade policy balances market access with security objectives.

The administration’s fact sheet emphasizes that this action builds on prior steps to diversify supply — from unlocking domestic critical mineral projects to securing cooperation with allies on supply resilience — but stops short of immediate punitive tariffs that could disrupt markets or provoke retaliation.

As negotiations proceed and the 180-day timeline unfolds, the potential for price floors or other import adjustments represents a significant policy lever with implications for global commodity markets, national security strategy and the competitiveness of U.S. battery, semiconductor and defense supply chains. Observers expect continued debate over the appropriate balance of trade policy tools, price stabilization mechanisms and domestic industry support as the administration calibrates its next moves.

Accompanying Podcast

We argue that a new U.S. proclamation on critical minerals signals the imminent use of government price floors to secure strategic materials such as silver and copper. Price floors act as de-facto demand subsidies, ensuring supply while avoiding overt tariffs. The policy implies aggressive stockpiling of above-ground supply, infrastructure investment, and eventual government ownership of market pricing power. We also believe markets are already reacting and that future opportunity lies less in metals themselves and more in small, well-run mining companies with proven reserves and limited capital access.

Podcast Continues here