BRICS Slam US Stablecoins, Seek To Combine Money

GFN – MUMBAI: India’s central bank has proposed that BRICS nations link their official digital currencies to enable cross-border trade and tourism payments, a move that could gradually reduce reliance on the U.S. dollar as geopolitical tensions rise.

According to Reuters, the Reserve Bank of India has recommended that a proposal to connect BRICS central bank digital currencies be placed on the agenda of the 2026 BRICS summit, which India will host later this year. Two sources said the recommendation has been submitted to the government, marking the first time such a linkage proposal would be formally tabled within the bloc.

If approved, the initiative would connect the digital currencies of Brazil, Russia, India, China and South Africa through interoperable infrastructure and governance standards. The goal would be to improve efficiency in trade finance and tourism payments while reducing transaction costs.

The proposal could draw resistance from the United States, which has warned BRICS members against efforts to bypass the dollar.

“The BRICS alliance is anti-American,” U.S. President Donald Trump previously said, while threatening tariffs on countries aligned with the bloc.

The RBI, India’s finance ministry and Brazil’s central bank did not respond to requests for comment. China’s central bank said it had no information to share, while South Africa and Russia declined to comment.

The RBI’s proposal builds on a 2025 BRICS declaration calling for greater interoperability between members’ payment systems. The central bank has said publicly that it wants to link India’s digital rupee with other nations’ CBDCs to speed up cross-border settlements and increase the rupee’s global usage, while stressing that the policy is not aimed at de-dollarisation.

None of the BRICS members has fully launched a retail CBDC, but all five core members are running pilot programs. India’s e-rupee has reached about seven million retail users since its 2022 launch, while China has pledged to expand international use of the digital yuan.

The RBI has promoted adoption through offline payment capability, programmability for government transfers, and partnerships allowing fintech firms to offer digital-currency wallets.

For the BRICS linkage to function, issues such as interoperable technology, governance standards, and settlement mechanisms for trade imbalances would need to be resolved, one source said. Concerns about relying on technology platforms developed by other member states could slow progress without consensus on regulation and infrastructure.

One solution under discussion is the use of bilateral foreign-exchange swap lines between central banks to manage imbalances. Past attempts to expand local-currency trade between Russia and India encountered problems after Russia accumulated large rupee balances that were difficult to deploy, leading India to permit investment of those funds in domestic bonds.

Weekly or monthly settlements through swap arrangements are also being considered, a second source said.

BRICS, founded in 2009, has expanded beyond its original five members to include countries such as the United Arab Emirates, Iran and Indonesia. The bloc has regained prominence amid renewed U.S. tariff threats and rising trade friction.

Previous ambitions, including a common BRICS currency, failed to gain traction. Interest in CBDCs has also cooled globally as stablecoins gain popularity, though India continues to promote the e-rupee as a regulated alternative.

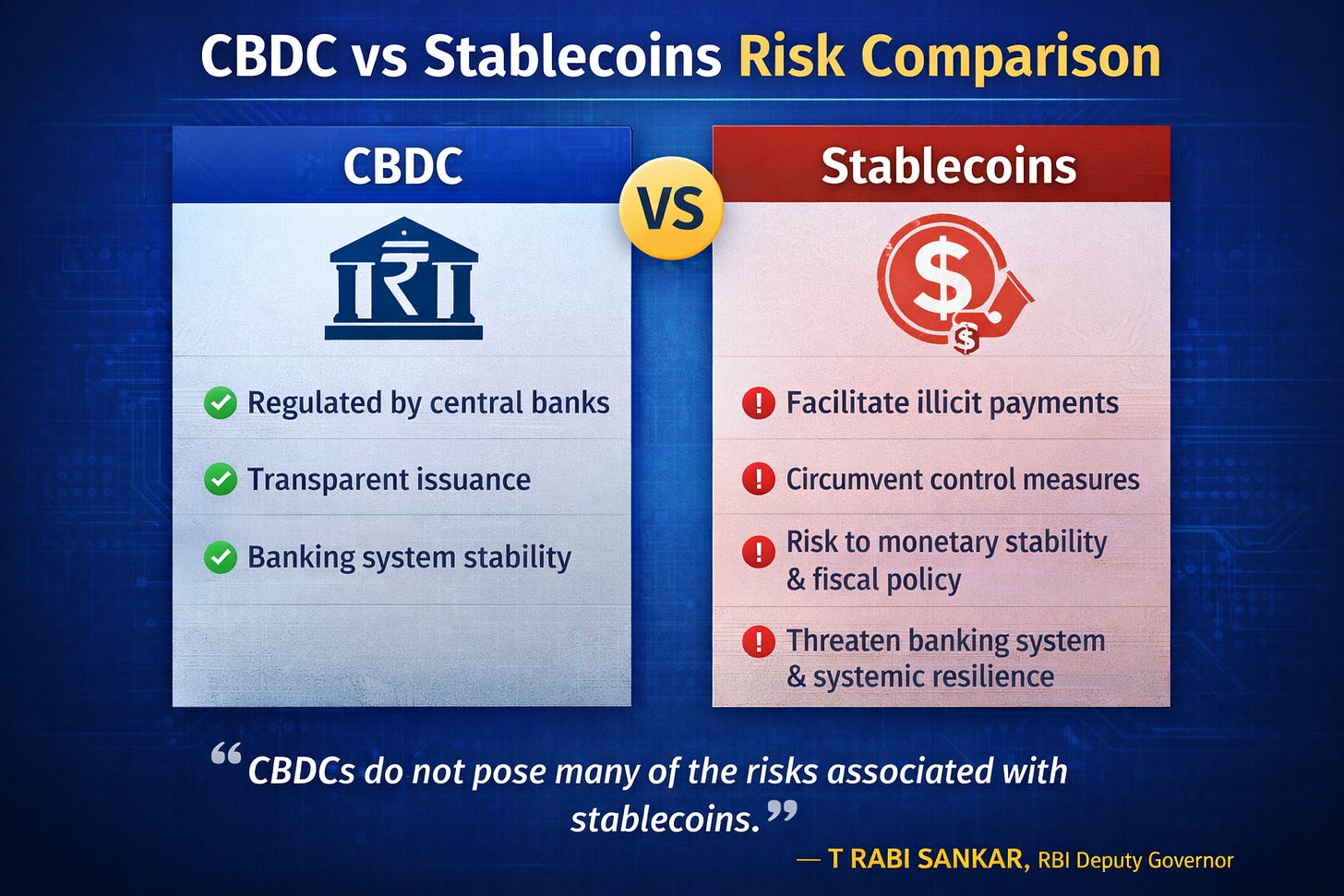

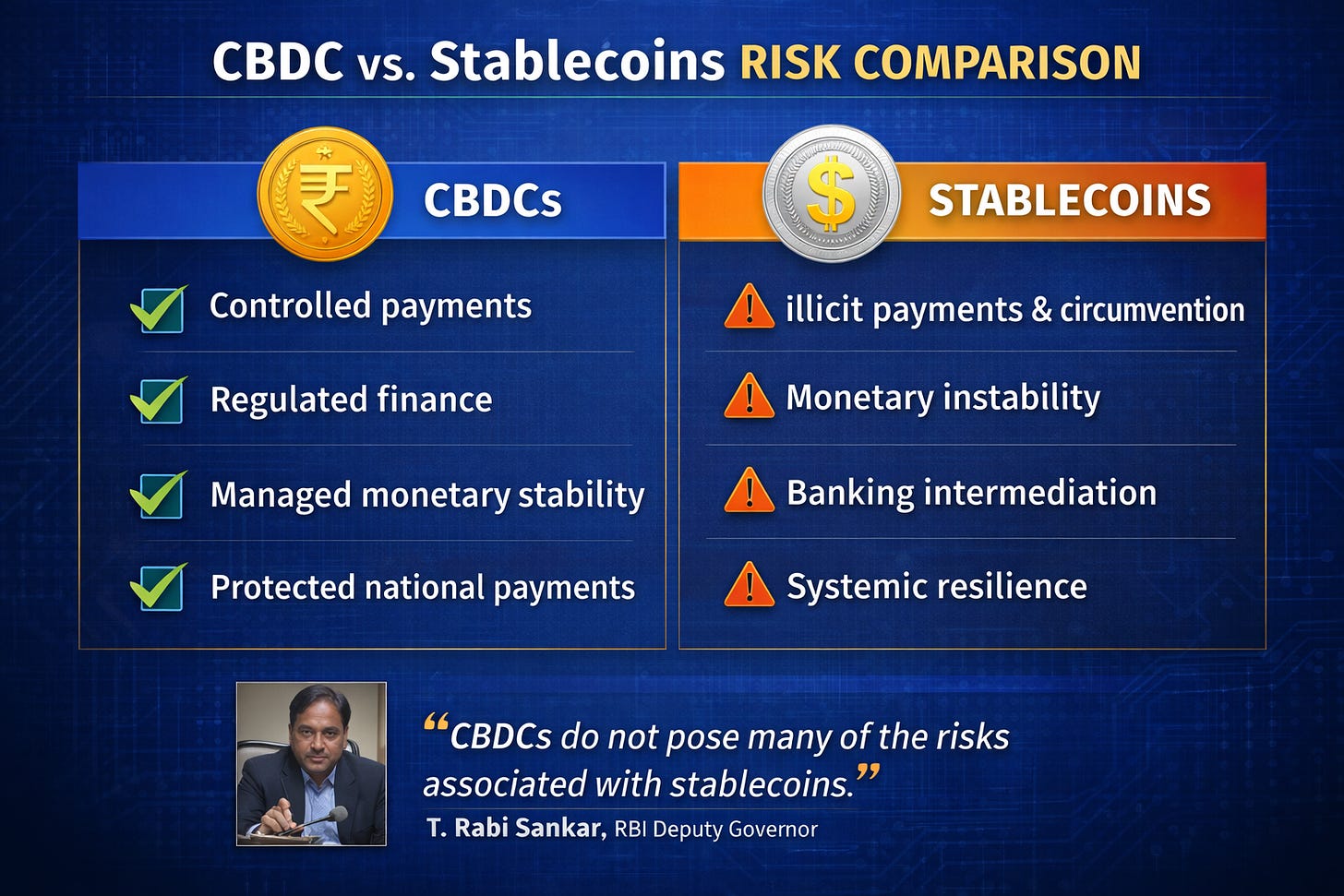

“CBDCs do not pose many of the risks associated with stablecoins,” RBI Deputy Governor T Rabi Sankar said last month.

“Stablecoins raise significant concerns for monetary stability, fiscal policy, banking intermediation and systemic resilience.”

India fears widespread stablecoin adoption could weaken national payment systems and fragment domestic financial infrastructure