Credit Card Cap Is A Populist Measure

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

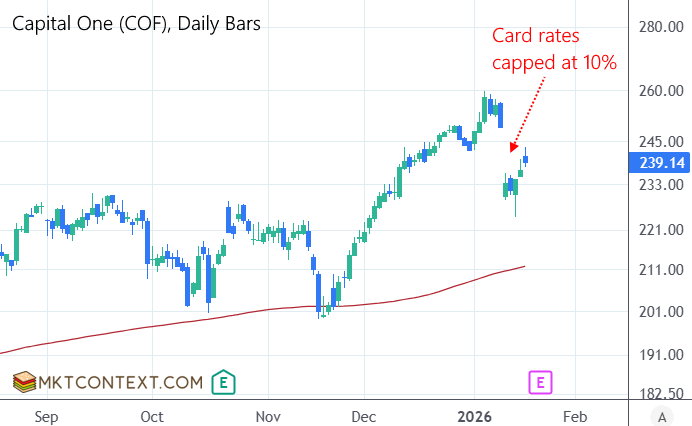

Last weekend, Trump announced a plan to cap credit card interest rates at 10%. Rates were previously at 23% so this would cost banks a lot. Studies show this would save $100B/year in interest nationwide, in particular for lower-income families who tend to spend more in the economy.

To illustrate: A person with $5000 debt at 24% pays $100 monthly. At 10%, that drops to $41, speeding up payoff.

Card lending is a highly lucrative business. The banks’ share prices all fell on the news, and JP Morgan CEO Jamon Dimon personally spoke out against it. Shares of Visa, Mastercard, Capital One, and American Express were also hard hit.

Prior efforts at such regulation have failed, but it is notable that this time there is bipartisan support. Banks and credit card companies are arguing that borrowers will turn to pricier loans like payday loans or buy-now-pay-later (BNPL). The reality is that expensive processing fees will be cut, along with points rewards programs.

This is the 4th populist measure aimed at easing living costs for Americans — the others being the housing investment ban, drug price cuts, and health insurance premium reductions. Trump also wants tech companies to pay their share of electricity costs, and defense contractors to stop paying exorbitant salaries.

In the era of populism, big business and monopolies get attacked. We noted early on in Trump’s presidency that he would likely come after Healthcare and Defense sectors. Investors need to think twice about owning high-margin businesses that are susceptible to “antitrust” measures. Unfortunately, many of America’s best businesses have strong market power that allow them to generate abnormal profits.

Watch the BNPL stocks and alternative payment providers like AFRM, KLAR, PYPL, and XYZ. They will be the beneficiaries as millions of consumers are steered away from credit cards.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!