Gold: Hong Kong-Shanghai Deal Attacks US Bonds

Breaking: HK–SGE Deal Advances Gold’s Collateral Repo Path

GFN – HONG KONG Hong Kong and Shanghai will sign a memorandum of understanding next week to establish a cross-border gold trade clearing system, a move that deepens financial connectivity between China’s two primary bullion markets and strengthens Hong Kong’s ambition to become a global gold trading hub.

Financial Secretary Paul Chan Mo-po said the agreement with the Shanghai Gold Exchange will be signed at the Asian Financial Forum, paving the way for a central clearing infrastructure designed to improve settlement reliability, reduce transaction costs, and increase liquidity in cross-border gold trading.

“We are accelerating the push to establish a central clearing system as a vital piece of financial infrastructure, to enhance the reliability and efficiency of gold trading and delivery in Hong Kong, lower transaction costs and increase liquidity,” Chan wrote in his weekly blog.

Trial operations are expected to begin within the year, with the Shanghai Gold Exchange participating in the initial phase.

The initiative comes as global investors continue to shift away from U.S. dollar-denominated assets amid rising geopolitical tension. Gold prices rose more than 60 percent in 2025, while global demand by value increased 44 percent year on year to US$146 billion in the third quarter, according to Chan.

Independent market analysts note that the agreement extends beyond trading convenience.

“GoldFix, a financial research platform focused on global metals and monetary structure, has argued that vault connectivity and clearing interoperability are the core prerequisites for gold to evolve into functional balance-sheet collateral within emerging multipolar financial systems.

*Exclusive: China’s Next Move is HQLA/REPO Status

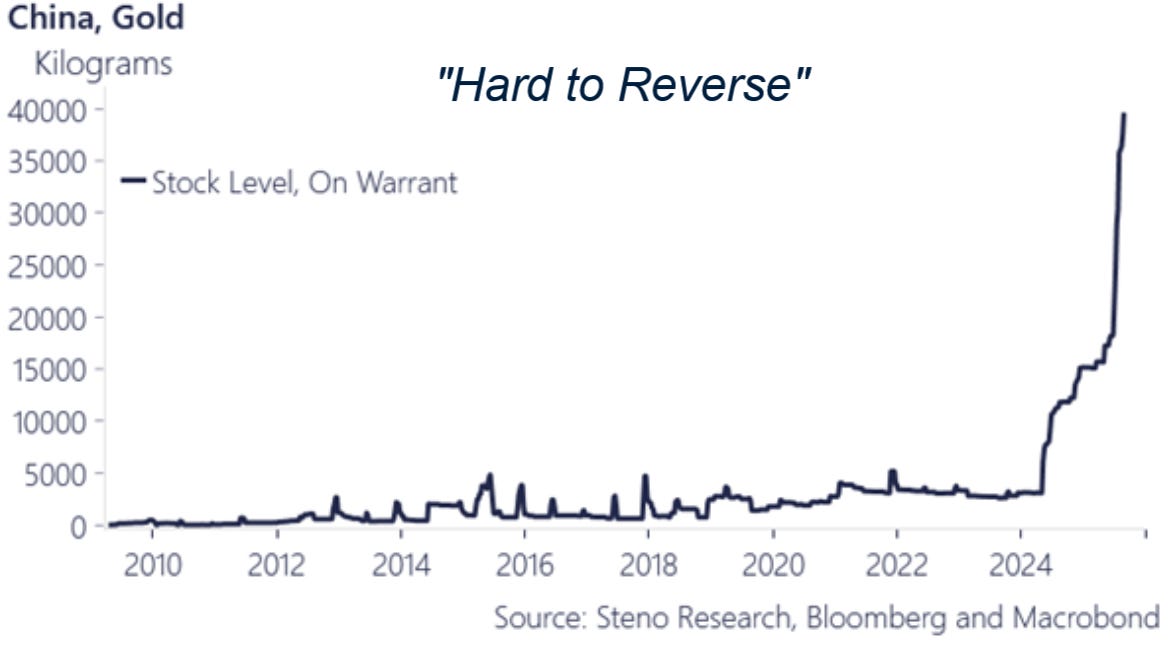

China is positioning itself for a monetary shift that could (will) redefine collateral markets. The country has accumulated thousands of tons of gold in recent years, and its vault1 and warrant systems are expanding.

The next step may be to move gold beyond the role of a passive reserve and into the realm of an active financing instrument. At the center of this idea is the possibility of designating gold as a High-Quality Liquid Asset (HQLA) for repo transactions.Read full story

According to GoldFix’s framework, interoperable vault networks and clearing corridors allow gold to transition from a passive reserve asset into a mobilizable liquidity instrument capable of supporting repo, settlement, and collateralized funding structures. In that model, gold increasingly competes with sovereign bonds as high-grade collateral inside non-Western financial architecture.”

The Hong Kong–Shanghai clearing agreement aligns closely with that thesis, as it directly addresses custody recognition, delivery certainty, and cross-border settlement friction, which are the primary constraints preventing gold from operating as institutional liquidity rather than merely a traded commodity.”

While officials framed the initiative as a market development project, its timing reflects a broader reorientation in global financial infrastructure, where metals, custody networks, and settlement systems are becoming strategic components of financial sovereignty rather than neutral market utilities.

As we have previously noted, gold does not need to replace currencies to reshape financial power. It only needs to replace collateral.

//end//////

More here