Why a Multi-Year M&A "Overshoot" is Inevitable

From the Tight Spreads Substack.

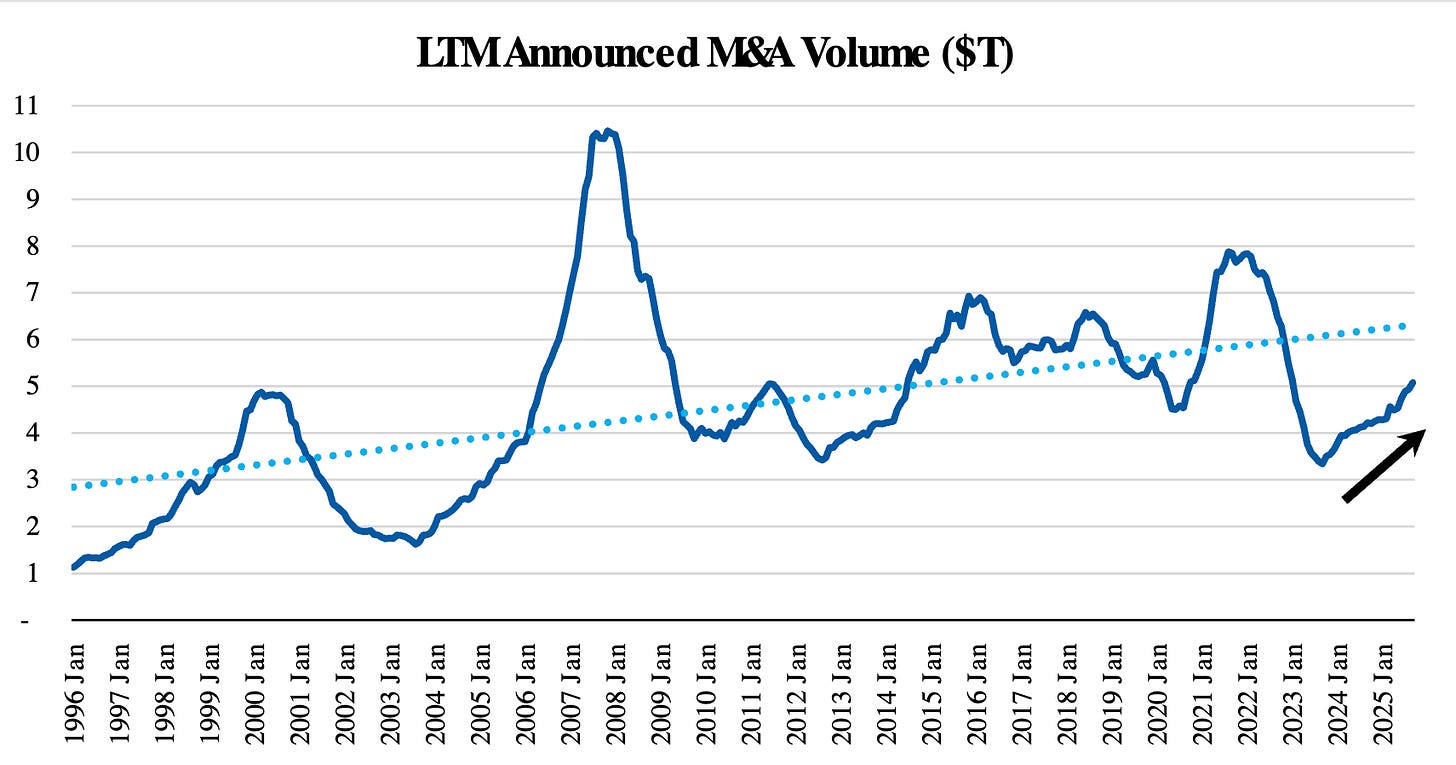

The global M&A market has transitioned from an executed 30-year low in 2023 to a period of sustained recovery. Following a 43% year-over-year increase in announced volumes in 3Q25, a multi-year rebound is anticipated. This trend is supported by robust equity markets, greater corporate confidence, lower interest rates, growing pressure on private asset managers to deploy, and a more predictable regulatory environment.

Morgan Stanley (MS) projections indicate global M&A volumes, inclusive of strategic, sponsor, and buyback deals, will increase by 32% this year and 20% next year, potentially reaching $7.8 trillion by 2027.

Source: Dealogic, Morgan Stanley Research; Note: LTM refers to last 12 months. Data as of September 2025; Data include strategic, sponsor, and buyback deals; data exclude rejected/cancelled deals.

Source: Dealogic, Morgan Stanley Research; Note: LTM refers to last 12 months. Data as of September 2025; Data include strategic, sponsor, and buyback deals; data exclude rejected/cancelled deals.

“Fewer reasons to wait. More reasons to go”

Market conditions are supportive to bring sellers to the table, with the record S&P 500 highs and market volatility low.

Markets are due for an inflection following three years of below-trend M&A volumes relative to nominal GDP. Company management teams are incentivized to grow their business, and opportunistic inorganic levers are common mechanics toward these objectives. Theoretically, managements should have used the last three year window to set up growth strategies with pre-identified prospects and preliminary conversations to accelerate deal announcements and completions in an upturned market.

U.S. antitrust regulators have committed to a more transparent, predictable, and expedited approval process. The Department of Justice (DOJ) has publicly signaled a departure from aggressive “sub-regulatory” tactics, such as issuing warning letters or expansive second requests intended primarily to stall transactions. Similarly, the Federal Trade Commission (FTC) has shifted toward a “litigate or clear” stance, explicitly moving away from administrative delays designed to let deals “die on the vine.” The stated priority is to foster a dynamic and innovative economy by allowing non-violating mergers to proceed without interference. While selective challenges will likely persist, this transition toward a more structured and streamlined regulatory environment serves as a significant tailwind for the current M&A cycle.

“The FTC is not going to try to use sort of sub-regulatory means to hold up mergers without actually taking people to court and hope that they die on the vine. That’s over. If we think it violates the laws, we’re going to litigate. And if it doesn’t, we’re going to get out of the way and we’re going to let markets do their thing. We want the economy to grow. We want it to be vibrant. We want it to be dynamic. We want it to be innovative.” FTC Chair Andrew Ferguson on a CNBC interview, March 13, 2025

The “sponsor spark” is prepared to ignite a resurgence in private market activity, driven by a dual-pressure environment of unprecedented capital reserves and a growing exit backlog. After years of extended holding periods, sponsors are facing mounting pressure from limited partners to return capital, which will likely force a significant increase in M&A, IPOs, and the use of continuation vehicles through 2026. The Federal Reserve’s move toward interest rate cuts further catalyzes this shift by lowering the cost of leverage for buyouts and improving the overall economics for large-scale acquisitions.

Currently, general partners hold over $4 trillion in “dry powder”—uninvested capital that must be deployed to generate returns.

Simultaneously, an estimated $6 trillion worth of private equity-backed portfolio companies—comprising approximately 31,000 firms—now require a liquidity event.

Structural drivers for M&A include demand for AI and cloud capabilities, the steep power and grid shortfall, innovation in life sciences, reshoring in a multipolar world, and cross-border M&A as slower GDP growth geographies look to the US for growth.

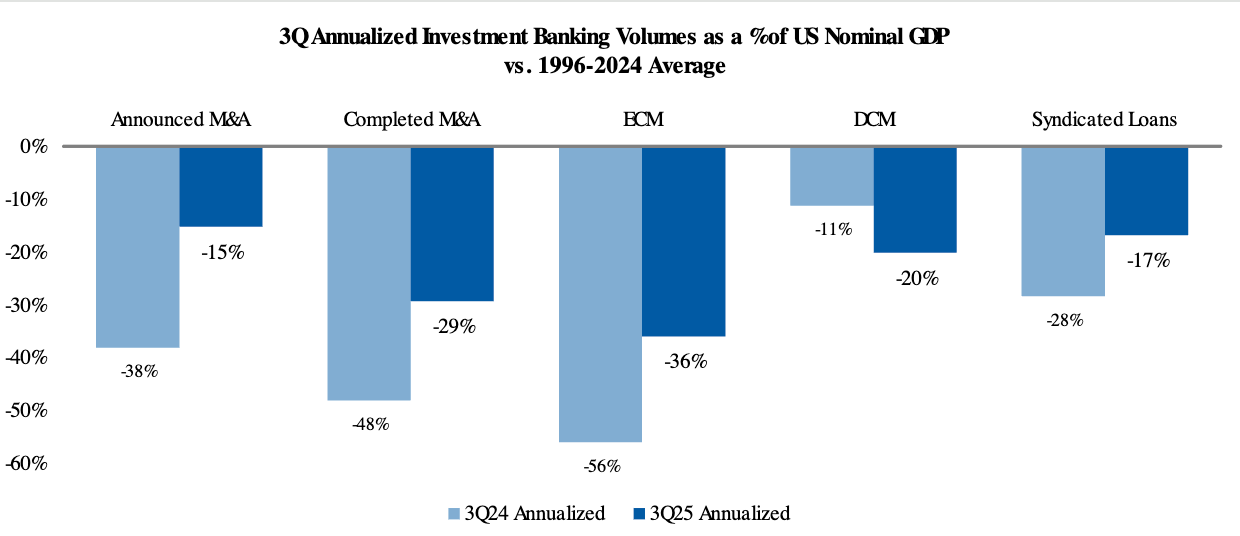

3Q25 annualized investment banking volumes relative to nominal GDP are still 15% below average for announced M&A and 29% below average for completed M&A, even after a significant improvement versus 3Q24:

Source: Dealogic, Federal Reserve, Morgan Stanley Research estimates

Source: Dealogic, Federal Reserve, Morgan Stanley Research estimates

How are investment banks describing the current pipeline?

Lazard

“Looking ahead, we see an increasingly constructive environment for advisory activity.” Peter Orszag, October 23, 2025.

Jefferies

“The environment, as much as there’s concerns, as much as there are issues, as much as there are divides, there’s pretty clear momentum. There’s a pretty clear willingness to take risks. There’s a willingness to lean into strategy and to lean into growth.” Brian Friedman, October 16, 2025.

Bank of America

“We’ve obviously seen a pickup in activity here in the third quarter. We were happy to see that. As we’ve seen more certainty now around trade and tariffs and around taxes as well, it’s allowed our client base to make longer-term decisions, and that’s reflected in our investment banking activity. In terms of the pipelines, they’re up this quarter, up over double digits. So, we feel good about the pipeline and the way it’s developing. And we’ll need to see how the transactions execute in Q4, but it feels like a good environment in terms of, for example, M&A at this point.” Alastair Borthwick, October 15, 2025.

Citigroup

M&A seeing”momentum across several sectors and with continued share gains with financial sponsors and more sell-side activity.” Mark Mason, October 14, 2025

Goldman Sachs

“The pickup in dealmaking broadly is meaningful, but it’s particularly accelerating in the US. And what’s driving the pickup in dealmaking is a changed regulatory environment. So if you’re thinking strategically and you wanted to really expand your scale or your competitive position in almost any industry, for the last 4 years in the United States the answer was no from a regulatory perspective, it really wasn’t what’s the question, what can be answered, the answer was no. And I think CEOs at this point imagine they’re in an environment where you actually can get strategic transactions done to expand your competitive position and so we obviously at Goldman Sachs have an early look at that activity and those dialogues and I would say it’s accelerated very significantly. There is real momentum in the dealmaking environment, I think you’re going to see an acceleration of that into 2026 for sure. And increasingly CEOs are testing what the bounds are of their ability to enhance their competitive position and improve their scale.” David Solomon, October 3, 2025.

JPMorgan Chase

“But we feel there’s a lot of animal spirits at the moment. Big M&A is back. It’s maybe one of the biggest last few months we’ve had in a long, long time. There is a strategic imperative to be global, big, diversified, integrate your operations, and there’s also a sense that you have a finite window of time to complete large M&A before the regulatory sentiment may shift back. So I think that we’re expecting to see large M&A continue until something happens that slows it down.” Doug Petno, September 9, 2025.

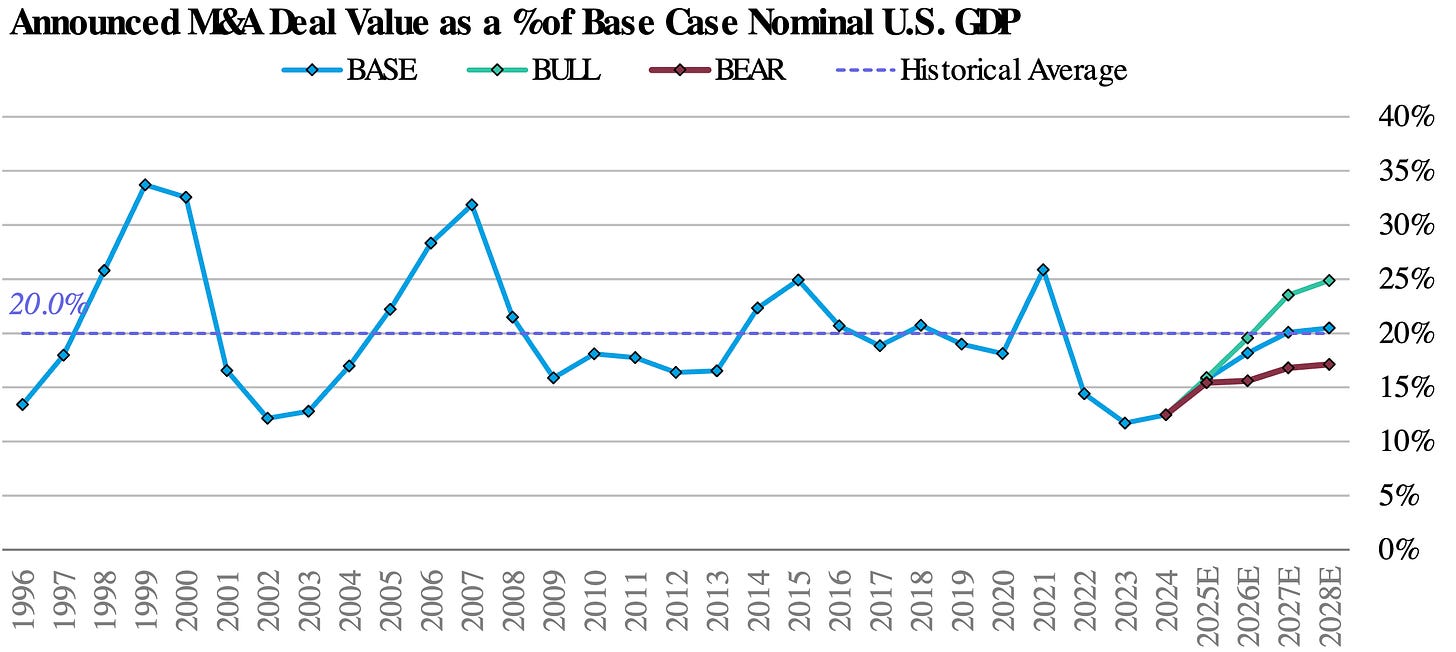

Global announced M&A volumes improved by 12%Y in 2024; MS expects a further 32%Y increase in 2025, a 20%Y increase in 2026, and 15%Y increase in 2027 in our base case

Relative to US nominal GDP, MS forecasts global announced M&A volumes to improve from historical lows back to 1996-2024 average levels by 2027 (base case) and by 2026 (bull case):

Source: Dealogic, Federal Reserve, Morgan Stanley Research forecasts; Note: We model global volumes against US nominal GDP, as the US economy drives the majority of M&A advisory activity.

Source: Dealogic, Federal Reserve, Morgan Stanley Research forecasts; Note: We model global volumes against US nominal GDP, as the US economy drives the majority of M&A advisory activity.

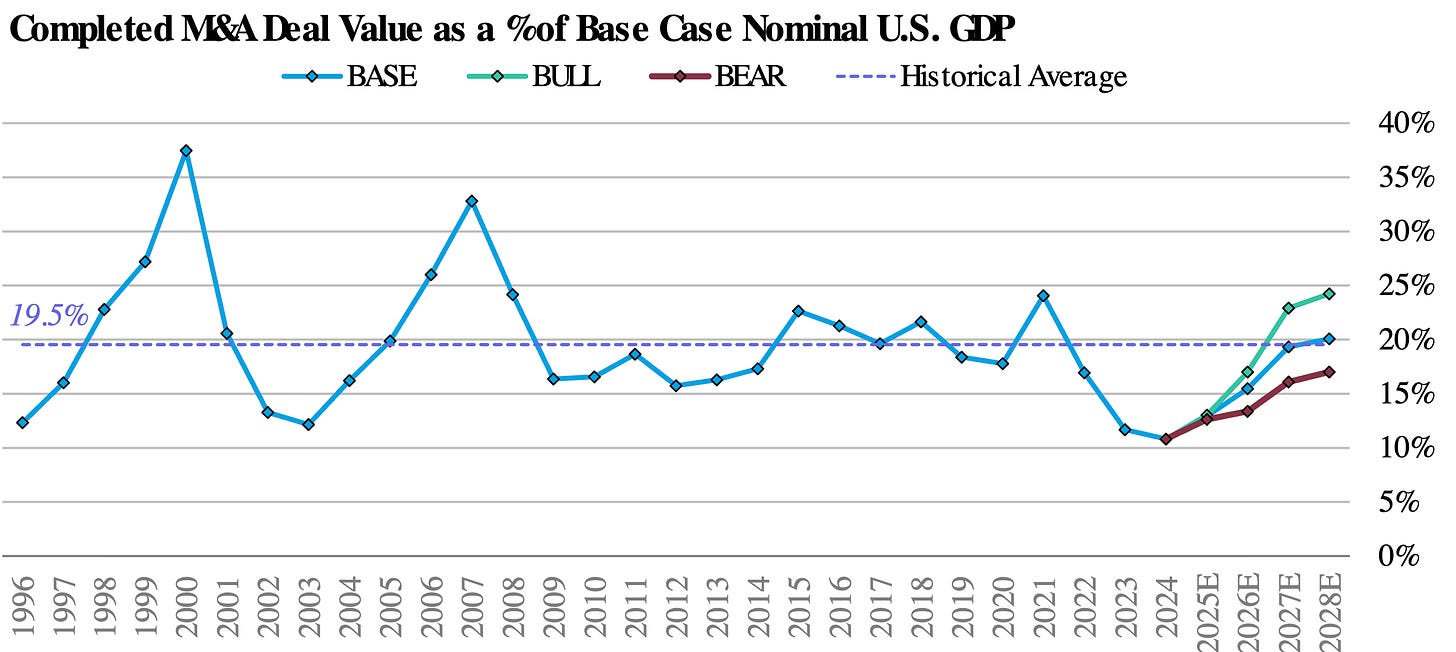

Relative to US nominal GDP, MS further forecasts global completed M&A volumes to improve from historical lows back to 1996-2024 average levels by 2027 (base case) and by 2026 (bull case):

Source: Dealogic, Federal Reserve, Morgan Stanley Research forecasts; Note: We model global volumes against US nominal GDP, as the US economy drives the majority of M&A advisory activity.

Source: Dealogic, Federal Reserve, Morgan Stanley Research forecasts; Note: We model global volumes against US nominal GDP, as the US economy drives the majority of M&A advisory activity.

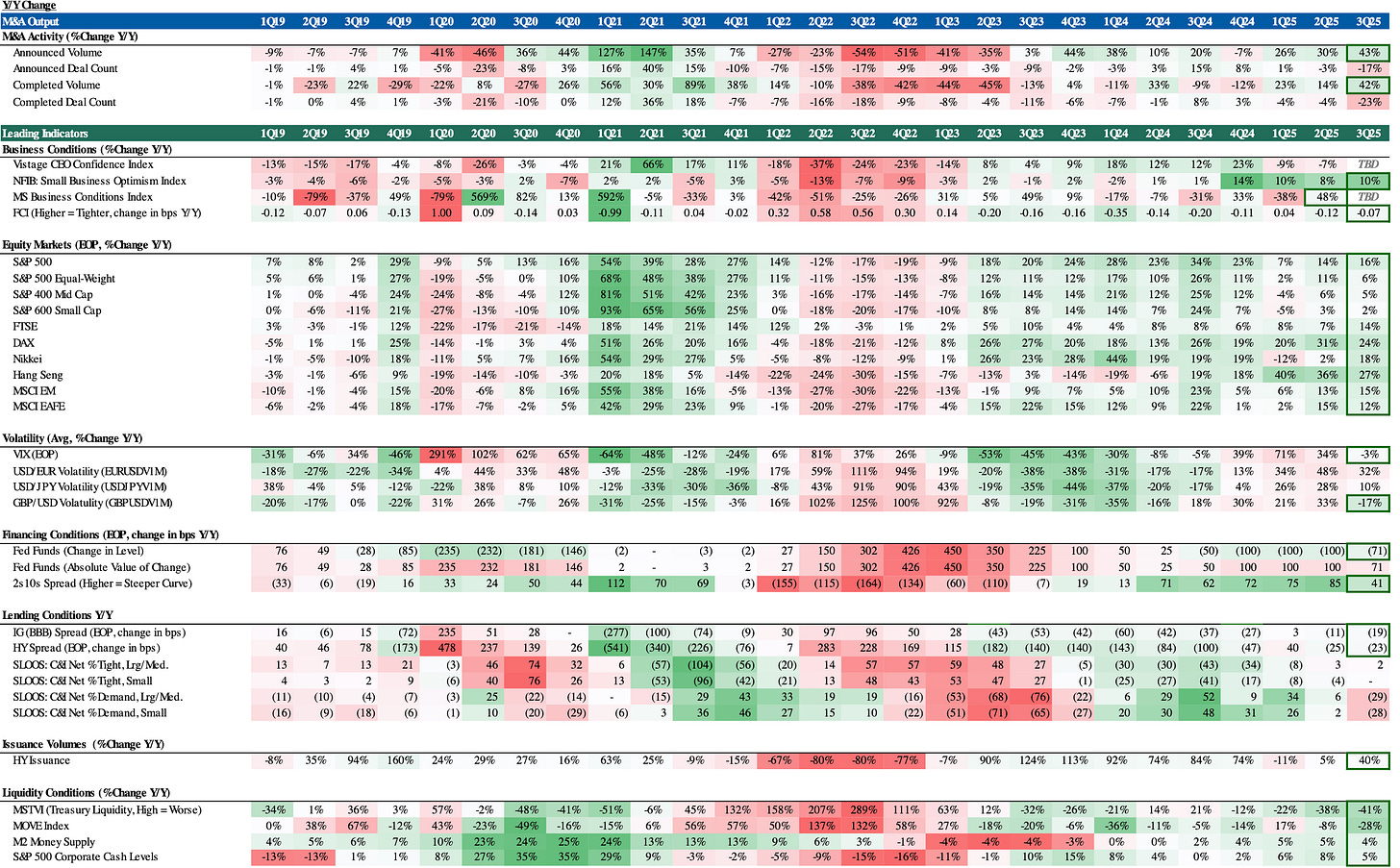

Lead indicators point to a rebound in M&A deal activity:

As of 3Q25, MS updated their heat map framework of leading indicators for M&A activity. It shows the majority of indicators improving YoY for the past several quarters, with global M&A announcements building YoY for three consecutive quarters. Important highlights include:

Every major global equity market index is up YoY, thus supporting deal valuations, encouraging corporate sellers to the table, and incentivizing exit events. Equity is an important currency for buyers looking to expand via M&A.

Volatility is low, with daily average VIX 3%Y lower. Low volatility provides more stability in valuation and narrows bid-ask spreads in deals.

Deal financing markets are wide open, with HY and IG spreads both tighter year on year and HY issuance up 40%Y.

Liquidity is improving and corporate cash levels are higher.

Source: Dealogic, Vistage, FactSet, Bloomberg, Federal Reserve Senior Loan Officer Survey, Morgan Stanley Research; Note: M2 data as of August 2025.

Source: Dealogic, Vistage, FactSet, Bloomberg, Federal Reserve Senior Loan Officer Survey, Morgan Stanley Research; Note: M2 data as of August 2025.

MS strategist, Andrew Sheets, highlights a confluence of supportive macro and micro factors that are central in their multi-year M&A cycle predictions. But the simply top-down call is:

Less Reasons to Wait + More Reasons to Go = An Inflecting Multi-year Cycle

Less Reasons to Wait:

His view holds some significance toward the idea of decreasing uncertainty. The disconnect between strong equity performance, and subdued corporate activity over 2020-2024 can be explained by Sheets’ rolling series of less “reasons to wait”:

2020: The worst global pandemic in ~100+ years.

2021: Uncertainty around reopening; companies were focused on managing current operations and dealing with a surge in stimulus-driven demand. M&A activity did rise...but it was temporary.

2022: The highest inflation in 30+ years, and a significant equity market correction.

2023: The faster pace of rate hikes in 30+ years, uncertainty around where they’d end, and widespread expectations of recession.

2024: The US election, and uncertainty around what tax and trade policy could look like in the aftermath.

Reasonably so, corporates were more cautious. This explains relatively conservative balance sheet trends, which have been a core driver of credit market strength, and the unusual divergence between modest M&A activity and a soaring stock market.

The rest of this article is available to Premium Subscribers on the Tight Spreads Substack