The Natural Gas Moment

Every civilization that has ever endured did so because it mastered energy before it tried to moralize it. From firewood to coal, from coal to oil, and from oil to gas, the dominant energy source of each era was not chosen by committees or consensus, but by physics. Cheap, reliable, and scalable energy has always been the invisible foundation of economic growth, social stability, and political power. When energy becomes expensive or unreliable, societies do not gradually adjust; they fracture. Inflation rises, industry decays, trust erodes, and political extremism fills the vacuum.

https://ai.studio/apps/drive/1nA1hRgt5FuO1wgGC3Gmql5AnFLNW8bkR

Energy, before it becomes a market slogan or a moral crusade, is a stubborn physical constraint. It obeys the laws of thermodynamics, chemical bonds, and time — none of which have ever shown much respect for press releases, regulations, or well-intentioned speeches. These laws do not negotiate, do not compromise, and certainly do not care how virtuous a policy sounds. Ignore them long enough and reality stages a hostile takeover in the form of shortages, price spikes, and grids that mysteriously stop working. The current energy debate in the United States is no different. It is not really a debate about the environment or technology; it is a wrestling match between physics and politics, and physics has an undefeated record.

Natural gas sits awkwardly at the center of this confrontation. It doesn’t inspire chants, doesn’t look good on posters, and doesn’t make anyone feel morally superior. It is neither fashionable nor photogenic, and it will never be invited to the cool kids’ table. Yet it stubbornly keeps the lights on, factories running, and prices from going completely off the rails — not because it tells a good story, but because it quietly follows the rules of reality.

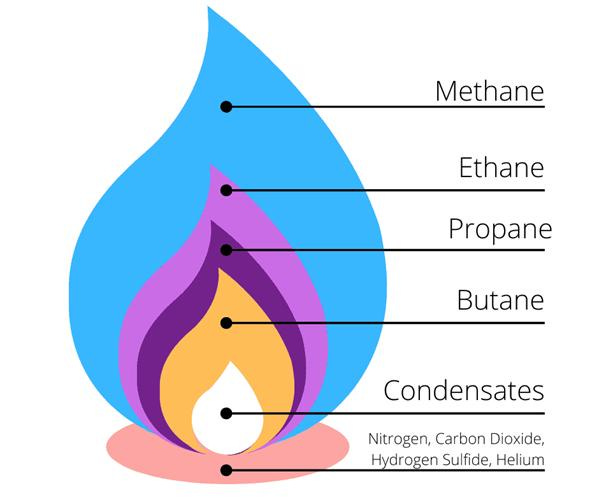

Chemically speaking, natural gas is basically methane — a minimalist molecule with one carbon atom and four hydrogens that somehow does a lot with very little. That high hydrogen-to-carbon ratio is the whole trick: hydrogen releases energy without the carbon baggage, meaning more power and less CO₂ for each unit burned. When methane meets oxygen, it produces heat, water vapor, and some carbon dioxide — and the heat is the star of the show. It’s easy to control, burns cleanly, and wastes very little, making it the energy equivalent of a well-designed machine: simple, efficient, and allergic to unnecessary drama. This isn’t politics or green marketing — it’s just chemistry doing its job.

https://www.croftsystems.net/oil-gas-blog/natural-gas-composition/

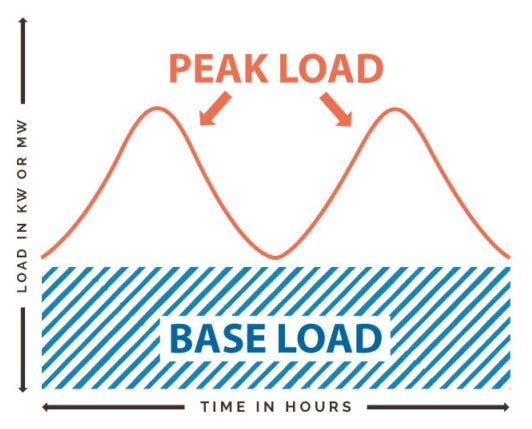

Electricity isn’t a storage problem, it’s a timing problem. Power has to be produced exactly when it’s used — too much and the grid gets dizzy, too little and everything goes dark. Unlike oil or coal, you can’t just stack electricity in a warehouse and deal with it later without paying a fortune. Grid stability isn’t a “nice to have,” it’s the whole game.

Grid resilience ultimately comes down to one unglamorous requirement: enough reliable baseload power that actually shows up when called. The uncomfortable question is where that power comes from over the next three to five years, just as demand accelerates. The Grid, resilience depends on steady, predictable generation — something that becomes harder, not easier, as ESG mandates pile intermittent sources onto the system. Wind and solar don’t provide baseload; they create mood swings. Those swings push peak loads higher and more erratic, forcing peaker plants to sprint in whenever the weather loses interest. Intermittent energy can decorate the grid, but it can never anchor it — and grids without anchors tend to drift into trouble.

This is where natural gas earns its keep. Gas plants are fast, flexible, and obedient. Demand goes up, they ramp up. Demand drops, they dial it back. No waiting for the sun to wake up or the wind to feel inspired. They run when needed, as long as needed, which is why they quietly hold the grid together. Combined-cycle gas plants take this efficiency obsession one step further. First, gas spins a turbine and makes power. Then the leftover heat — instead of being wasted — spins another turbine and makes even more power. The result is over 60% efficiency, which is energy’s way of saying, “Nothing wasted, nothing fancy, just works.”

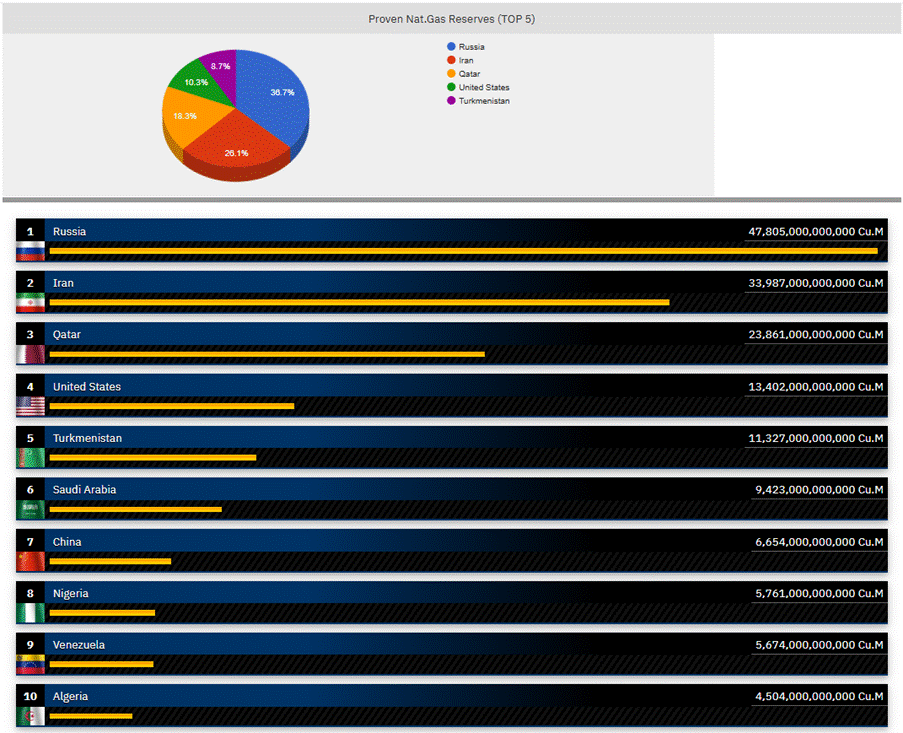

The United States has an energy cheat code that most countries can only envy. It sits on vast natural gas reserves, masters advanced drilling technology, enjoys deep capital markets, and has spent decades stitching the country together with pipelines.

https://www.globalfirepower.com/proven-natural-gas-reserves-by-country.php

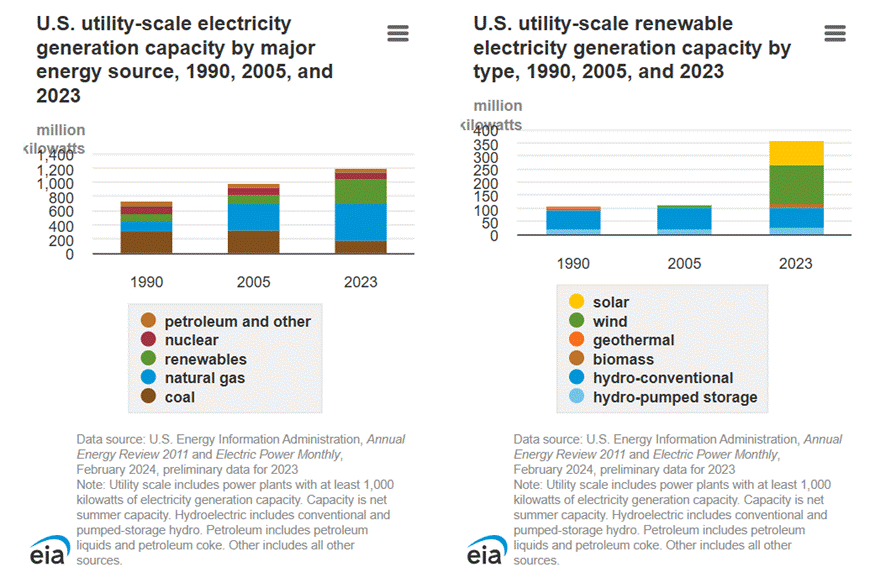

The result is that natural gas has quietly taken over the power grid, now generating roughly forty percent of US electricity. This wasn’t the product of grand climate plans or central coordination. It happened the old-fashioned way — gas is cheaper, more reliable, and more flexible than everything else, so it won and will keep winning.

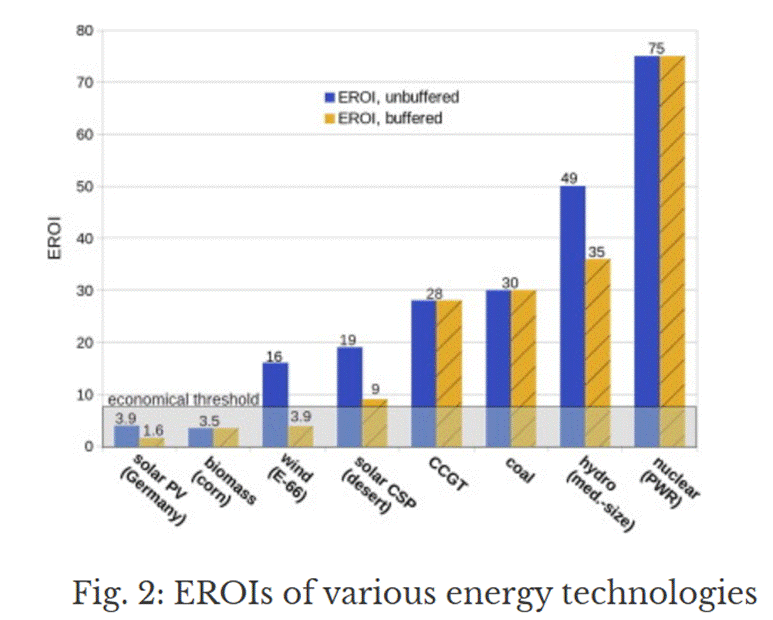

Natural gas didn’t replace coal because of speeches or virtue — it replaced it because coal started failing the most important test in energy: effort versus reward. That test is called Energy Return on Investment, or EROI, which is just a fancy way of asking, “How much energy do you get back for all the energy you had to spend digging, hauling, processing, and burning the stuff?”

https://corporatefinanceinstitute.com/resources/accounting/energy-return-on-investment-eroi/

Coal’s EROI has been sliding as miners dig deeper, move more rock, and burn more energy just to get the same payoff. Natural gas, on the other hand, shows up with modern drilling, horizontal wells, and pipelines already in place, then gets burned in highly efficient power plants. The result is more usable electricity for less effort. Power producers didn’t need a moral awakening to switch — they looked at the math, shrugged, and picked the fuel that actually pulls its weight.

https://cccu-wustl.com/eroi-and-energy-availability/

A carefully approved combination of ill-intentioned ESG mandates has given America a brand-new Energy Achilles’ Heel, and the AI race may soon be issued the official arrow. After more than a decade and over $10 trillion spent electrifying everything in the name of hydrocarbon independence, the US somehow ended up more energy-fragile, more geopolitically exposed, and staring down an AI-driven power crunch at home. This is progress, as defined by the ‘Gretaverse’: dependence reduced in theory, vulnerability increased in practice. Like Achilles, the system was dipped in virtue from head to toe — carefully held by the heel — and everyone agreed not to notice the weak spot until physics inevitably does.

After trillions of dollars invested and a steady reduction in the share of fossil fuels, atmospheric CO₂ has continued its steady climb — stubbornly refusing to end the world on schedule. At the end of the day, climate dynamics operate over Phanerozoic time scales spanning hundreds of millions of years and are driven by a complex, multivariate system. Against that backdrop, assuming that a single variable measured over roughly two centuries is the master dial of the climate system is not just optimistic — it is a textbook case of modern hubris.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/the-natural-gas-moment

Visit The Macro Butler Website here: https://themacrobutler.com/

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence