Energy Fuels Valuation Scenarios

From the Tight Spreads Substack.

Energy Fuels ($UUUU) is strategically pivoting from a conventional uranium producer to a vertically integrated “critical minerals hub” for the Western world. By leveraging its unique regulatory assets in the United States and aggressively acquiring global feedstock, the company is positioning itself to control the entire supply chain for:

Uranium Production

Rare Earth Elements (REE) production

Heavy Mineral Sands Production

Medical Isotopes production

This will simply explain the business, their strategy, and provide a step-by-step valuation sensitivities section at the end. I’d categorize this as a long-term speculative buy and hold. NFA.

Energy Fuels is trading at a ~40% discount to MP and is worth $38 per share from their heavy mineral sands and rare earth production business alone.

And if we bake all segment EBITDA contributions, shares should trade between $XX-$YY.

Simply, the company’s business model is vertically integrated. Its domestic processing infrastructure at the White Mesa Mill in Utah serves as the primary refinery for globally sourced materials from their uranium and heavy mineral sands (HMS) segments. What is not well known about the company is the significance of HMS in securing its rare earth feedstock, insulating the company from any external supply chain vulnerabilities.

Segment 1: Uranium Production

This segment remains the financial and operational foundation of the company. Energy Fuels is currently the leading U.S. producer of natural uranium concentrate (U308). Its primary assets include the White Mesa Mill, which is the only facility capable of processing conventional uranium ore and recycling uranium-bearing materials from third parties. Another very important asset includes their The Pinyon Plain Mine, which is arguably one of the highest-grade uranium mines in U.S. history. Pinyon Plain drives down production costs with significant margin expansion to be realized in early 2026.

“Uranium cost of production cost of sales are expected to decline. We have previously mentioned that we believe the Pinyon Plain cost will be in that $23 to $30 per pound range as we ramp up production and as we process this material. We have existing inventory right now at the mill of 485,000 pounds, and that is currently at a cost of goods sold of around $50 to $55 per pound… But as we start ramping up the Pinyon Plain run, we see… costs dropping pretty materially, should be in that $30 to $40 per pound range in Q1 of this ‘26 and lower as time progresses” [November 4th, 2025 earnings call transcript]

Year-End 2025 Production Forecast: Total uranium inventory (including finished goods and ore) is expected to be between 1,985,000 and 2,585,000 pounds coming from existing feed from their La Sal Complex (with an associated COGS of $50-55/lb) in Utah and Pinyon Plains production starting Q4 2025.

Q1 2026 Production Forecast: 430,000 to 730,000 pounds.

Q1 2026 is the last quarter of feed contribution from the La Sal complex, which bolsters margin expansion from increased production contributions from Pinyon Plains (with a COGS of $30-40/lb) moving forward in production forecasts. This, in conjunction with Pinyon Plains experiencing idiosyncratic margin tailwinds with COGS dropping materially from $30-40/lb to $23-30/lb in an increasing Uranium term market, will drive SIGNIFICANT margin expansion for this business segment. Management is ramping up to become the lowest-cost producer in the United States and competitively within the lower quartile globally.

Uranium term pricing: Sell-side uranium term pricing estimates reach ~$90/lb by mid-2026. Reaching low $100s in 2027-2028.

Inventory Retention: Management’s stated philosophy is to retain most finished product in inventory to capture higher uranium prices, selling only what is required for contracts or opportunistic spot sales.

2026 Production Outlook: The company expects to mine over 2.0 million pounds of U3O8 at Pinyon Plain alone in 2026.

Long-Term Goal: The company is advancing permitting on additional mines to increase its total production capacity to 4 to 6 million pounds per year in the coming years.

White Mesa Mills

Source: Energy Fuels

Segment 2: Rare Earths Production

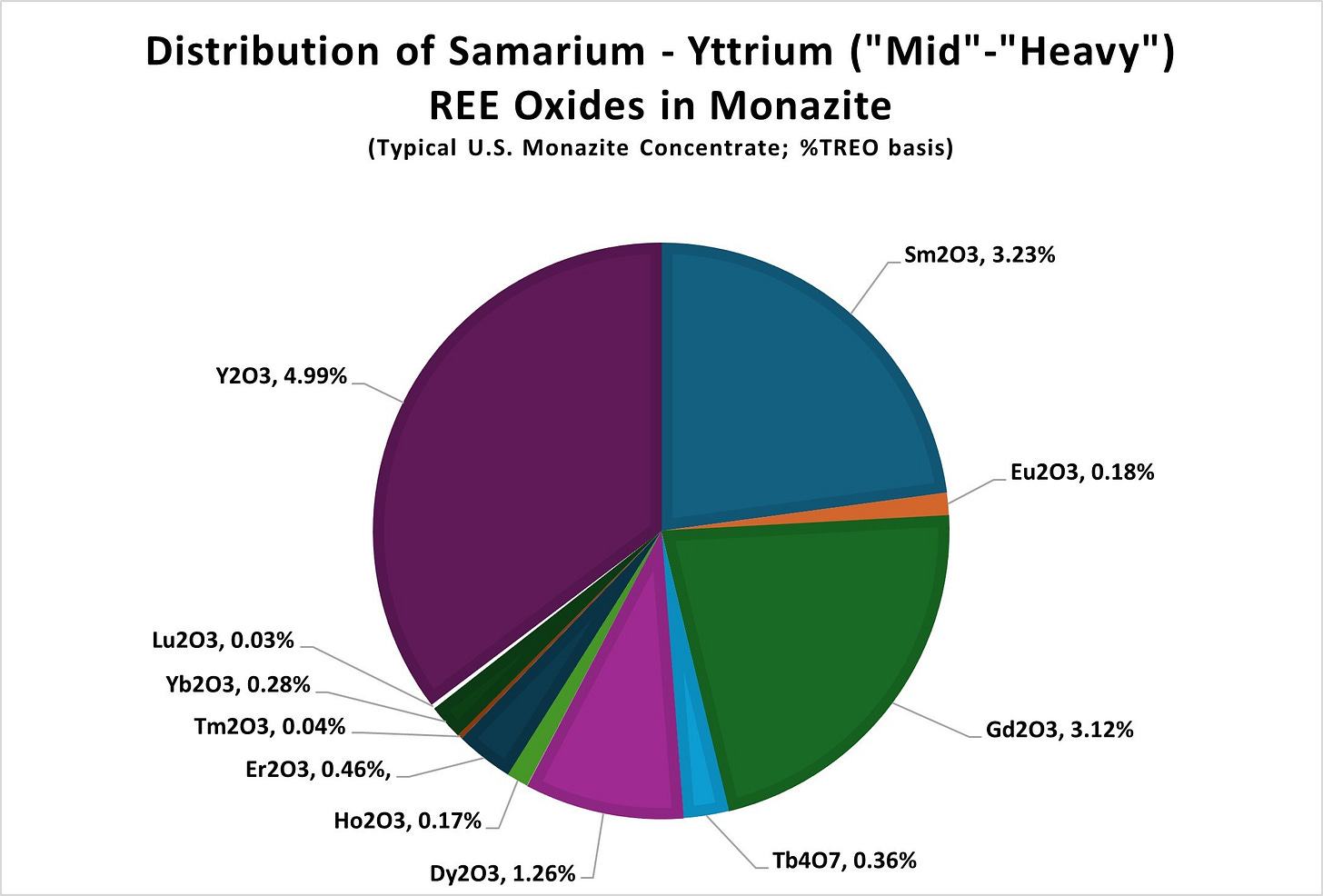

Energy Fuels is utilizing its existing infrastructure to separate critical elements like Neodymium-Praseodymium (NdPr), Dysprosium (Dy), and Terbium (Tb). The White Mesa Mill has been upgraded with a Phase 1 separation circuit, with plans to expand to a Phase 2 capacity of 6,000 tonnes of NdPr per year. Unlike “pure-play” REE companies, Energy Fuels processes monazite sands.

What are Monazite sands?

The crown jewel of their heavy minerals sand (HMS) segment through a 2024 strategic acquisition of ‘Base Resources’ Monazite is a “super high-grade” concentrate, typically containing 50% to 60%+ total REE oxides.

How important are they for the rare earth segment?

Monazite is often produced as a low-cost byproduct of HMS mining, allowing the company to leverage revenue from other minerals like zircon and ilmenite to offset costs. Processing monazite provides a uranium credit. And they’re the only business in the United States that can do this.

3 key assets in from their HMS segment that contribute feedstock for REE processing:

The Toliara Project, now renamed Vara Mada, in Madagascar

The Kwale project in Kenya

The Bahia project in Brazil

Through a joint venture, Energy Fuels is earning a 49% interest in the Donald Project in Australia for 100% of their monazite.

Source: Energy Fuels

Segment 3: Heavy Mineral Sands

While the monazite (a rare earth by-product) is sent to the White Mesa Mill for processing, the heavy mineral sands production ALONE is a robust, large-scale operation that generates substantial EBITDA independently of the downstream rare earth business. This segment was significantly expanded following the acquisition of Base Resources Limited in October 2024.

The segment produces a suite of heavy minerals used across various industrial and high-tech sectors:

Ilmenite & Rutile → yields Titanium (Ti02)

End market uses: Pigments for paint, paper, and plastics; welding consumables; and titanium metal.

Zircon → yields Zirconium (ZrO2)

End market uses: Ceramics (opacifiers), foundry sands, and zirconium chemicals.

Monazite → REE

End market uses: Permanent magnets for EVs, wind turbines, defense systems, and robotics.

Energy Fuels is an extremely strong candidate to receive government secured margins to produce rare earths via a price floor that would be competitive to that of MP Materials’ for a few reasons as highlighted by Energy Fuels’ CEO, Chris Chalmers:

“We have a clear pathway to supplying 45% of total U.S. rare earth requirements in the near-term, including 100% of much-needed ‘heavy’ REEs like Tb and Dy by 2030”

“We can scale our production of these critical REE oxides at a fraction of the capital costs required by others.”

“Our operating costs, and expected margins, should be in the first quartile globally including Chinese producers.”

As well as the existing synergies with their private market partner, Vulcan Elements, who received $1.4 billion from the US Government to expand their permanent magnet production in NC. It would make sense for the company to be incentivized with an additional price floor the government will be implementing for the industry as mentioned by Scott Bessent.

The Department of Energy (DOE) explained in their Fusion Science and Technology Roadmap how they will invest in critical infrastructure for Vanadium, Samarium, and the specific type of magnet Energy Fuels and Vulcan Elements will co-produce: neodymium-iron-boron magnets. This magnet will have cross-sector demand, stemming from the DOE for fusion technology, the Department of War for defense applications, and wide-scale commercial applications. Energy Fuels also has, as of the Q3 2025 earnings call, 905,000 lbs of finished vanadium, 37,000 kg of finished separated NdPr oxide, and 9,000 kg of finished high purity, partially separated mixed “heavy” samarium-plus rare earth carbonate in inventory to strategically sell to above-market bidders.

The company also qualified their NdPr and Dy oxides with Posco, a major South Korean and global automotive supplier. Last March, Energy fuels indicated that this could lead to the:

“Potential delivery of additional mass production supply volumes of NdPr oxide later this year for permanent REE magnet production, which will be enough to power 30,000+ EVs, which could be available to consumers later this year.”

This an additional contract that is arguably more considerate for commercial validation. This is not included in this article’s valuation.

To further cement themselves as one of the premier rare earth players globally, Energy Fuels acquired Australian Strategic Metals (ASM). The ASM acquisition is described as the final step to becoming the largest fully integrated REE producer outside of China, moving beyond just being a supplier of oxides to becoming a downstream producer of high-value metals and alloys. Cantor’s incorporated ASM REE processing business and permitted Dubbo REE mining project increases their NPV (7.5-12.5%) estimates on Energy Fuel’s business from $1.7B to $2.7B.

Energy Fuels Madagascar Project, Vara Mada, Delivers $1.8B Post-Tax NPV & 24.9% IRR from Heavy Mineral Sands Development:

Source: DiscoveryAlert AU News

Segment 4: Medical Isotopes

Energy Fuels established a strategic alliance with RadTran, focusing on recovering medical isotopes from process streams. This partnership leverages the company’s licensed mill to solve global shortages of Radium-226 and Ra-228 for targeted alpha therapy cancer treatments, creating a high-margin revenue stream from what was previously considered waste. R&D revenues are expected to come in the next few months, with meaningful EBITDA as of 2027. Management is currently in negotiations for off-take agreements here. Significant cashflow potential in coming years upon successful execution.

Current Core Assets Production and Valuation

Excluding EBITDA contributions from medical isotopes, uranium production, the Kwale project in Kenya, the Bahia project in Brazil, and ASM’s REE processing business and permitted Dubbo REE mining project

Production Volumes Per Asset & Material:

White Mesa Mill Phase 1 Circuit

Monazite Feed: ~10,0000 tonnes per annum (tpa)

NdPr Oxide: ~1,000 tpa

Heavy REEs (Dy/Tb): Pilot/Small scale

Important notes:

The company is evaluating a “Phase 1b” addition to provide custom-built solutions for other specialty products if required by the government.

The company also notes that the White Mesa Mill may reconfigure the Phase 1 circuit in the future to allow it to operate simultaneously with both conventional uranium production and the Phase 2 REE separation circuit.

White Mesa Mill Phase 2 Circuit

Monazite Feed: ~50,000 - 60,000 tpa

NdPr Oxide: ~6,000 tpa

Heavy REEs (Dy/Tb): ~350+ tpa

Phase 2 is also projected to produce 198,000 lbs of uranium (U3O8) per year as a byproduct.

Vara Mada (Production 2029)

Stage 1 Capacity: The initial operation is designed for a mineral processing capacity of 13 million tonnes per annum (tpa)

Stage 2 Capacity: A planned expansion is expected to nearly double the capacity to 25 million tpa.

Monazite Production: At full capacity, the project is expected to produce 24,000 tonnes of monazite annually.

Other Mineral Production: Expected annual output includes 959,000 tonnes of ilmenite, 66,000 tonnes of zircon, and 8,000 tonnes of rutile.

Important notes:

At full capacity, monazite produced from Vara Mada and Energy Fuels’ other projects has the potential to supply up to 30% of U.S. demand for light rare earth element oxides and 85% of U.S. demand for heavy rare earth element oxides.

Mine Life: The feasibility study confirmed an initial 38-year mine life, with potential for expansion through additional drilling

The feasibility study yielded a $1.8 billion or $7.30 per share post-tax net present value discounted at 10%, pre-debt and post-final investment decision.

+$500 million average annual EBITDA from the project alone, not including the expected additional downstream EBITDA from processing the recovered monazite.

Also to note, I’ve seen people publish valuation notes saying they’ll make $550M EBITDA from Vara Mada as of 2027. That’s untrue.

Valuation Sensitivities & Step-by-Step Math

The rest of this note is available for Premium Subscribers to the TightSpreads Substack.