Yen Collapse Behind Gold's Explosive Rally

Sections

Japan as the First Visible Stress Fracture

Treasury Stability as the Primary American Constraint

Monetary Tools as Expressions of the Same Outcome

Financial De-Globalization and the Burden of the Dollar

Policy Timing and the Gold Constraint

Systemic Fragility and the Hierarchy of Dependence

After Readiing Plaza Accord II? After The Coordinated Global Yen Intervention, What Happens Next,; These thoughts occurred

Japan as the First Visible Stress Fracture

Authored by GoldFix

The present environment is defined by the synchronization of long-discussed risks, as conditions that once evolved as separate contingencies are now converging into a single, interdependent sequence. Japan sits at the center of that sequence because its constraints have tightened into binding policy choices, which makes its stress both observable and transmissible; its importance is immediate in market terms and prospective in policy terms, because the response function developed there will shape how Washington reacts when similar pressures spread across funding markets and currencies.

Japan’s debt burden and growth profile impose a narrow corridor for policy. Economic maintenance requires nominal expansion, nominal expansion requires tolerance for inflation, and that tolerance necessarily spills into bonds and FX. Rising yields and a weaker yen are coherent outcomes inside that corridor. The variable that determines whether the system remains stable is speed; gradual depreciation can be absorbed domestically, while accelerated depreciation compresses real incomes, tightens financial conditions, and forces intervention.

Intervention requires yen demand. Yen demand requires dollar supply. Dollar supply, at scale, requires the liquidation of foreign assets, and the deepest pool available to Japan remains U.S. Treasuries. Selling Treasuries to obtain dollars and converting dollars into yen is a straightforward mechanism. The systemic consequence is equally straightforward: foreign Treasury selling applies upward pressure to U.S. yields precisely when the United States is most sensitive to funding costs, refinancing capacity, and the optics of market control.

Treasury Stability as the Primary American Constraint

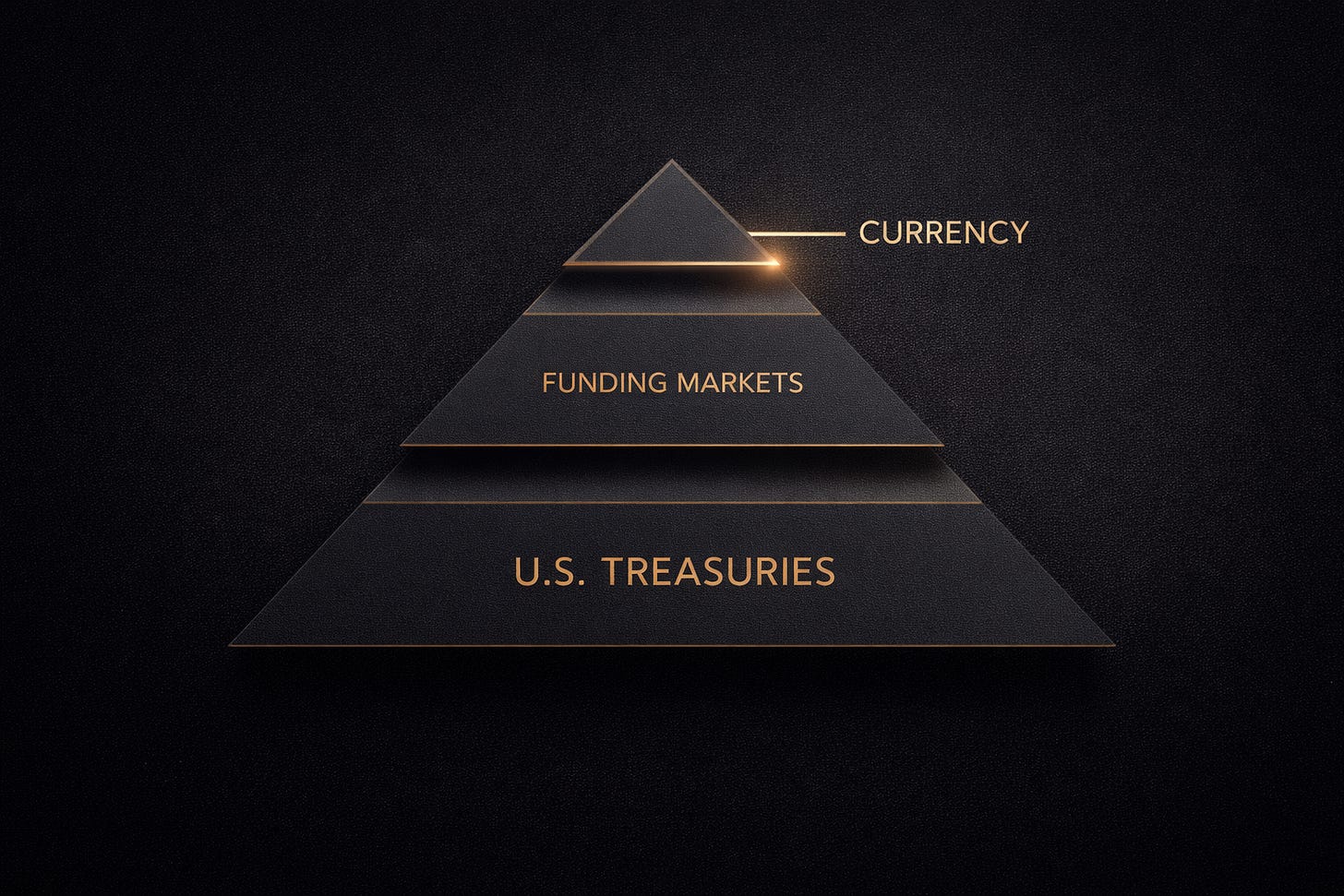

The United States treats the Treasury market as the structural base layer of the global system: collateral, reserves, hedging, and balance-sheet construction. A large, fast, and unilateral reduction in foreign Treasury holdings therefore functions as a destabilizing event rather than a neutral portfolio choice. Within the fiscal hierarchy, Treasury stability governs borrowing capacity, borrowing capacity governs policy space, and policy space governs political survival. Currency strength sits below those priorities when the bond market’s integrity is in question.

The accommodation channel runs through the dollar. Supporting the yen while preserving Treasury stability pushes the adjustment into the U.S. currency rather than into U.S. yields. In practice, this becomes a distributed form of coordination, achieved through outcomes rather than declarations. Decades of financial integration created transmission mechanisms that run automatically; stress introduced at one node reappears at another, and the system’s center absorbs the residual.

As an American, the obligation is clear. Treasuries matter more than dollars in the fiscal sense because creditworthiness determines the state’s ability to borrow at scale, and borrowing at scale remains the condition for maintaining the entire policy architecture. Currency depreciation ahead of bond-market disruption acts as a pressure valve by redirecting adjustment costs through inflation and away from funding access.

Monetary Tools as Expressions of the Same Outcome

Yield curve control and quantitative easing differ operationally, yet they converge in function. Both suppress long-term funding costs. Both expand balance sheets. Both weaken the currency. The implementation details matter to technicians; the macro consequence matters to holders of purchasing power and to anyone tracking reserve behavior.

This environment explains the repricing of gold and silver as balance-sheet responses to structural change rather than episodic reactions to headlines. Gold absorbs the residual risk embedded in currency accommodation and debt preservation. Silver amplifies that response because physical constraints, inventory behavior, and retail substitution pressures sit on top of monetary demand.

The chain reaction extends beyond Japan and the United States. A weaker dollar constrains Europe’s policy latitude by tightening trade-offs between competitiveness, imported inflation, and domestic credit conditions. European resistance to easing shifts pressure into Asia through relative FX levels, where China’s currency management intersects with export dependence and regional correlation. The resulting configuration resembles a global recalibration conducted through exchange rates and funding markets, even when official language remains domestically oriented.

Financial De-Globalization and the Burden of the Dollar

Financial globalization embedded obligations that now unwind alongside the physical repatriation of supply chains. As trade onshores, capital retrenches. Payment chains and settlement structures reorganize. Reserve behavior adapts. The network that previously distributed imbalances across borders tightens into national balance sheets.

The United States benefited most from the prior configuration. As that configuration contracts, adjustment pressure accumulates at the center. Orderly contraction requires a currency pathway that prevents credit markets from seizing. That pathway implies a weaker dollar delivered sooner than policymakers would choose under stable conditions, because the alternative is a disorderly repricing of the Treasury market and the collateral system built on it.

This dynamic underpins the persistence of the precious-metals bid. Gold functions as a neutral asset inside a system renegotiating claims, priorities, and settlement credibility. Silver participates as both monetary proxy and constrained physical commodity, with its own microstructure stresses.

Policy Timing and the Gold Constraint

At some valuation, gold enters the policy calculus directly through reserve management, hedging behavior, and possible revaluation logic. The exact level remains unknowable. The constraint is visible. Early hedging by official actors compresses confidence in fiat claims and accelerates the move. Late hedging allows instability to mature beyond controllable boundaries. Timing becomes the policy risk.

Until that boundary appears, tactical hedging remains compatible with strategic conviction. Short-term volatility structures manage exposure without altering the primary thesis. Structural allocation reflects recognition of regime transition rather than a bet on daily price behavior.

More here