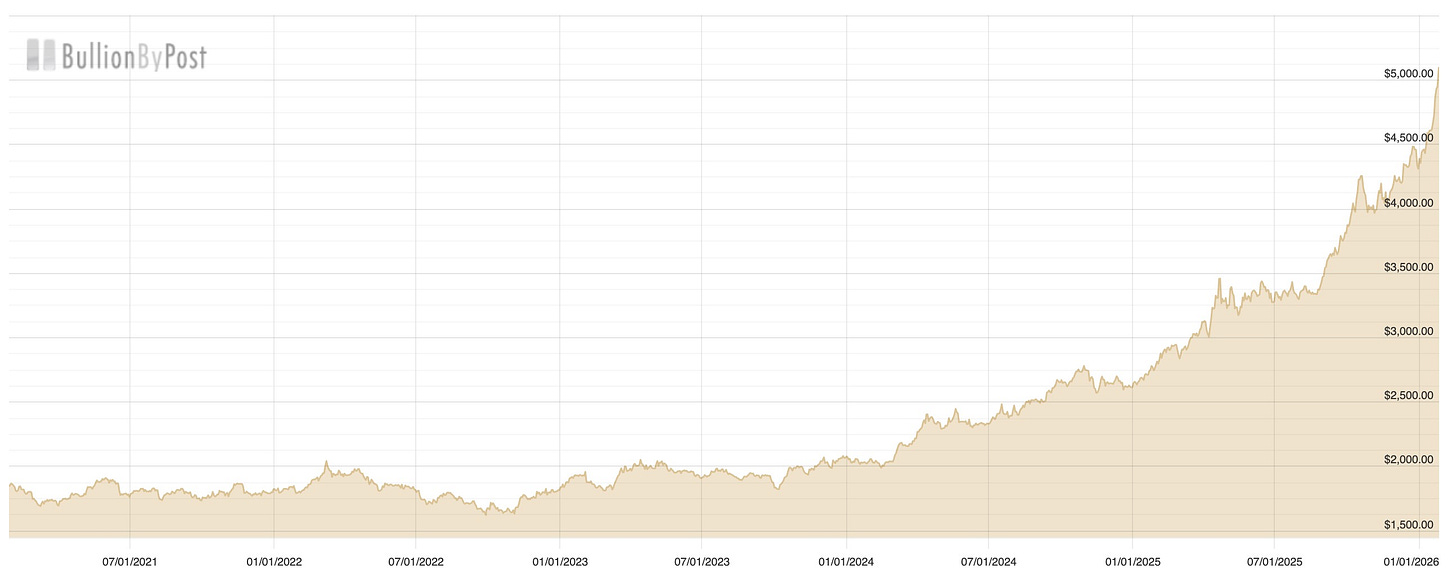

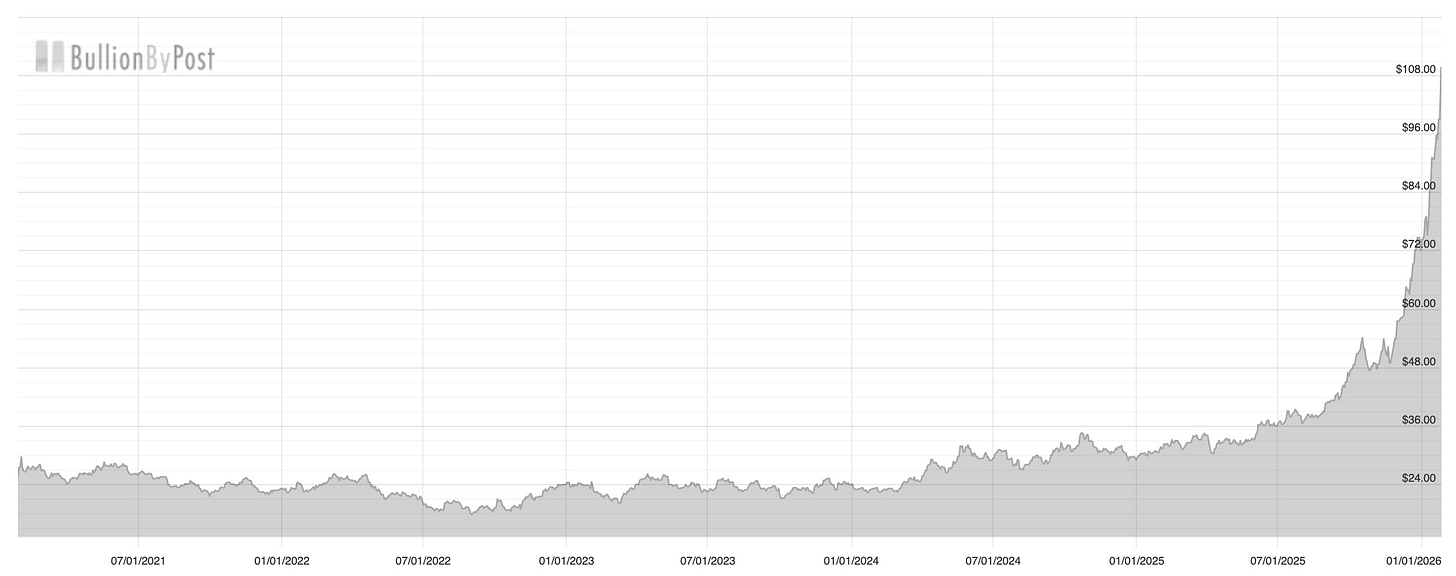

How I'd Trade Gold At $5,000 And Silver At $100

Submitted by QTR's Fringe Finance

This week's move in gold and silver caps an astronomical move over the last year and a half. Here’s gold over the last 5 years:

And here’s silver:

Wild shit, right?

Everyone knows I’ve been long gold and silver basically forever at this point. This isn’t some sudden epiphany I had last week after seeing a headline. I’ve been beating this drum for years, probably to the point of major annoyance. If you’ve followed my stuff for any length of time, this shouldn’t be remotely surprising. I’ve believed in the long-term setup, the macro backdrop, and the structural story for a long time, and nothing about the last few months changes that.

Here’s what I’m thinking today, though — and four brand new data points as of today that I’m looking at to inform my decision.

Let’s be honest, the move in gold and silver has been insane. Both are now beating the S&P over pretty much any recent time period you want to look at in recent memory.

I've been dead on right about gold and silver for nearly a decade now. And now, here’s how I've decided to trade it here -- and four things I noticed today that are informing my decision...(READ MY FULL THOUGHTS HERE).