Japan's Debt Unwind Will Crush Stocks

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

While the mainstream media was focused on minor volatility, the Japanese bond market just underwent a violent, Liz Truss-style meltdown. Japanese bonds experienced a sharp selloff, with long-term interest rates surging to record highs. Prime Minister Takaichi floated an ambitious fiscal plan of cutting taxes on food, but without money to fund it. Bond investors viewed this budget to be unsustainable, similar to the UK’s 2022 meltdown.

When a nation’s fiscal position deteriorates, meaning it risks rising debt levels or defaulting on its obligations, the bond market punishes them with higher yields. That is the balancing factor that stops all governments from spending profligately.

The result: Long-term Japanese yields exploded to record highs. The effect started spilling over into US Treasury bond markets, which also experienced a sharp rise in rates. This represents a tightening of financial liquidity conditions, causing Tuesday’s selloff in stocks.

But the real story isn't just the selloff; it's the desperate, coordinated intervention by the Central Bank of Japan and its "institutional allies" to plug the dike.

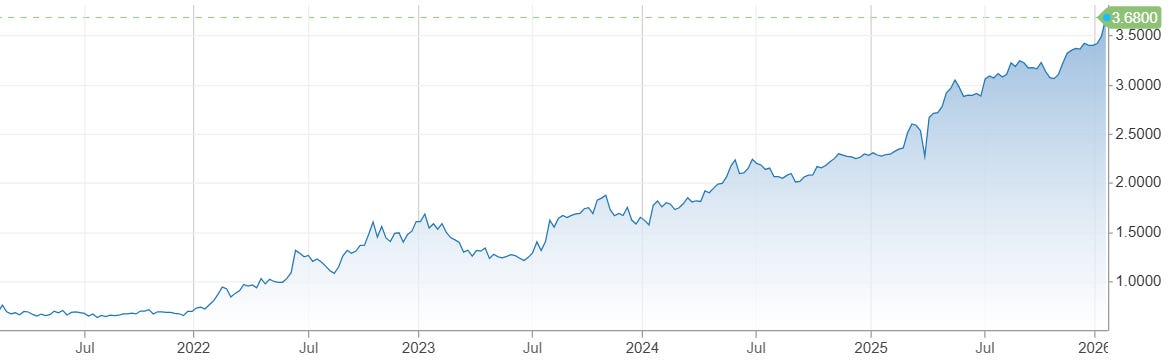

History shows these dislocations force a massive unwind of elevated positioning. Is this another August 2024 Yen Carry Trade "nothingburger," or is the sudden, parabolic move in Gold and Silver signaling something far more permanent regarding global fiscal stability?

We’ve charted the correlation between Japan’s crumbling fiscal position and the breakout in precious metals, along with our latest SPX positioning data.

Is the selloff a dip to buy, or the start of the "Great Unwind"?

Read the full macro analysis and stock positioning report at MktContext.com.

Join 11,000+ macro investors who get these insights before the mainstream media catches on!