The Return of Gold as Global Money- Video

Three years ago, Zoltan Pozsar made a comment about Bitcoin that stuck with us. There is very little, if any chance he said, that Bitcoin will become money in a nation-state. Money has a good chance of becoming either sovereign or a sovereign joint venture with a private company, but not a private company all by itself.

The Return of Gold as Global Money

“There are foreign countries that are buying a lot of gold, and we believe that these countries will soon launch tokenized versions of gold as a competitive currency to the US dollar.”

— Paolo Ardoino CEO, Tether Jan. 26, 2026

This statement is unusually direct for a private-sector executive. On its surface, it reads as a competitive observation about foreign monetary behavior. At a deeper level, it reveals something more consequential: a private issuer of digital money openly framing its strategy around nation-state monetary conflict. That framing is neither casual nor rhetorical. It signals participation in a geopolitical contest over the future architecture of money.

At the most immediate level, the meaning is straightforward. The United States and its aligned institutions are preparing gold-linked, stablecoin-based financial products to defend dollar market share against foreign entities that are building alternative monetary instruments. These foreign systems, backed by physical gold and increasingly delivered through tokenized formats, are designed to compete with the dollar both as a store of value and as a medium of exchange. In this context, gold-backed stablecoins function as competitive currency instruments, even when they do not carry formal sovereign status.

The quote acknowledges that reality explicitly. It confirms that gold accumulation by foreign states is being interpreted as preparatory behavior for monetary issuance. It also confirms that stablecoins represent the operational layer through which that issuance is expected to occur. This is not a forecast framed in abstract economic terms. It is an assessment grounded in active market observation by a firm positioned at the center of global digital liquidity.

The second level of significance emerges when one asks a more structural question: why is the chief executive of a private company discussing nation-state monetary strategies at all? The answer lies in the role that firms like Tether now play. Stablecoin issuers operate at the intersection of capital markets, payment infrastructure, and monetary transmission. Their products circulate globally, influence settlement behavior, and shape currency usage at the margin. As a result, they occupy a functional position that was once reserved exclusively for central banks and sovereign intermediaries.

This positioning draws such firms directly into geopolitical competition, whether formally acknowledged or not. When a stablecoin issuer assesses foreign gold purchases as a precursor to currency competition, it reflects an understanding that the firm itself is participating in that same competitive field. The distinction between public and private monetary actors has narrowed. What remains decisive is jurisdiction, alignment, and control over settlement rails.

Within this framework, Tether’s behavior and commentary align with a broader U.S. strategy that can be described as corporatist in structure. Rather than relying solely on state-issued digital currency, the United States leverages private enterprise operating under domestic legal authority to extend and adapt dollar influence. Stablecoins, particularly those with credible collateral backing, serve as flexible instruments within this approach. Gold enhances their credibility, especially in an environment where trust in sovereign debt is unevenly distributed.

This helps explain why gold accumulation, repatriation, and tokenization have accelerated simultaneously across both public and private domains. Gold functions as neutral collateral, recognized across political boundaries and monetary regimes. When paired with digital settlement, it becomes an adaptable foundation for new forms of money that retain global acceptability while operating within defined legal frameworks.

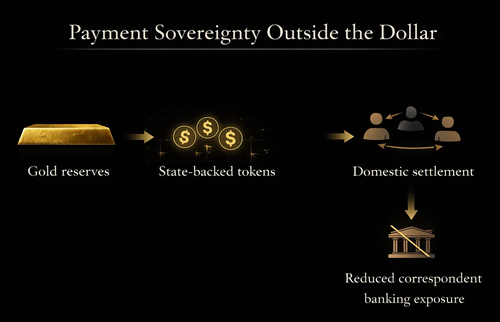

Outside the United States, similar logic is applied with different objectives. Many states view dollar-based stablecoins as an extension of U.S. monetary reach into domestic economies. In response, they are building gold- and silver-backed digital instruments designed to preserve internal payment sovereignty. These initiatives focus on ensuring that local trade, savings, and settlement activity remain anchored within nationally governed systems. Payment chains are treated as strategic infrastructure, alongside supply chains and energy systems.

At the sovereign level, this strategy is reinforced through cross-border settlement platforms that integrate gold into trade finance and interbank clearing. These systems reduce reliance on traditional correspondent banking networks and mitigate exposure to external monetary leverage. They also establish technical pathways for broader adoption of gold-backed digital settlement in international commerce.

The common thread across these developments is control. Decentralized ownership of assets, including gold, has expanded through tokenization and digital custody. That decentralization increases mobility and optionality for holders, while simultaneously challenging traditional mechanisms of monetary governance. Stablecoins provide a means of reintroducing structure. Through regulation, custody rules, and settlement oversight, they allow states and aligned institutions to channel decentralized demand into systems that remain subject to jurisdictional authority.

The emerging end state is increasingly visible. Gold is being repositioned as foundational collateral beneath a fragmented digital monetary landscape. Stablecoins serve as the transactional interface. Jurisdiction determines governance. Rather than a single dominant currency or a return to fixed convertibility, the system points toward competitive payment ecosystems anchored by a shared reserve asset.

The Tether CEO’s statement belongs at the beginning of this discussion because it captures the moment with unusual clarity. It reflects a world in which private monetary actors speak openly about sovereign behavior, and in which gold, once again, sits at the center of strategic monetary planning.

And that, friends is why every bank on Wall Street has been promoting Gold for the last six months if not the last two years, they all know when some level of this is coming and most of them if not all of them have products coming out as wel. Gold will become the new SOV used to keep American money in dollars and attract foreign money to American money, while the BRICS will created gold backed money to broaden their dedollarization

Gold, forever the bane of the dollar’s existence, will be resurrected as the savior of the US dollar by discouraging money to flee American shores for other gold backed currencies

A new monetary age is coming

More here