Selling Germany’s Gold Would Be A Strategic Mistake

Authored by GoldFix

The Bloomberg Opinion column argues that partial gold sales could reduce borrowing and improve fiscal flexibility under current conditions.

TL;Dr

Germany’s gold reserves have become economically material due to price appreciation, prompting debate over whether they should remain passive or be mobilized.

The Bloomberg Opinion column argues that partial gold sales could reduce borrowing and improve fiscal flexibility under current conditions.

Why the Bloomberg piece is wrong: Gold does not need to be sold to unlock value. It is increasingly being positioned as a financing and collateral instrument (repo, HQLA), preserving optionality without reducing reserves.

Selling gold is also tactically unwise for euro-area states as reserve ownership and ECB balance-sheet credibility are under stress, making gold retention more important, not less.

Exec Sum.

Germany’s gold reserves have surged in value, reviving debate over whether they should be sold to ease fiscal pressure. While a Bloomberg Opinion column argues for partial liquidation, this view misreads gold’s evolving role. Gold is increasingly positioned as a financing and collateral asset that can be mobilized without sale. At the same time, euro-area balance-sheet tensions make reserve reduction tactically risky, strengthening the case for retention rather than monetization.

Why Selling Gold Is Strategically and Tactically Inadvisable

Germany’s Gold Hoard as a Fiscal and Governance Question

Germany’s debate over its gold reserves has re-emerged as the value of those holdings has surged and as political anxieties about the United States have intensified. The immediate focus is not simply the size of the reserves, but their location, governance, and potential economic role at a moment when Germany faces rising borrowing needs and structural economic pressures.

In a Bloomberg Opinion column, Chris Bryant examines whether Germany should reconsider the long-standing assumption that its gold stockpile is untouchable, and whether part of that wealth could be mobilized more productively under current conditions, specifically by selling it.

Reframing the Question the Op-Ed Leaves Ope

The Bloomberg column correctly identifies that Germany’s gold reserves have become economically material in a way they were not when prices were lower and balance sheets were smaller. It also correctly notes that this repricing forces a reconsideration of long-standing assumptions about passivity, symbolism, and opportunity cost. Where the analysis becomes incomplete is in treating liquidation as the primary, or even natural, mechanism for extracting value from gold.

That framing overlooks two critical developments. First, gold itself is changing function within the global financial system. Second, the institutional context inside the euro area has shifted in ways that make reserve reduction tactically risky. When these factors are taken into account, the case for selling gold weakens materially, even before political considerations are introduced.

The suggestion that Germany should sell part of its gold reserves rests on the assumption that gold’s value can only be unlocked through liquidation. That assumption no longer holds. There are two distinct and sufficient reasons why selling gold would be inappropriate under current conditions, one structural and one tactical.

1. Gold Is Emerging as a Financing Instrument, Not a Disposable Asset

Gold is increasingly being treated as an instrument of finance rather than as a passive reserve asset. Its role is shifting toward use as high-quality collateral in repo, lending, and settlement structures, particularly at the sovereign and quasi-sovereign level. This evolution means that gold does not need to be sold in order to generate economic utility.

Endgame: BRICS Replacing Bonds With Gold as Collateral

Gold becomes the store of value. Yuan becomes the international medium of exchange. Blockchain becomes the unit of account ledger in the multipolar rollout

As monetary systems fragment and trust in sovereign debt as a universal reserve asset weakens, gold’s neutrality becomes a feature rather than a limitation. Gold does not depend on another state’s fiscal capacity, legal system, or political alignment. For that reason, it is increasingly suitable for collateralization in stress environments where other assets carry jurisdictional or policy risk.

This matters for Germany because collateralized financing preserves balance-sheet optionality. Gold can be pledged, swapped, or structured to support liquidity and funding without reducing reserve depth or increasing headline debt. Once gold is sold, that optionality disappears permanently. The trade is irreversible.

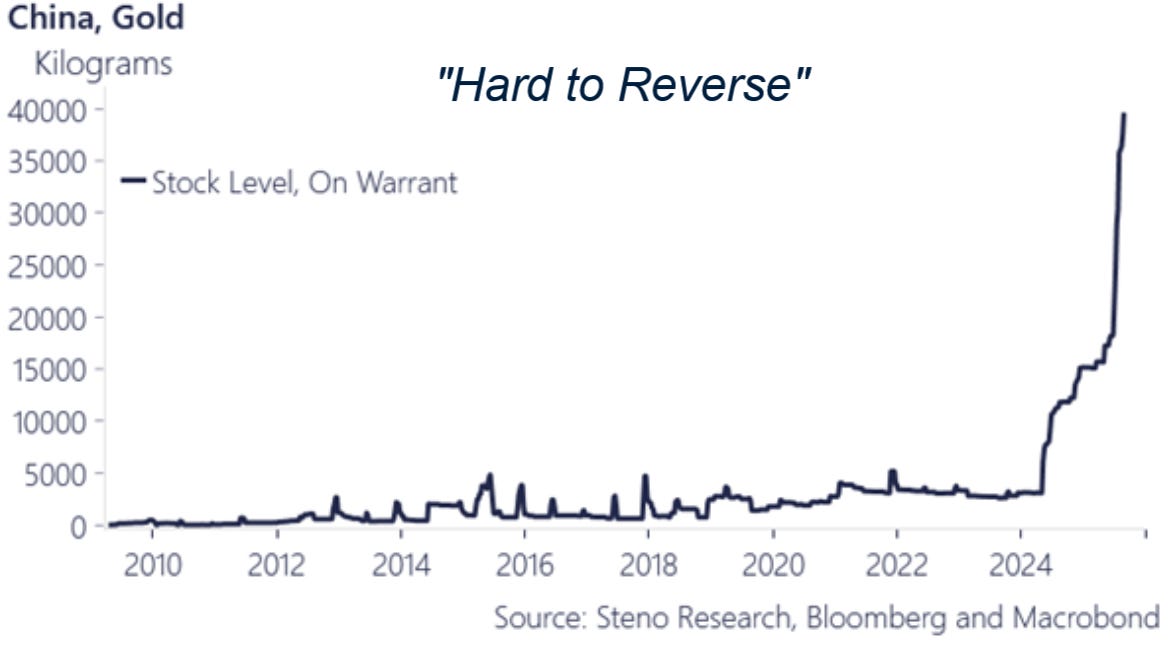

*Exclusive: China’s Next Move is HQLA/REPO Status

Our central finding is that China intends to move gold from its current Tier-1 status toward recognition as a High-Quality Liquid Asset (HQLA), unlocking its use in repo markets and trade finance. Such a change would allow gold to substitute for U.S. Treasuries as collateral within the BRICS system.

The argument that gold “accrues no interest” applies a narrow accounting lens to an asset whose value increasingly lies in its financing flexibility. In a system where high-quality collateral is scarce and politically neutral assets are in demand, gold’s utility is expanding, not diminishing. Its repricing reflects this shift.

From that perspective, selling gold to unlock value is unnecessary. The value is already there, embedded in gold’s capacity to support future financing mechanisms as repo, high-quality liquid asset treatment, or collateral backing. Liquidation is a blunt instrument in a context where more precise tools are becoming available.

2. Selling Gold Is Tactically Unwise Given Emerging Euro-Area Balance-Sheet Risk

Beyond the structural argument, selling gold is tactically ill-timed for euro-area states. Recent developments around Italy’s gold reserves highlight a growing sensitivity around who ultimately controls, and can rely on, reserve assets within the euro system.

Italy Seeks to Put its Gold Outside ECB Reach

TL;DR: Italy’s attempt to reclaim its gold reveals deeper cracks inside Europe’s monetary system. As gold regains importance as geopolitical collateral, national governments are testing supranational rules that once limited sovereign control of reserves.

Italy has recently called for its gold to be removed from European Central Bank influence. This is not an abstract legal debate. Gold held by national central banks functions, in aggregate, as part of the euro system’s credibility buffer. These assets help offset liabilities on the ECB’s balance sheet, particularly after years of large-scale asset purchases and the resulting expansion of central bank liabilities.

If national gold holdings are reasserted as fully sovereign assets outside ECB reach, the euro system’s consolidated balance sheet becomes more fragile. The ECB’s asset base is already under strain from valuation losses and interest-rate mismatches. A reduction in effective reserve backing would exacerbate that vulnerability.

In this environment, it is unwise for any euro-area country to reduce its gold holdings voluntarily. Doing so weakens not only national balance sheets but also the perceived resilience of the euro system as a whole. Selling gold now would reduce the pool of assets that implicitly support confidence in the system’s liabilities at precisely the wrong moment.

The risk is not theoretical. As political pressure around reserve ownership increases, gold’s role as a stabilizing asset inside the euro architecture becomes more important, not less. Selling gold into this backdrop sends an unfavorable signal about reserve adequacy and institutional confidence.

More here