Goldman US Power Demand Update

From the TightSpreads Substack.

The pace and sourcing of US power infrastructure is a front and center area of focus for investors given implications for the pace of AI deployment as a driver of our 2.6% CAGR in US power demand through 2030. In this note, we analyze the generation capacity data from the EIA to track currently planned and added capacity. We believe Parts/People availability are among the key drivers/constraints to AI/data center (and broader) power demand growth, and the latest EIA data is supportive for renewables development through 2030 amid policy incentives sunsetting.

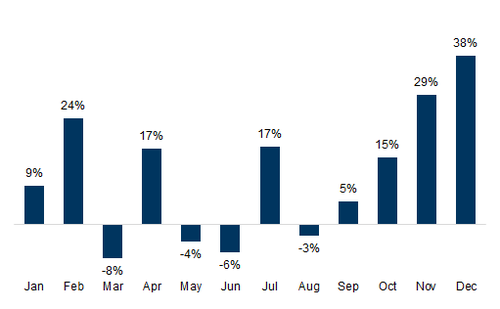

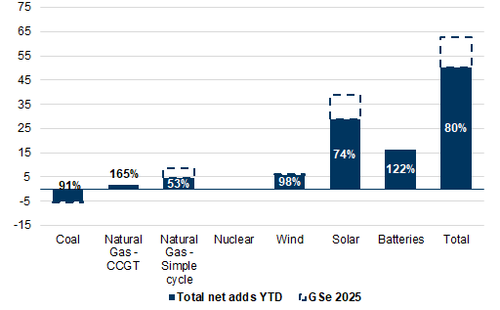

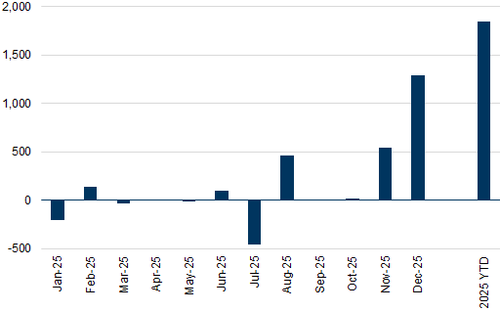

We provide further details regarding net generation additions by technology and color on planned projects, such as cumulative delays and cancellations. Capacity additions totaled ~50 GW in 2025, making up 80% of our estimates for 2025. December additions lagged in 2025, with only 19% of the YTD capacity added that month compared to an average of 38% of yearly capacity being added in the last month of the year since 2017.

By technology, wind capacity additions and coal retirements were roughly in-line with our expectations in 2025, while storage and CCGT surpassed our estimates at 122% and 165% of GSe. The main laggards were simple cycle gas and solar additions, reaching only 53% and 74% of GSe in 2025, respectively, even though nominally, solar capacity adds were strong at 29 GW making up for 57% of total yearly additions.

We highlight companies under our coverage that are more levered to natural gas generation capacity and/or CCGT newbuild in their investment pipeline, such as Buy rated DUK (on CL), AEP and XEL, as the recent increase in natural gas planned projects and higher than expected capacity additions could point to a more constructive gas outlook in the near to medium term. We also highlight Buy rated NEE and FSLR, given their exposure to the renewables theme and natural gas generation newbuild in the case of NextEra, and as we continue to expect change in the industry generation mix towards renewables versus coal over time, despite lower than expected solar adds in 2025.

The pace and sourcing of US power infrastructure is a front and center area of focus for investors given implications for the pace of AI deployment as a driver of our 2.6% CAGR in US power demand through 2030. In this note, we analyze the generation capacity data from the EIA to keep track of currently planned and added capacity. We believe Parts/People availability are among the key drivers/constraints to AI/data center (and broader) power demand growth, and the latest EIA data is supportive for renewables development through 2030 amid policy incentives sunsetting. We highlight NextEra (NEE, Buy) as the stock most leveraged to the renewables theme in our Utilities coverage, as it currently operates the largest portfolio of renewables in the US and plans to double its size by the end of 2027, and also plans to add 4-8 GW of natural gas power plants in 2030-2032.

We provide further detail regarding net generation capacity additions by technology, planned capacity projects development stages, cumulative delays, cancellations/postponement and expected capacity additions in 2026-2030. Our main takeaways are:

Net generation capacity additions totaled ~50GW in 2025, representing 80% of our estimates for 2025. Notably, ~1.3 GW of CCGT capacity got added in December, and CCGT capacity adds surpassed our estimates for the year, totaling 1.8 GW vs our 1.1 GW.

Planned capacity decreased marginally month over month in December for solar and energy storage, but still at the level of 120 GW and 66 GW respectively in the pipeline, while natural gas accelerated month over month to 45 GW, up from 41 GW in November.

While renewables growth momentum remains strong, particularly in solar and storage, planned projects delays remained elevated and above historical averages, while natural gas projects are currently showing lower delays as a percentage of planned capacity.

While project delays are down from peaks last year, we estimate the need for an additional 500k+ workers across the power & grid value chain by 2030E could play a role in project execution driven by skilled labor shortages.

In terms of expected timeline, the majority of renewables planned capacity is expected to come online in 2026-2027, while ~68% of natural gas projects are expected to come online between 2028 and 2030. Notably, December data showed significant increase in gas projects planned for 2030 jumping to ~7 GW from ~3 GW.

Capacity Additions Tracker: 50 GW of operating capacity added in 2025

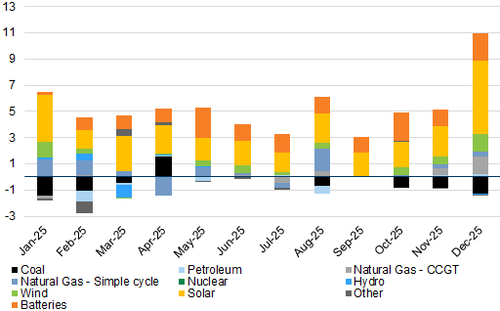

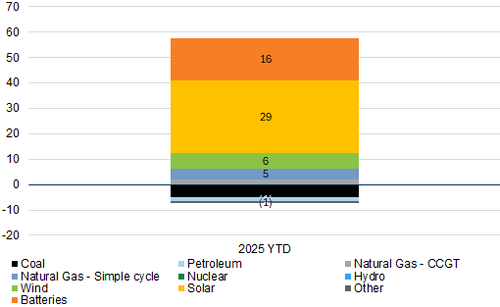

Net generation capacity additions to the system totaled ~50 GW in 2025, with utility scale solar and battery net additions of 29 GW and 16 GW YTD, respectively (Exhibit 1). Total net additions fell short of our expectations in 2025, making up 80% of our total net capacity addition estimates of 63 GW for 2025 (65% in November). Notably, storage, wind and CCGT additions ended the year surpassing or meeting our expectations at 122%, 98% and 165% of our full year capacity addition estimates, while simple cycle gas and solar fell short, reaching only 53% and 74% of our 2025 estimates. Finally, ~5GW of net coal capacity was retired in 2025 compared to our expectation of ~5.5GW, marking 91% of our 2025 expectation. We believe less coal retirements could be a short-term solution to meet increasing power demand and offset potentially slower capacity additions from other technologies.

Exhibit 1: Strong solar and CCGT net additions marked December added capacity

Monthly net generation capacity additions by technology, in GW

Source: EIA, Data compiled by Goldman Sachs Global Investment Research

Exhibit 2: Solar capacity contributed with higher net adds to the system in 2025, followed by batteries, wind and gas

2025 YTD net generation capacity additions by technology, in GW

Source: EIA, Data compiled by Goldman Sachs Global Investment Research

Exhibit 3: Coal retirements, wind, batteries and CCGT net additions surpassed or came close to our estimates for the year, while solar and simple cycle gas lagged

2025 Capacity additions YTD vs GS estimates, in GW

Source: EIA, Goldman Sachs Global Investment Research

Exhibit 4: In 2025, 19% of total capacity got added in December vs. an average of 38% since 2017

2017-2024 Average monthly capacity additions over total yearly additions

Source: EIA, Goldman Sachs Global Investment Research

Exhibit 5: 1.3 GW of CCGT capacity was added in December

Monthly net generation capacity additions in natural gas CCGT, in GW

Source: EIA, Data compiled by Goldman Sachs Global Investment Research

How does currently planned capacity compare to our estimates?

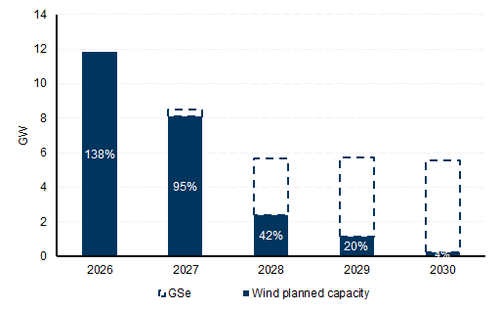

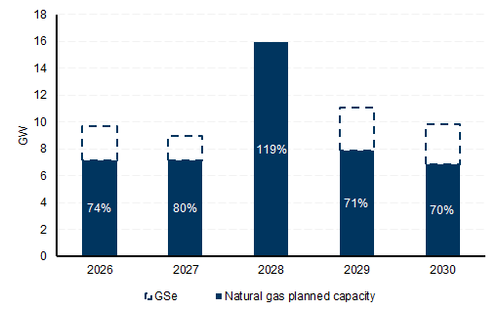

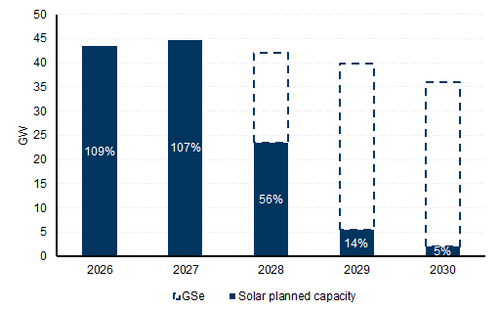

Projects currently on the pipeline (including under construction and pending approval) represent 109% and 107% of our expected net adds for solar capacity in 2026 and 2027, respectively, and 138% and 95% for wind. However, planned projects in the pipeline for renewables drop significantly in the 2028-2030 time frame, which could be a function of the timeline or the sunsetting of tax credits. Projects under planning status for natural gas continue to be heavily concentrated in the 2028 delivery time frame, with pipeline projects for 2028 representing 119% of our gas capacity net additions estimates for that year. Notably, planned natural gas projects for the year of 2030 increased significantly (see Exhibit 8), jumping from ~3 GW planned to ~7 GW planned for that year in the December data release. We would note that, according to the EIA, the data on project updates is self reported by the companies and, therefore, susceptible to some subjectivity on the reporting timeline of the projects.

Exhibit 6: Projects currently on the pipeline for solar capacity represent 109% and 107% of our net adds estimates in 2026 and 2027

Solar capacity projects currently under planning status vs GS solar capacity net additions, in GW

Source: EIA, Goldman Sachs Global Investment Research

Exhibit 7: Similarly, wind projects on the pipeline represent 138% and 95% of estimates in 2026 and 2027

Wind capacity projects currently under planning status vs GS wind capacity net additions, in GW

Source: EIA, Goldman Sachs Global Investment Research

Exhibit 8: Natural gas planned projects continue to be concentrated in 2028, but we note significant increase in projects planned for 2030

Natural gas capacity projects currently under planning status vs GS natural gas capacity net additions, in GW

Source: EIA, Goldman Sachs Global Investment Research

Potential Pipeline Constraints - Eyes on labor availability and new developments

The rest of this article is available to Premium Subscribers.