Explaining Today's Market Flows and Where It Goes Next

From the TightSpreads Substack.

The past week was one of the busiest in earnings season, and it brought some big volatility—including that brought by the nomination of Kevin Warsh as the next Federal Reserve Chair by President Trump. This news triggered sharp moves across markets, causing rotations away from some of 2025’s most crowded trends.

What happened to major indexes and popular investments?

The S&P 500 (a broad measure of 500 large U.S. companies) ended the week roughly flat (+0.3%), while the Nasdaq (tech-heavy) dipped slightly (-0.2%). Smaller-company stocks (Russell 2000, often tracked via IWM) fell more noticeably (-1.9%). Bitcoin dropped about 6%. Stocks with high short interest, retail investor favorites, and unprofitable tech names saw sharp sell-offs (around -2 standard deviations, a statistically big move down).

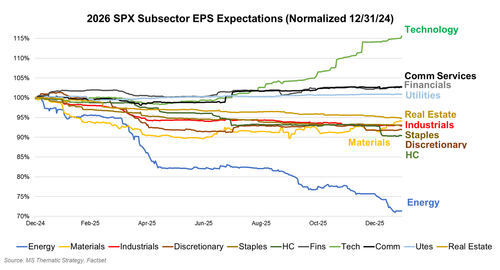

What supported the S&P 500? Strength in Energy (crude oil +7%), Industrials (examples: Caterpillar +5%, GE Vernova +10%), and some semiconductor companies (like Micron +20%, Seagate +19%, Texas Instruments +11%). On the flip side, big software names weighed on Nasdaq—Microsoft -8% (Azure cloud growth +38% year-over-year but below some expectations), ServiceNow -12%, SAP -13%.

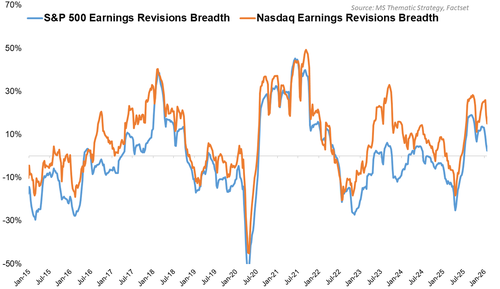

A key theme: The “Software vs. Semiconductors” trade had its worst monthly performance on record (-24.6%). Software weakness hurt Nasdaq returns in January compared to the broader S&P 500 and small caps (Nasdaq +1.2% YTD, S&P +1.4% YTD, small caps +5.5% YTD). Still, broad AI-related stocks (especially semis) remained strong, with Morgan Stanley’s AI basket up +10.6% in January. Global investor flows into semis YTD are already about half of all 2025 buying—and more than 5x larger than any other industry.

Hedge funds (long/short equity players) had a solid start to 2026, with average U.S. equity long/short strategies up +2.1% (slightly beating the S&P 500’s +1.9% through Thursday). Leverage dipped a bit recently, but remains elevated historically.

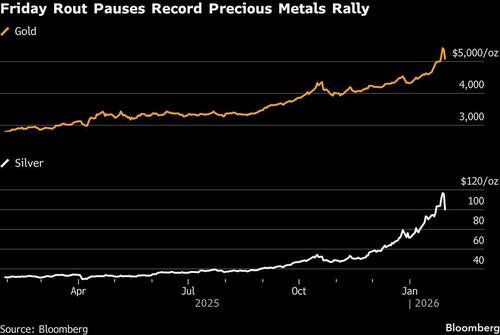

Market puking from Trump’s Fed Chair nomination

Kevin Warsh, a former Fed governor viewed as potentially more supportive of lower rates and growth-friendly policy, was nominated to replace Jerome Powell (term ends May 2026—subject to Senate confirmation). Markets reacted sharply. Gold fell ~9-12% and Silver plunged ~26-35%, exceeding their largest intraday drops seen during the 2008 global financial crisis and the biggest daily decline since the early 1980s (gold). Some reports called it decades-worst single-day moves in metals. The U.S. dollar strengthened, and the yield curve steepened (short-term yields down slightly, long-term up a bit).

These metals swings haven’t spread much to stocks or bonds yet. Gold’s recent volatility is extremely elevated (5+ standard deviations above normal since 2010), while stock and bond volatility remain below average. Historically, when gold vol spikes this much relative to other assets, stocks have tended to keep performing over the next 1-3 months, with volatility trending lower.

One caution: Metals are now more tied to speculative stocks, and retail investors have poured heavily into gold/silver ETFs (> $20bn last year, demand hit 1-year highs recently). Today, retail flipped to net sellers in those ETFs, representing ~27% of volume (over 2x normal).

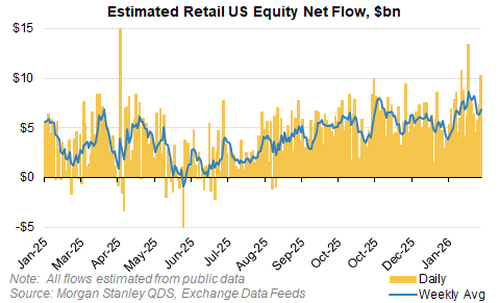

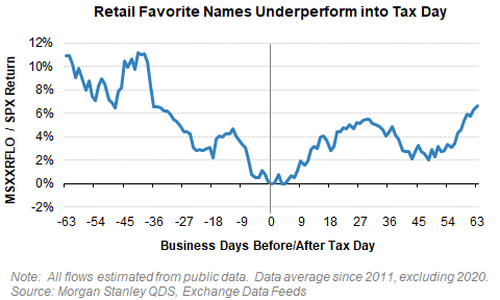

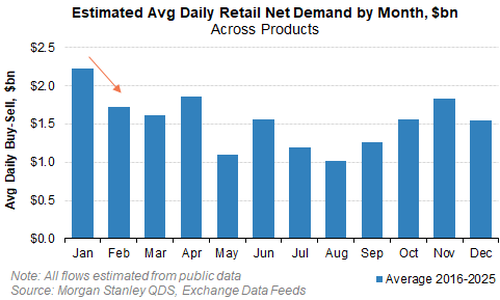

Looking ahead: Retail flows, buybacks, and systematic strategies

Retail investors bought an estimated $30bn of equities last week (high percentile historically), split between single stocks and ETFs. But retail trading participation was low (institution-driven week), and seasonal patterns suggest February demand typically drops ~23% from January levels (~$6.8bn/day to ~$5.3bn/day average). With capital gains taxes owed estimated at a very high $290bn this year (third-highest on record, +$70bn vs last year), retail-heavy or high-vol stocks could face headwinds into March/April tax season—potentially underperforming the S&P 500 by up to 10% in a re-risking rotation.

Corporate stock buybacks remain active (60+ companies), with daily amounts steady. Expect a pickup soon as blackout periods end—February is historically one of the busiest months.

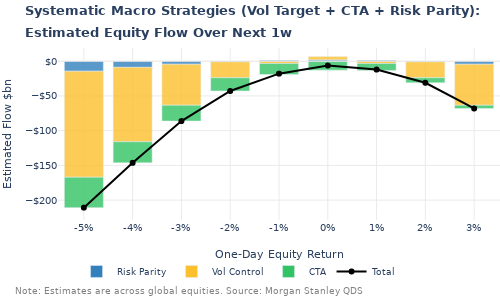

Systematic funds (vol-targeting, CTAs, risk parity) hold extremely high equity exposure (91st percentile). Models suggest modest selling (~$10bn global equities over next week), with bigger potential supply if volatility rises sharply.

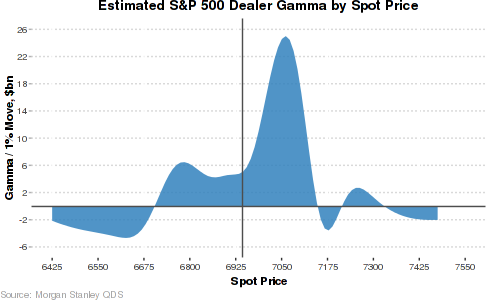

The following charts and their moves are explained in my last note, here.

Bottom line

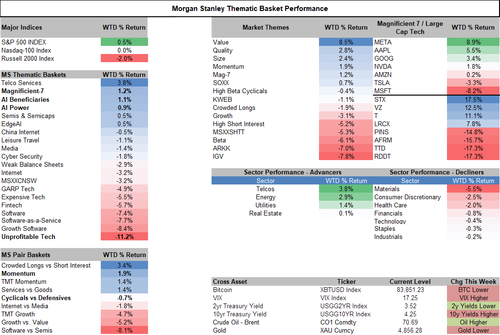

Markets rotated hard away from some crowded 2025 winners (software, certain retail favorites, metals) toward cyclicals like energy and industrials. The Warsh nomination added volatility but hasn’t derailed the broader uptrend yet. Earnings from Google (Wednesday) and Amazon (Thursday), plus jobs data (Friday), will be focus points next week. Below you can see how Morgan Stanley’s baskets of different equity themes, pairings, and sectors performed to give you an idea of sector flow and performance. And for those who took advantage of today’s sell-off in physical metals, congratulations.