The Fed's Next Move

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

Last week's Fed meeting went as expected. They remained on hold, with 2 dissenters (Miran and Waller) who wanted a 25 bps cut.

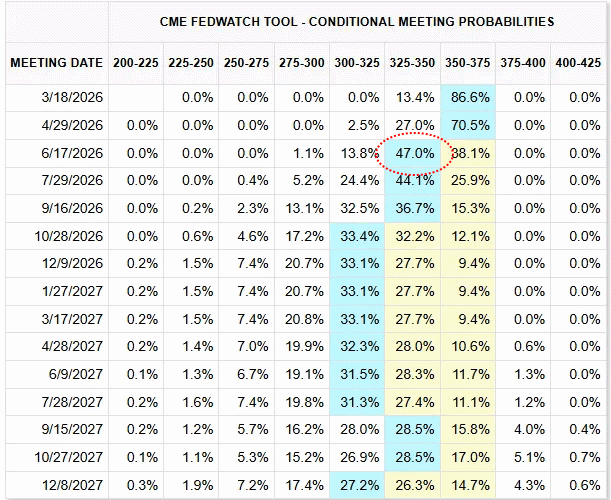

Key to their decision was the labor market showing signs of stabilization, while inflation risk is lower. The whole point of cutting rates in the past several meetings was to support jobs, but that may not be necessary anymore. Hence, rate cut odds fell:

Fed members see some uncertainty in the economy, but things are generally on the up and up; consumer spending resilient, fixed investment expanding, shutdown distortions dissipating. We’ve been talking about the reacceleration thesis for a while now, so it’s nice to have the Fed confirm.

Powell declined to comment on the DOJ subpoenas or whether he will stay on the board after his term as Chair ends. Market continues to discount Fed messaging, on the assumption that the next Fed Chair will push several cuts in 2026.

The risk with this thinking is that the new Chair fails to convince the others to cut (it is a vote, after all) and inflation concerns take a higher turn. The market won’t get the cuts it’s hoping for, which will be bad for stocks. On that note, let’s talk about the next Fed Chair.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!