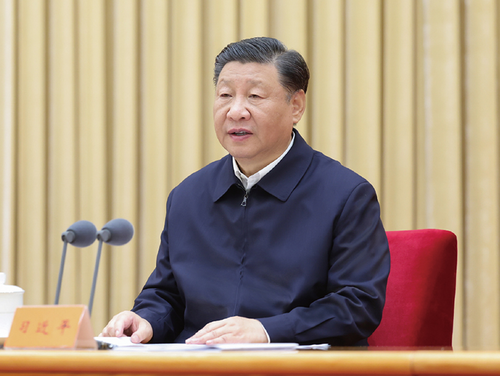

Xi Makes RMB Reserve-Currency Push Official

Xi Jinping Elevates the Renminbi to Explicit Reserve-Currency Ambition

GFN – BEIJING :In a private speech in 2024, Xi only released publicly this weekend1, Xi Xinping announced his plans for the RMB to be the world’s global reserve currency

China’s leadership has moved its currency strategy from implication to articulation according to the FT writers Cheng Leng and Joe Leahy. In newly published remarks, President Xi Jinping called for the renminbi to attain global reserve currency status, marking the clearest public definition yet of Beijing’s long-stated ambition to elevate its currency within the international monetary system.

English Translation of Qiushi(literal and consistent with the Chinese wording)

First, have a powerful currency that is widely used in international trade, investment, and foreign exchange markets and that has global reserve currency status.

Second, have a powerful central bank capable of conducting monetary policy adjustment and macro-prudential management and of effectively and timely preventing and resolving systemic risks.

Third, have powerful financial institutions that operate efficiently, have strong risk-resilience capability, encompass a full range of services, and possess global footprints and international competitiveness.

Fourth, have a powerful international financial centre that can attract global investors and influence international pricing systems.

Fifth, have powerful financial supervision, a sound financial legal framework, and strong voice and influence in the formulation of international financial rules.

Sixth, have a strong team of financial talent.

From “Internationalization” to Reserve Status

China has promoted renminbi internationalisation for more than a decade, primarily through trade settlement, bilateral swap lines, and alternative payment infrastructure. Xi’s language represents a shift from tactical expansion to strategic destination.

“China needs to build a powerful currency that can be widely used in international trade, investment and foreign exchange markets, and attain reserve currency status.”

The remarks define “strong currency” status in functional terms rather than symbolic ones. Reserve status is framed as an outcome of system credibility rather than declaration, anchored in usage, liquidity, and institutional depth.

Institutional Foundations Outlined

First, a powerful central bank capable of effective monetary management.

Second, globally competitive financial institutions.

Third, international financial centres able to attract global capital and exert influence over global pricing.

China must build “a powerful central bank”, globally competitive financial institutions, and international financial centres able to “attract global capital and exert influence over global pricing”.

The emphasis places currency credibility downstream of governance, pricing power, and capital attraction rather than exchange rate policy alone.

Timing and Global Context

The release of the comments coincides with a period of global reassessment of dollar dominance. A weaker US dollar, welcomed publicly by President Donald Trump, combined with leadership change at the Federal Reserve and ongoing geopolitical fragmentation, has sharpened scrutiny of reserve allocations.

Continues here

Free Posts To Your Mailbox