Who Is Kevin Warsh?

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

Trump announced the next Fed Chair to be Kevin Warsh. He had a career at Morgan Stanley, has past Fed experience, and is about as steady as you could possibly get. He has street cred as an economist and an understanding of internal Fed culture including all its processes and constraints.

The pick was a surprise to many because he is known to be hawkish. During the post-GFC depression, with unemployment near 10%, he pushed back against aggressive rate cuts and warned of impending inflation risks. These calls proved incorrect, as inflation stayed well below target for years thereafter.

In more recent years he has called for a radical Fed balance sheet reduction. This risks contracting liquidity in the US economy. We have said many times before, liquidity is oxygen for risk assets. Investors worry that Warsh will be less likely to do emergency rate cuts when needed (the “Fed put”). Hence, US bond markets sold off on this news.

Warsh also has personal/business ties with Trump, Bessent, and figures like Stanley Druckenmiller which puts him in the elite “inner circle” and a trusted change agent when installed at the Fed. These relationships ensure monetary policy will be aligned with Treasury strategy and White House agenda. Said bluntly: He is the ultimate puppet without appearing overtly so.

Investor debate is focused on whether he will cut rates or not, but that misses a huge point about Warsh’s ideologies. For decades, Warsh has openly called for regime change at the Fed, calling monetary policy “broken”. He believes inflation is not caused by supply shortages and workers’ wages, but rather excess government spending.

Quote from the above CNBC interview:

“AI will make almost everything cost less. And the US can be a big winner. If I were the President, I’d be worried about a central bank that doesn’t see any of that. A central bank that is stuck with models from 1978. Governance from a prior period… and don’t recognize we could be at the front of a productivity boom. And they might think economic growth is somehow going to be inflationary. We are in the early innings of a structural decline in prices.”

-Kevin Warsh, CNBC Interview

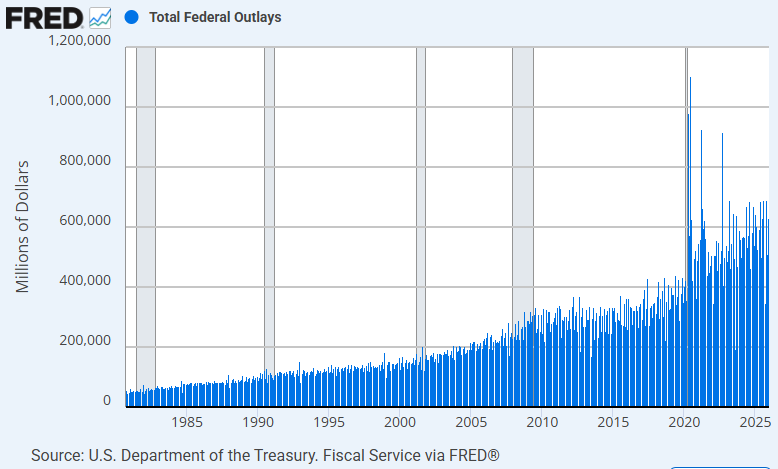

According to Warsh, inflation happens “when the government prints too much, spends too much, and lives too well.” He sees fraud and largesse as the cause of inflation; money pumped into the system without productive output. This is strongly aligned with Scott Bessent’s repeated calls for tighter fiscal policy. Here’s what US’ fiscal spending has looked like in recent years:

Therein lies the Fed's regime change...

Read the full macro analysis and stock positioning report at MktContext.com.

Join 11,000+ macro investors who get these insights before the mainstream media catches on!