Explaining Today's Market Flows and Where It Goes Next

From the TightSpreads Substack.

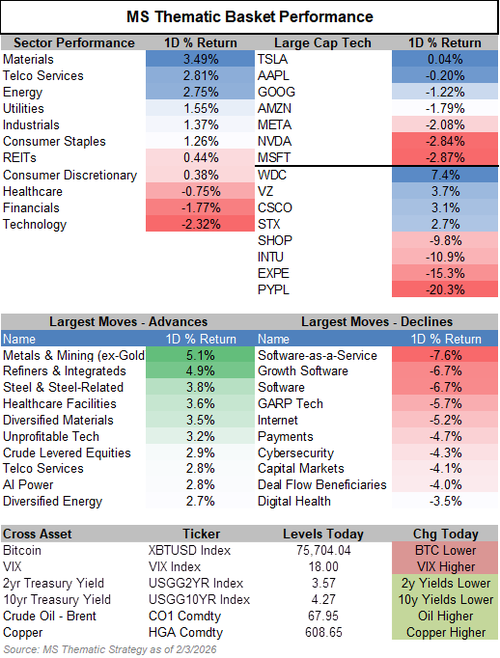

The market showed a clear rotation: money leaving expensive tech/software names and flowing into other areas tied to economic cycles, policy changes, and momentum.

The S&P 500 (SPX) closed down about 0.8% at roughly 6,918, while the tech-heavy Nasdaq-100 (NDX) fell around 1.4–1.5% to about 23,255. The Dow was only down modestly (~0.3%). This wasn’t a broad panic sell-off; it was selective weakness in one group (tech/AI-related) offset by strength in others.

*Indexes mentioned “MS….” are Morgan Stanley baskets that group equities together, in a combination of long and short weightings, to express a trade theme. This is a popular bank provided product for investment firms.

Why tech and software got hit hard

Software and SaaS stocks (tracked by an index like MSXXSAAS) dropped 7.6% in a single day and are now down 25% year-to-date. This is extreme. Gartner (a big IT research firm) reported terrible earnings, down 20%. Private equity (PE) firms own a lot of software/SaaS companies bought at high prices during low-interest-rate years; now with slower growth and AI competition, those investments look riskier—PE funds may need to mark them down or sell, creating more selling pressure. Anthropic (makers of Claude AI) announced upgrades to Claude Cowork (better team collaboration features) plus entry into the legal field (tools for document review, risk spotting, compliance). This triggered the worst single-day drop ever for “AI-disrupted” companies (MSXXAIDT -7.8%). When powerful general AI models start doing specialized jobs (like legal work), dedicated software companies lose their edge fast—investors sell those stocks aggressively, fearing lower profits or obsolescence. This fear spread beyond software: healthcare contract research organizations (CROs like IQV -10%, ICLR -7%) fell because AI could automate parts of clinical trials/research. Travel booking sites (OTAs like Booking.com -9%, Expedia -15%) dropped after news that hotel chains (Hyatt, Accor) are adding ChatGPT and Google’s new AI search directly into their apps—customers might book straight with hotels instead of paying fees to OTAs, hurting their business long-term.

Where the money rotated to

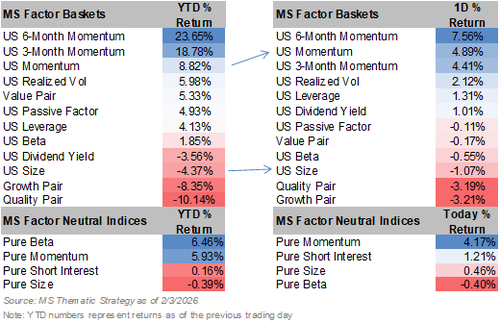

Small- and mid-cap stocks (Russell 2000/IWM) edged up +0.2% and held up well. “Early cycle” cyclicals (industries that do better as the economy improves, MSXXECYC) rose +2.3% and are up 5% over the past week, extending gains after a solid PMI (purchasing managers’ index) report showed economic resilience. When investors get nervous about expensive tech, they often move into cheaper, economically sensitive stocks that benefit from growth—especially if data like PMI signals no recession.

Momentum stocks (companies already rising strongly) were the top factor, up +4.9% (MSZZMOMO), with the pure momentum factor posting its best day ever (+4.2%, +2.6 standard deviations). This was powered by memory/semiconductor strength (MSXXGMEM +5.7%) and onsite power generation breakout (MSXXONPW +3.3%). Momentum leadership during tech weakness can signal a real shift in market drivers—if it holds, more money chases winners outside the old Magnificent 7 leaders.

Policy and news-driven winners

Rare earth materials (MSXXRMAT) exploded +12.6% after the Trump administration announced “Project Vault”—a ~$12 billion plan (funded partly via EXIM loans) to stockpile critical minerals (rare earths, lithium, copper) to reduce reliance on China, plus talks of EU-US partnerships. This creates steady government demand and supply-chain security for EVs, defense, renewables—miners and processors in this space could see sustained buying if policy executes.

Housing/homebuilders (MSXXHOME) gained +2% on reports of a builder-proposed plan for 1 million “Trump Homes” to boost affordability (potentially $250bn+ impact). Housing is sensitive to policy and rates; even if not yet official White House support, the idea highlights focus on supply—could lift builders if it gains traction, though it faded from highs on lack of confirmation.

Venezuela-exposed oil firms (MSXXVOIL) rose +3.9% (outperforming Canadian peers +2.2%) on news of impending White House licenses for more oil/gas production in Venezuela, plus strong refiner earnings (MPC +6%) and crude prices up (Brent +2.5%, broader energy +1.7%). Easing restrictions boosts supply access for U.S.-linked producers/refiners—could support energy if crude holds firm, reinforcing cyclical rotation.

Bottom line

This is a healthy rotation, not a crash—tech/AI names are correcting on real disruption and valuation concerns, while cyclicals, policy plays, and momentum absorb flows. Breadth improved (more stocks up than down despite index drops). Near-term: I’ll be maintaining pressure on vulnerable software/SaaS/OTAs/CROs if AI news continues. This trade is insanely crowded, so will be rotating out ahead of the snap back. Read my last market flows note to understand how extended into the extremes some of these trades are,. I am also positioned for upside in rare earths, energy proxies, housing if policy momentum builds. I will be long relative winners (policy cyclicals, momentum pockets) and short losers (disrupted verticals). Keeping an eye on breadth and vol for signs this shift sticks or reverts.