January's AI Neocloud, Enterprise, and Sovereign Projects

From the TightSpreads Substack.

Summarized recent announcements and developments in the AI project space across neoclouds, sovereigns, and enterprise made in January 2026. This represents select project announcements and is not indicative of the total AI infrastructure opportunity. The end also includes a data center project cost calculator / framework to provide a high-level framework on how to size spend by total power or number of XPUs.

Key highlights in January 2026 include:

- AI neocloud demand remains robust, as indicated by new financing arrangements (CRWV/NVDA) and data center build announcements (e.g., Digital Edge, Soluna, xAI). Strong AI infrastructure demand from neoclouds & hyperscalers should benefit GS rated DELL (Buy), SMCI (Sell), and CLS (Buy-CL) for AI servers & ANET (Buy), HPE (Buy), CSCO (Neutral), and CLS for data center networking.

- Major sovereign AI projects tracking on schedule. Key Middle Eastern sovereign AI projects including G42 and HUMAIN are on schedule to bring the first phases of AI infrastructure online in 2026, which should benefit CSCO, DELL, and SMCI.

- Enterprise AI use cases are expanding as customers transition from proof-of-concept work in the cloud to on-premise/hybrid full-scale deployments. Use cases span from AI-powered chatbots for an insurance broker (South Korea) to autonomous network operations for a telco provider (New Zealand). While enterprise on-premise AI infrastructure investments are still early days, we view expanding uses cases (including strong adoption of vibecoding platforms like Claude Code) as a positive of enterprise-oriented IT hardware companies like DELL, HPE, and PENG.

Neoclouds & data center operators

Headlines presented in reverse chronological order.

- New Indonesia data center: Digital Edge (January 28, 2026): Data center developer and operator Digital Edge announces $4.5 bn data center in Jakarta, Indonesia with up to 1 GW of capacity & direct-to-chip liquid cooling capabilities. Phase 1 of the new data center is expected to be operational in Q4 2026 (then Q1 2027, Q2 2027).

- Previously announced collaborations: Digital Edge publicly partnered with Juniper Networks (now part of HPE) for full stack data center & campus networking solutions in other projects (November 2023).

- NVIDIA invests $2 bn into CoreWeave (January 26, 2026): CoreWeave and NVIDIA reaffirm their partnership to enable the build out of more than 5 GW of AI factories by 2030, with NVDA investing $2 bn in CRWV common stock.

- Details: Coreweave intends to deploy multiple generations of NVIDIA infrastructure including Rubin GPUs, Vera CPUs and BlueField storage systems. In a Bloomberg interview, CEO Jensen Huang announced that NVIDIA will begin to offer Vera CPUs as a standalone chip, making it a direct competitor to Intel’s Xeon and AMD’s EPYC processors.

- New Mexico data center: Project Jupiter (January 23, 2026): Oracle confirmed as major tenant in New Mexico Project Jupiter data center developed by Stack and BorderPlex Digital Assets

- Key Partners: Oracle will occupy the data center, and will use it to host AI infrastructure for OpenAI

- Delta Forge 1 Applied Digital (January 22, 2026): New AI factory campus to be developed in the Southern US.

- Size: 430 MW of total IT power (300 MW of IT load), with first phase expected to be two 150 MW buildings with operations commencing in Mid 2027

- Key Partners: Applied Digital disclosed that it has a prospective investment grade hyperscale customer for Delta Forge 1.

- Applied Digital’s existing hyperscale campuses are set to be leased to CoreWeave and an unnamed hyperscaler.

- Lighting AI merges with Voltage Park (January 21, 2026): GPUaaS provider Voltage Park (35k+ GPUs fleet) has merged with cloud platform Lightning AI (lab behind open source tool PyTorch Lightening). The merged company will be called Lightning AI.

- Location: Voltage Park has six data centers across the US in Washington, Utah, Texas, and Virginia

- Size: Voltage Park has over 60 MW of active data center capacity

- Key Partners: Voltage Park’s GPU cloud is powered by Dell PowerEdge XE9680 servers (as of March 2025).

- Previously announced collaborations: Professional and managed services for Voltage Park have been provided by Penguin Solutions in past deployments.

- New West Texas data center: Project Kati 2 (January 15, 2026): Soluna Holdings and MetroBloks sign a memorandum of understanding (MoU) to co-develop a ~100 MW AI data center in West Texas called Project Kati 2. The site has a non-binding letter of intent (LOI) with a potential neocloud tenant.

- Size: Initial development is for ~100 MW critical IT AI data center, with expansion roadmap supporting 300 MW of total capacity

- Key Partners: No partners named.

- Previously announced collaborations: Soluna publicly partnered with HPE Juniper Networking for data center switching in other projects (October 2025).

- CoreWeave hits chip-delivery milestone in Texas data center (January 12, 2026): CoreWeave is reported to have successfully deployed 16,000 GPUs in its Denton, Texas data center facility, scaling rapidly from initial rack deliveries in November

- Key Partners: The Information reports that CoreWeave’s Denton facility was being developed for OpenAI. Separately, Data Center Dynamics noted that CoreWeave has been leasing capacity from a Core Scientific data center in Denton. New Mississippi data center: xAI MACROHARDRR (January 2, 2026): xAI has confirmed plans to build a third data center in Mississippi with over $20 bn to be invested in the state.

- Location: Near xAI’s existing natural gas power plant & data centers in Southhaven, Mississippi

- Size: Upon completion, the Southhaven data center will bring xAI’s compute capacity up to almost 2 GW. The company expects to begin data center operations in Southaven in February 2026

Sovereign & Enterprise

Headlines presented in reverse chronological order.

- Technology OEM repatriating data from cloud to on-premise for AI workloads (January 27, 2026): ADC and application security vendor F5 highlighted an AI use case (high-bandwidth AI data ingestion) with a global technology OEM customer. Specifically, the customer is repatriating large amounts of IoT data from the cloud to enable AI and analytics workloads.

- Key partners: F5 is providing application delivery capabilities with BIG-IP 2degrees

- New Zealand Sovereign AI (January 27, 2026): Announced partnership between New Zealand telco 2degrees & HPE for sovereign AI capabilities. Initial AI use cases include autonomous network operations, predictive maintenance, and AI-powered capacity planning.

- Key Partners: HPE Private Cloud AI co-developed with NVIDIA

- Barfoot Supercomputer US Army Engineer Research & Development (ERDC) (January 26, 2026): New supercomputer located at ERDC’s Informational Technology lab in Vicksburg, Mississippi for advanced military research, climate modeling, and simulations

- Key Partners: HPE Cray EX400 Systems with 212,000 compute cores.

- Osaka Sakai Data Center operations commence (January 23, 2026): Operations commenced at Japanese telco KDDI’s Osaka Sakai Data Center, which offers access to GB200 NVL72s via its KDDI GPU cloud services.

- Key Partners: KDDI previously announced a collaboration with HPE for rack-scale systems for its Osaka Sakai Data Center DB Life Insurance builds AI-powered chatbot (January 22, 2026): South Korean insurance and financial services provider builds a generative-AI powered chatbot

- Key Partners: DB Life Insurance is deploying HPE’s GreenLake Flex Solutions (compute, storage, networking, and AI software in a pay-per-use model) Sovereign AI (S-AI) announces EMEA AI data centers (January 21, 2026). S-AI is building purpose-built AI compute capabilities for the Government, Defense, Healthcare and Finance sectors in EMEA

- Key Partners: S-AI is working with Accenture (digital transformation, operations, sales/engineering support), Palantir (software), and Dell (AI Factories)

- G42 expects to receive first AI chip shipments in coming months (January 21, 2026): G42 expects to its receive first shipments of AI chips for phase 1 of Stargate UAE (200 MW of planned total 1 GW project, previously reported to come online in 3Q26) within months, per CEO in Bloomberg TV interview at Davos.

- Location: Abu Dhabi, UAE

- Size: Reiterated expectations to build out between 200-500 MW of additional capacity per quarter on an ongoing basis to eventually reach 5 GW.

- Key Partners: CEO Peng Xiao expects to receive AI chip shipments from Nvidia, AMD, and Cerebras Systems.

- Previously announced collaborations: G42 has previously announced relationships with Cisco and Dell.

- HUMAIN & Saudi National Infrastructure Fund (January 21, 2026): HUMAIN & Saudi National Infrastructure Fund (Infra) announced a non-binding financing agreement of up to $1.2 bn for the development of up to 250 MW of hyperscale AI data center capacity

- Location: Kingdom of Saudi Arabia (KSA)

- Size: Financing terms for up to 250 MW of hyperscale AI data center capacity ($1.2 bn)

- Previously announced collaborations: HUMAIN publicly partnered with Cisco and AMD for data center infrastructure in a previously announced joint venture, with expectations to bring 100 MW online in 2026 (phase 1, with up to 1 GW deployed by 2030), including AMD GPUs and Cisco networking. HUMAIN has publicly partnered with KSA state-owned development & infrastructure company DataVolt (Supermicro customer) to bring over 6 GW of data center capacity online over the next decade

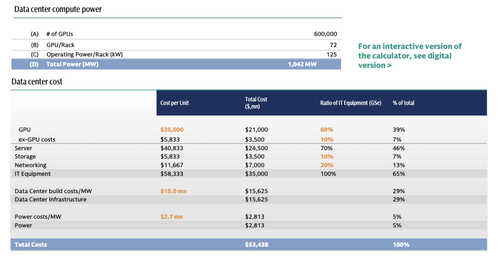

Data Center Project Cost Calculator

To provide a high level framework on how to think about the related spend for a project, we reference our GS Data Center Project Cost Calculator / Framework, introduced in our January 2026 IT hardware initiation. While we recognize that there can be a wide variety of XPU costs, energy performance, and adjacent networking requirements, we believe this tool to be a helpful framework to think about what goes into a data center project. For example, our calculator estimates that building out 1 GW worth of capacity of $35,000 H100s would cost approximately $54 bn in total when including all systems, power, and build costs. This estimate is largely in line with OpenAI’s previous comments that it costs ~$50 bn to bring 1GW of capacity online.

From Goldman Sach