This week UBS updated their clients with two timely reports, one each for gold and silver. Below is our breakdown of those reports, but first a summary of what you are about to read:

UBS argues gold’s sharp selloff reflects volatility inside a continuing bull market, supported by unresolved policy credibility risks, expected rate cuts, and strong official demand. Silver, by contrast, is undergoing a violent risk repricing, driven by extreme volatility, concentrated positioning, and industrial demand sensitivity, leaving the metal unattractive until prices adjust further to compensate for risk.

GOLD: Not the End: Gold’s Sharp Drawdown in Historical Context

Price Shock and Immediate Market Reaction

Gold experienced its steepest one day decline in more than a decade following the announcement that President Donald Trump nominated Kevin Warsh as his preferred candidate for Federal Reserve chair. Prices fell as much as 12 percent intraday before closing approximately 8.5 percent lower, marking the largest single session drawdown in 13 years.

Despite the magnitude of the move, gold remains up roughly 13 percent year to date. The bank emphasizes that volatility of this scale is historically common around perceived shifts in Federal Reserve policy expectations.

“Gold fell as much as 12% on Friday but ultimately closed about 8.5% lower, after President Donald Trump announced Kevin Warsh as his nominee for Federal Reserve chair.”

Interpreting the Selloff

The bank attributes the selloff to a combination of factors rather than a single catalyst. These include profit taking following strong gains, reduced liquidity in futures markets, margin related selling pressure, and renewed discussion around interest rate risks and US dollar strength.

Concerns intensified following Warsh’s nomination due to his public stance favoring tighter monetary discipline, balance sheet restraint, and institutional reform at the Federal Reserve. This prompted renewed debate around whether the move represented a turning point for gold’s broader bull market.

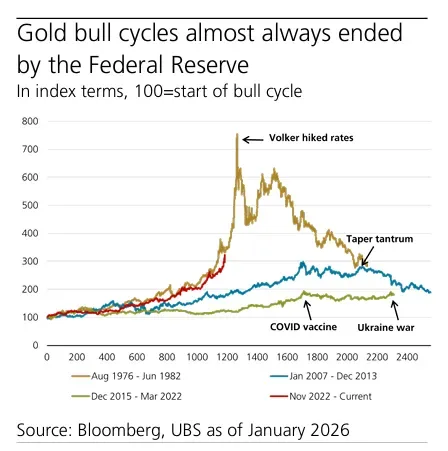

The bank argues that history suggests gold bull markets do not end simply due to price excess or declining fear. Instead, they tend to conclude when central banks re establish credibility through a sustained policy regime shift.

“Gold bull markets typically don’t conclude simply because fears diminish or prices become too high. They end when central banks establish their credibility and pivot to a new monetary policy regime.”

Historical Framework for Gold Bull Markets

UBS frames the current episode within prior gold cycles, highlighting that major regime shifts have historically coincided with bull market endings.

Examples cited by the bank include:

- 1980: The gold bull market ended following Paul Volcker’s aggressive monetary tightening, which restored Federal Reserve credibility, drove real rates sharply higher, and strengthened the US dollar.

- 2013: Gold peaked after the Federal Reserve convinced markets it could unwind quantitative easing without destabilizing the economy, leading to rising real yields and declining inflation expectations.

By contrast, sharp drawdowns occurring mid cycle have historically resolved once underlying structural drivers reasserted themselves.

“Throughout past price cycles, gold prices tended to rise when investors doubted policymakers’ ability to preserve the dollar’s real value, and only ended once confidence fully returned.”

Current Cycle Assessment

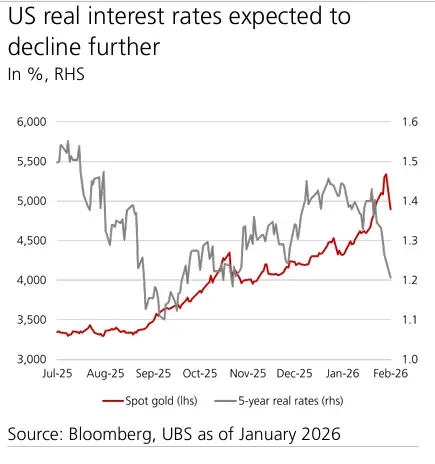

UBS assesses the current environment as mid to late stage within an ongoing gold bull market. The bank highlights that the typical ingredients required to end a gold cycle have not yet emerged. These include persistently high real interest rates, a structurally strong dollar, geopolitical stabilization, and restored central bank credibility.

While Warsh’s nomination initially appeared hawkish, the bank notes that Fed funds pricing continues to imply further easing rather than tightening. Markets are currently pricing approximately 53 basis points of rate cuts through the end of 2026, consistent with UBS expectations for two additional cuts this year.

“We do not believe a Volcker style tightening is likely, particularly given the need for consensus within the Federal Reserve and the recent cessation of quantitative tightening.”

Portfolio Implications

UBS views the recent drawdown as volatility within a continuing structural uptrend rather than a signal of cycle termination. Short term consolidation is expected due to higher margin requirements and liquidity constraints, with prices likely to range between USD 4,500 and USD 4,800 per ounce in the near term.