This Crash Is Bitcoin's Biggest Test Yet

Submitted by QTR's Fringe Finance

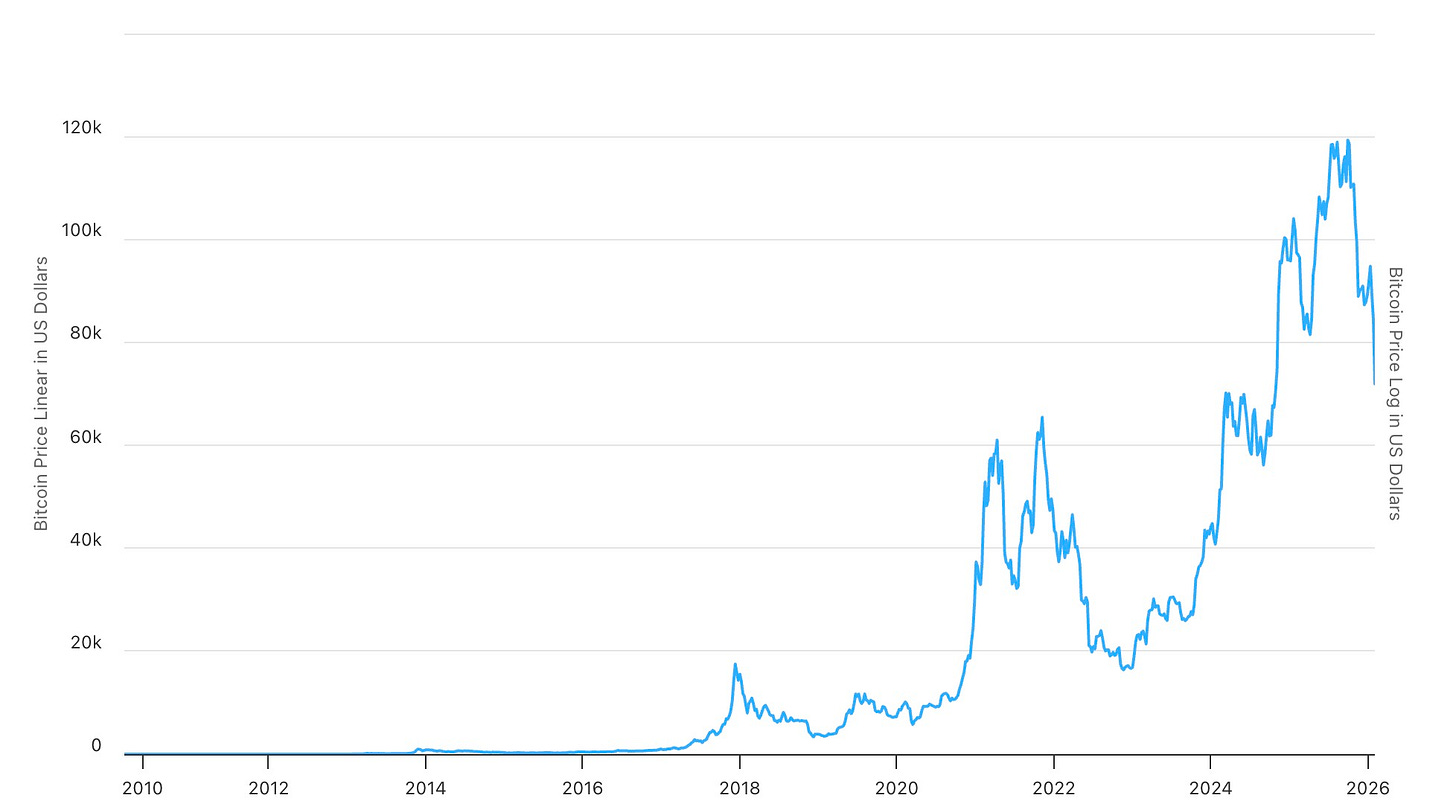

Bitcoin has a way of faking its own death, and this past week delivered another such instance with theatrical flair. After flirting with the once-unthinkable level of $120,000, the world’s most famous digital asset promptly face-planted to around $62,000 at its recent lows on Thursday.

Even for crypto, a 50% drawdown in months isn’t just a bad couple weeks. In a nascent asset like Bitcoin it’s always a bit of a spiritual test. More than that, this drawdown looks and feels like yet another Bitcoin “moment of truth,” the kind that forces believers and skeptics alike to confront what this asset really is—and what it isn’t.

For veterans of Bitcoin, the pattern is familiar. Exuberance builds. Headlines turn breathless. Group chats fill with laser-eye emojis. Then, without warning, gravity reasserts itself. Prices collapse. Influencers go quiet or get ornery on social media. Everyone suddenly remembers that “number go up” is not, in fact, a law of physics. But then Bitcoin always does — back to new highs over and over.

These moments of truth are supposed to be Bitcoin’s specialty. The “maxis,” sometimes proudly, sometimes ironically—have spent more than a decade preaching the same sermon. Volatility is not a bug, it’s a feature. Pain is purification. Weak hands must be shaken out. Michael Saylor once famously framed volatility as “Satoshi’s gift,” a kind of built-in psychological stress test designed to separate true believers from tourists. If you can’t stomach 50% drawdowns, you don’t deserve the upside. That’s the doctrine. Eat a dick, Sharpe ratio.

This time, though, the crash is being framed slightly differently by skeptics. Peter Schiff, Bitcoin’s longtime nemesis and professional eye-roller, has been quick to argue that this is not just another routine purge. In his view, this is not another dress rehearsal. He thinks it is the bubble finally popping after years of supposedly “mass” adoption.

Sure, he’s said this a lot over the years but unlike previous cycles, Bitcoin hasn’t been lurking in the shadows of Reddit forums and obscure exchanges. Over the past two years, it has marched directly into the mainstream. ETFs, retirement accounts, major banks, payment platforms, corporate treasuries, political campaigns—crypto didn’t just knock on the front door of the U.S. financial system. It moved in and started rearranging the furniture.

Which brings us to why “it’s different this time”...(READ THIS FULL ARTICLE, 100% FREE HERE).