China Signals Investors to Dump More Treasuries.

China Signals Risk Discipline on US Treasuries

Authored by GoldFix

Chinese regulators have recently instructed major domestic banks to curb additional exposure to US Treasuries and, in some cases, pare back existing positions, according to people familiar with the discussions. The guidance, delivered verbally and without explicit targets or timelines, was framed as a risk-management measure tied to concentration and volatility concerns rather than a statement on US creditworthiness or geopolitics.

The directive does not apply to China’s official state holdings of Treasuries. Officials emphasized diversification rather than disengagement, even as global investors increasingly debate the safe-haven status of US government debt amid fiscal uncertainty and shifting US policy priorities.

“The move was framed around diversifying market risk rather than anything to do with geopolitical maneuvering or a fundamental loss of confidence in US creditworthiness.”

Market Reaction: Initial Jolt, Then Recalibration

The communication triggered an immediate but contained market response. US Treasury yields edged higher across maturities, led by the long end, before paring gains as traders reassessed the signal. The 10-year yield rose modestly, while the dollar slipped slightly against major peers. Equity futures softened, with technology shares under renewed pressure following recent volatility.

Gold remained firm near record levels, holding close to $5,000 an ounce, while Bitcoin drifted lower after a choppy period. The reaction suggested sensitivity to headlines but little evidence of disorderly repositioning.

“There is no credible alternative as a global reserve asset at present.”

Selling or Custody Change?

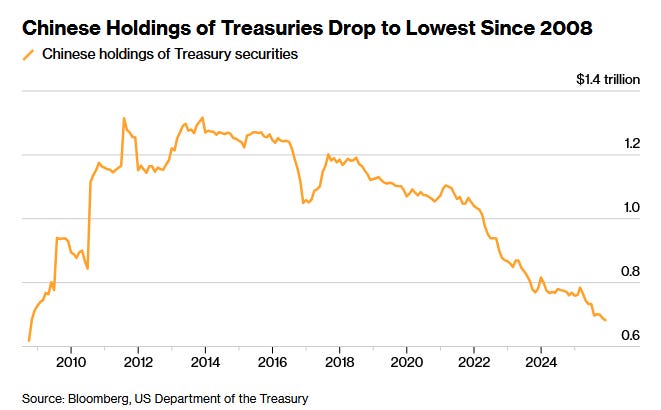

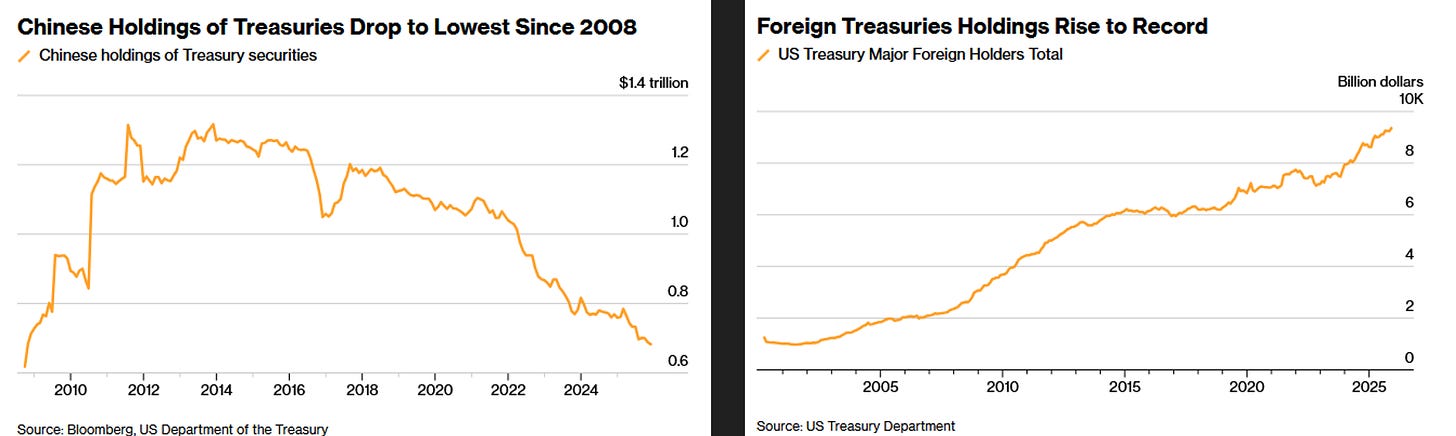

China’s overall state and private sector holdings of US Treasuries have trended lower for years. Bloomberg’s framing puts the stockpile near the lowest since 2008, and the longer-run arc shows China’s holdings down sharply from the 2013 peak. In parallel, some market participants argue the headline decline overstates actual reduction because a portion of China-linked holdings may have been shifted into offshore custodian channels.

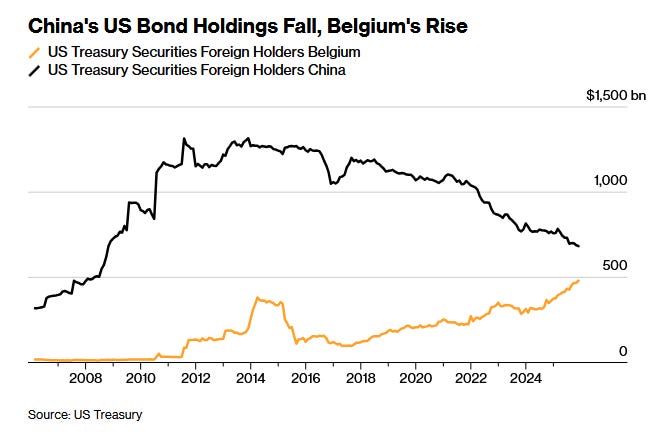

Belgium is central to that argument. Belgium’s reported Treasury holdings have risen sharply since 2017, and market analysts cited in the Bloomberg piece link part of that rise to Chinese custodial accounts held via European intermediaries. In other words, a portion of “China selling” can also read as “China relocating custody.”

“Some analysts say the actual decline may be smaller, as Beijing may have shifted some of its holdings to custodian accounts in Europe.”

Global Crosscurrents and the Policy Backdrop

The episode unfolded alongside broader global market adjustments. Political developments in Japan and the UK influenced local bond markets, while investors weighed US labor and inflation data ahead of heavy Treasury issuance later in the week. Attention remains focused on the Federal Reserve’s easing trajectory, with expectations for multiple rate cuts this year still shaping positioning.

Taken together, China’s guidance appears less a rupture than a reinforcement of an existing trend: incremental diversification, heightened sensitivity to volatility, and a more explicit focus on balance-sheet risk management in a world where US assets remain dominant, but no longer unquestioned.

China Says to Dump US Bonds

— VBL’s Ghost (@Sorenthek) February 9, 2026

Market Rundown | Housekeeping: ***Support Independent Media*** | Things are Happening Faster Nowhttps://t.co/JE9kVN9mzN

Continues here

Free Posts To Your Mailbox