Momentum Washout = Opportunity

Subscribe on our website www.gmgresearch.com

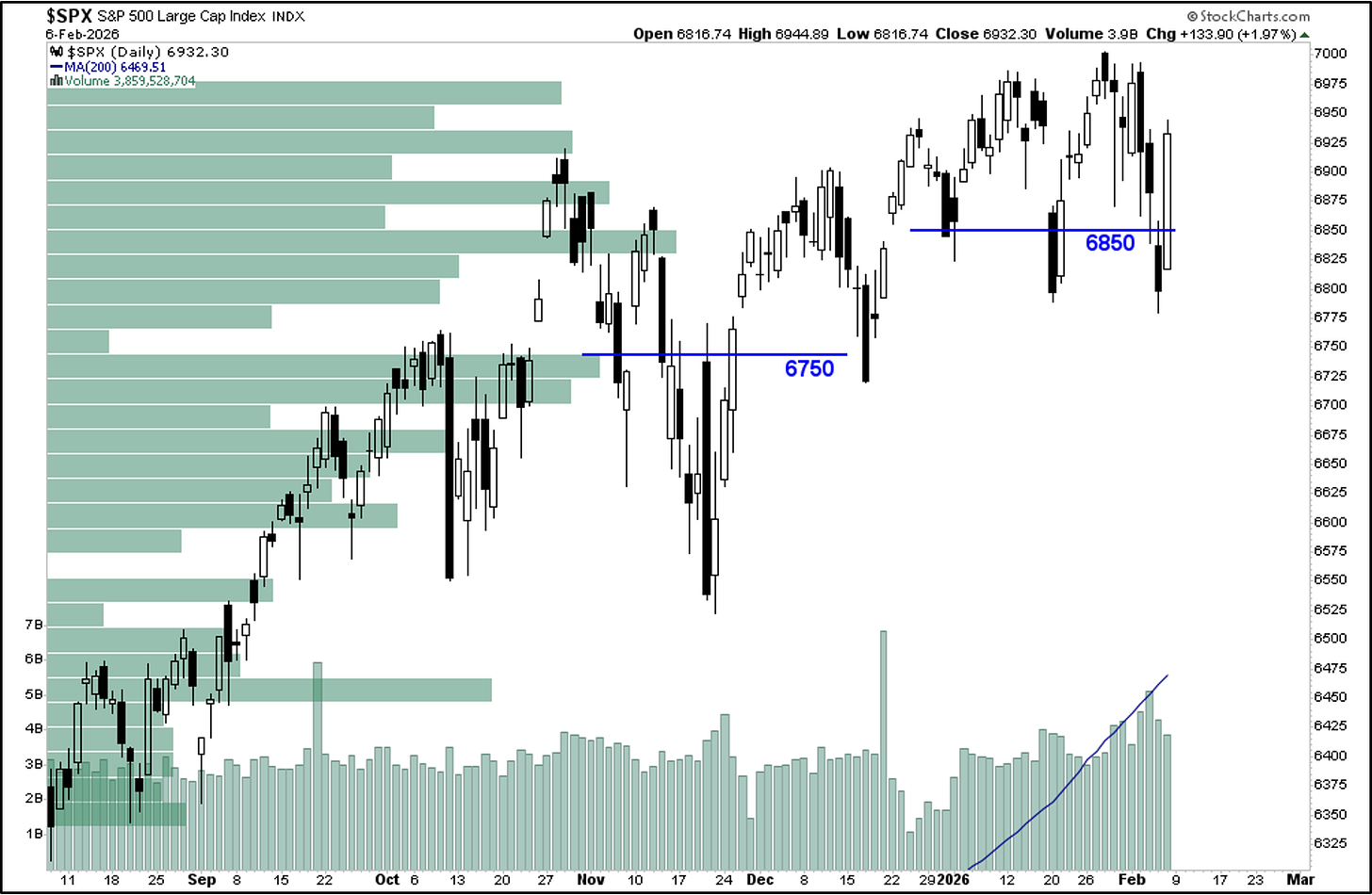

This is a longer BUT IMPORTANT write-up so buckle up. Momentum crashed and degenerates that were chasing these gains got wiped out — that’s healthy.

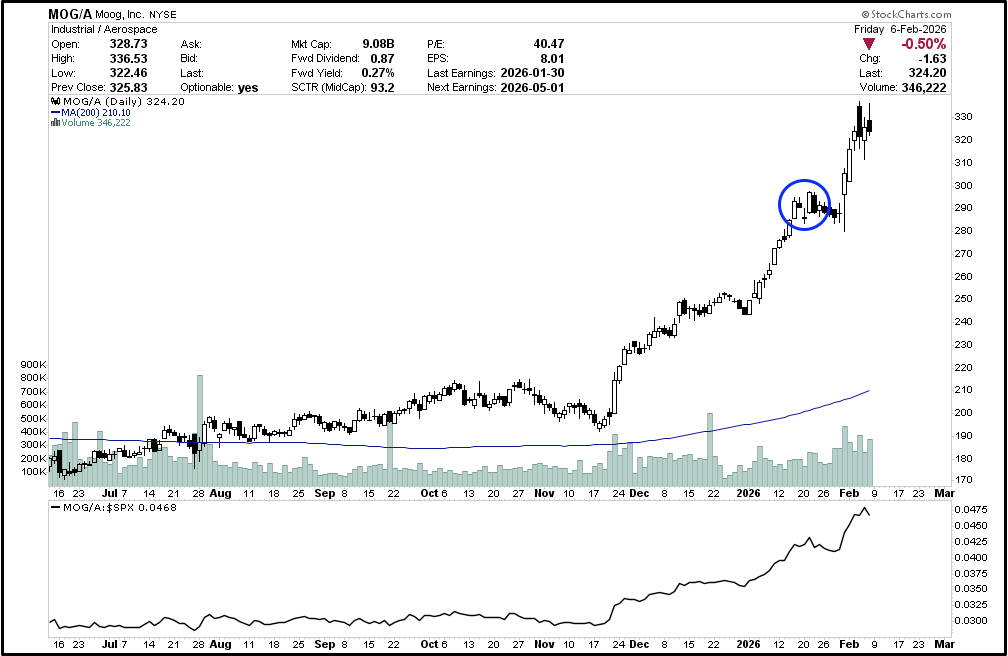

Drawdowns are how you find what is outperforming.

Like we stated before, “If you want to win in this market, see what is outperforming in the drawdown, that is the first step. Then boil down which sectors and sub-sectors are leading.”

No one heard this.

What brought the market down last week was Anthropic releasing their newest model where agents created a C compiler (look this up) in 2 weeks. What normally takes 5–8 senior, PhD-level engineers several years to build was completed by agent teams in days.

“We tasked Opus 4.6 using agent teams to build a C compiler…Two weeks later, it worked on the Linux kernel.”

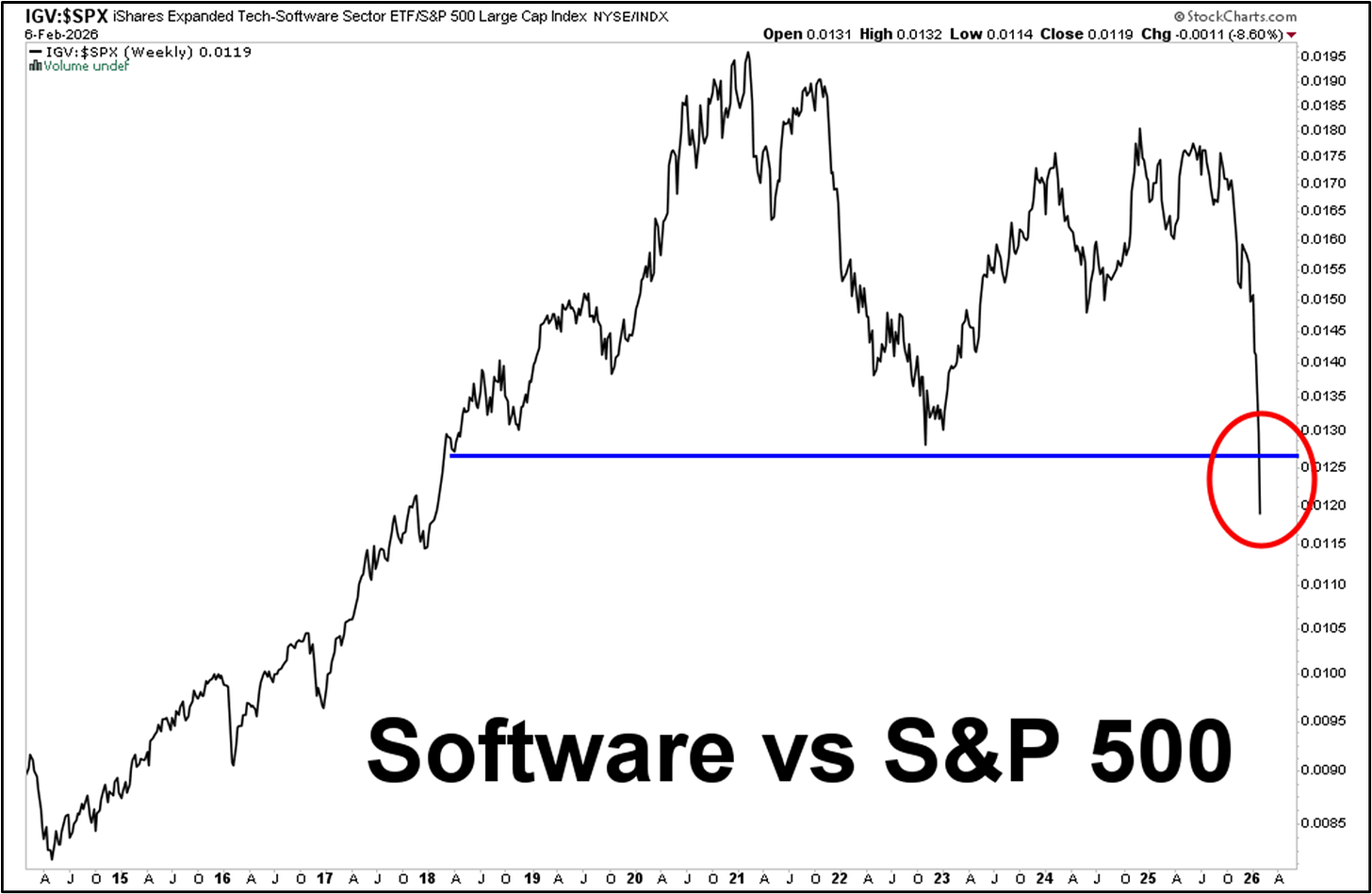

SaaS companies and business application will no longer exist they are basically CRUD Databases.

+7 YEARS OF PERFORMANCE vs S&P. GONE.

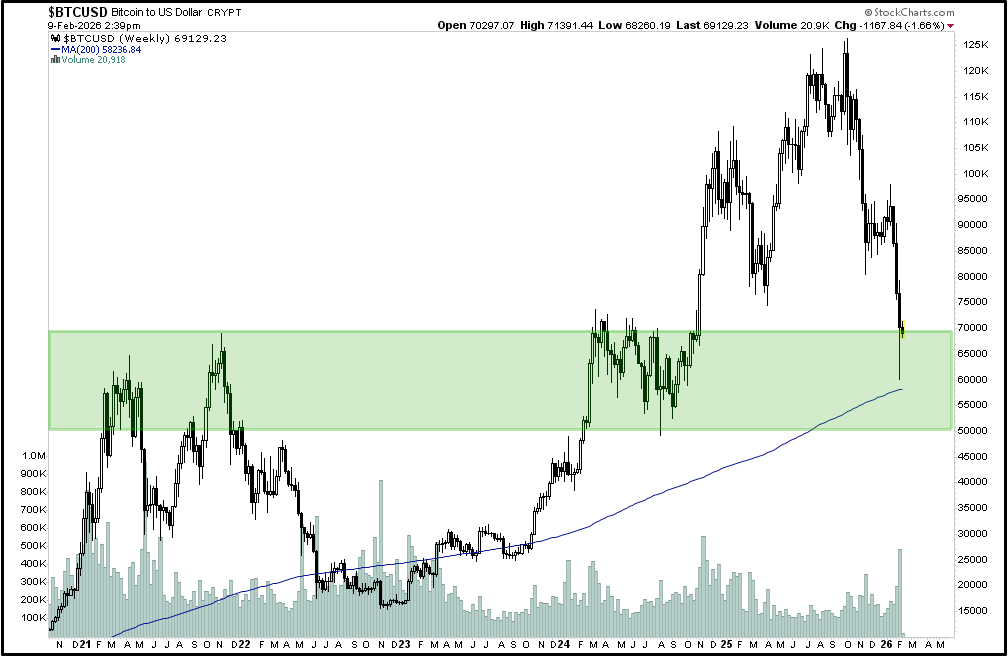

Computer Memory is our main concern.

Our main concern — consistent with Elon’s — is memory.

The limiting factor in space will be chips.

The limiting factor before space is power.

NVIDIA already signaled this with the reported pause around the 5090 GPU due to memory constraints. (HUGE DEAL)

The KOSPI is being led higher by SK Hynix and Samsung Electronics. Memory and advanced compute remain the marginal drivers of global equity leadership.

Names on our radar:

GameStop (keep your eyes peeled)

Moog

ASML

SK Hynix

Samsung Electronics (DDR5 exposure)