Where's the Bottom in Software?

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 12,000 subscribers at MktContext.com for our weekly deep dives and analysis!

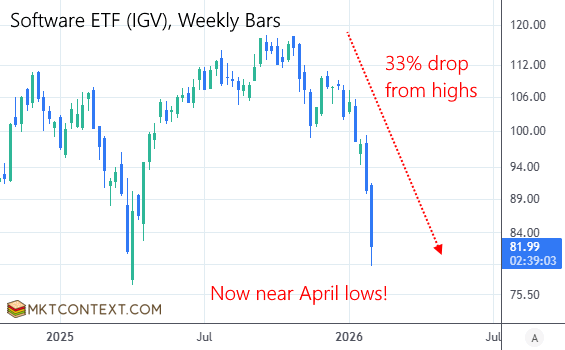

Last week we saw a sharp unwind in software stocks that dragged the Nasdaq down (dubbed “SaaS-pocalypse”). We initiated on this topic several weeks ago arguing that software is getting democratized and the SaaS pay-per-user business model is under pressure. The market is now waking to this reality, sending the IGV ETF down -33% to April lows:

The Catalyst: Autonomous Displacement.

The latest catalyst appears to be Anthropic’s release of new plugins for Claude Cowork (an autonomous AI agent). These plugins are able to perform the functions of entire departments including Legal, Sales & Marketing, Finance & Accounting, Data Analysis, and Productivity & Search.

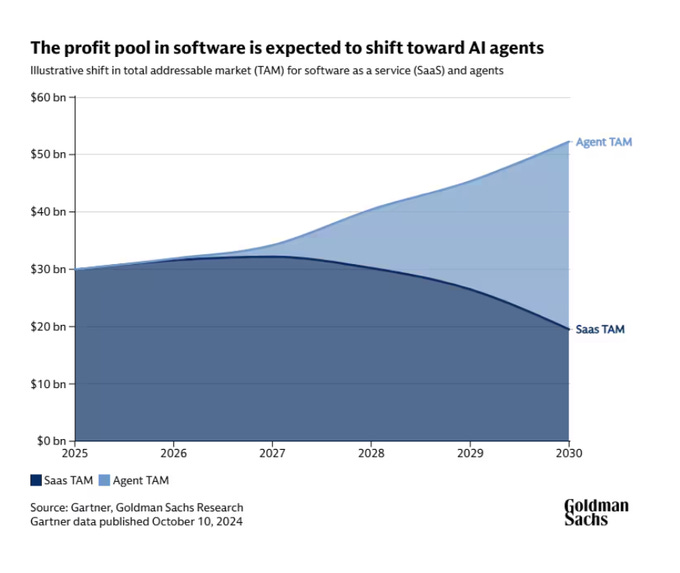

The major concern is that AI agents can take over what software accomplishes today. When one agent can automate what ten humans used to do, that’s ten subscription seats that the software vendor loses. The data is already showing per-user pricing dropping off a cliff.

It is estimated that in the long run, AI agents will steal 60% of profit from software companies.

The End of Pricing Power The productivity gains from AI agents are staggering. Companies are reporting 3-4x productivity gains and 2x revenues-per-employee. Software vendors are now forced to switch from the old per-user model to a fixed pricing model with AI-assisted workflows, or face obsolescence. Ironically, the very AI features vendors are building to retain customers are giving those customers the tools to shrink their contracts.

Software vendors have gouged customers for decades and customers are now looking at this area for obvious cost cuts. Instead of paying for an extra seat, they can eliminate the need altogether. In this way, software companies have lost their pricing power due to disruption, even if they don’t lose demand any time soon.

But the pain isn't staying contained to Silicon Valley...

Join 12,000+ macro investors who get these insights before the mainstream media catches on!