Our Liquidity Addiction Continues

Submitted by QTR's Fringe Finance

Today I’m extremely happy to be bringing you the latest from my friend Lyn Alden.

Lyn’s background bridges the fields of engineering and finance. She holds a bachelor’s degree in electrical engineering and a master’s degree in engineering management, specializing in engineering economics, systems engineering, and financial modeling. Her early career included roles as an electrical engineer and later an engineering lead at the Federal Aviation Administration’s William J. Hughes Technical Center.

Alden has been a passionate investor for years. From 2010 to 2015, she ran her first investing website as a part-time venture, eventually selling it to a larger publishing company. In late 2016, she founded Lyn Alden Investment Strategy, a research firm that grew significantly, leading her to leave engineering management in 2021 to focus on finance full-time.

Now an independent analyst, Alden aims to deliver institutional-level research in clear, accessible language for both professional and retail investors. She also serves as an independent director on the board of Swan.com and is a general partner at the venture capital firm Ego Death Capital. In 2023, she published the best-selling book Broken Money (congrats on more than 100,000 copies sold, Lyn!) exploring the history, present, and future of money through a technological lens.

Lyn is an investor I always read and always love to hear from, so I was grateful she gave me permission to share this month’s research with my subscribers. I’m sure you’ll find it as valuable as I do.

The Gradual Print Is Here

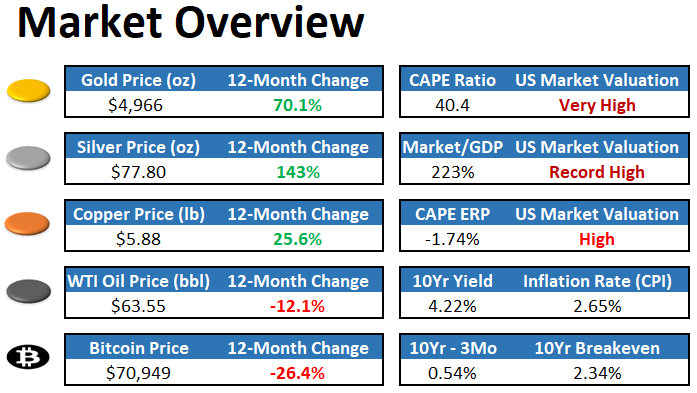

This newsletter issue discusses the implications of the Fed’s shift from long-term balance sheet reduction to its new trend of (expected) long-term balance sheet expansion. It also touches on Japan’s atypical bond situation and the volatile boom in precious metals.

The Gradual Print

In my prior newsletter, I discussed how the overnight financing markets were running into liquidity shortages, and that the Fed would likely begin balance sheet expansion in the not-too-distant future. In contrast to some that are calling for a large upcoming period of money-printing (e.g. a “big print” or a “nuclear print”), I’ve referred to this as the “gradual print.”

Shortly after that, the Fed did announce that they would begin expanding their balance sheet on an ongoing basis, in order to maintain what they consider to be ample reserves in the banking system and to maintain control of interest rates. They’ll be continuing to let mortgage-backed securities mature off of their balance sheet, while adding to treasury securities of durations up to 3 years.

Specifically, they called for $40 billion per month in purchases to start with, along with an expectation for that rate of purchases to remain elevated through tax season in April 2026. This, in their view, would alleviate the recent liquidity shortage and provide somewhat of a liquidity buffer to prepare for the annual liquidity drawdown that happens every tax season. Thereafter, Fed Chairman Jerome Powell estimates that $20-$25 billion per month is a baseline structural rate of balance sheet growth:

As detailed in a statement released today by the Federal Reserve Bank of New York, reserve management purchases will amount to $40 billion in the first month and may remain elevated for a few months to alleviate expected near-term pressures in money markets. Thereafter, we expect the size of reserve management purchases to decline, though the actual pace will depend on market conditions.

[…]

So, you know, we announced that we’re resuming reserve management purchases. That is completely separate from monetary policy. It’s just we need to keep an ample supply of reserves out there. Why so big? The answer to that is, you know, if you look ahead, you will see that April 15th is coming up, and our framework is such that we want to have ample reserves even at times when reserves are at a low level temporarily. So that’s what happens on Tax Day. People pay a lot of money to the government, reserves drop sharply and temporarily. So this seasonal buildup that we’ll see in the next few months was going to happen anyway. It was going to happen because April 15th is April 15th. There’s also a secular ongoing growth of the balance sheet. We have to keep reserves, call it, constant as a—as it relates to the banking system or to the whole economy. And that alone calls for us to increase about $20 or $25 billion per month.

-Jerome Powell, December 10, 2025 Press Conference

In the meeting minutes for that same December 10th meeting, the consensus by FOMC members was for $220 billion over the following 12 months, which equates to slightly under $20 billion per month. Powell’s estimate is thus on the higher end of the range.

The mechanism for this is that the Fed creates new bank reserves out of thin air, and then trades them to banks for treasury securities. The Fed’s assets...(READ THIS FULL ARTICLE HERE).