Silversqueeze Comes to China

Silver: China Inventories Squeezed by US Lockout of LATAM

TL;DR

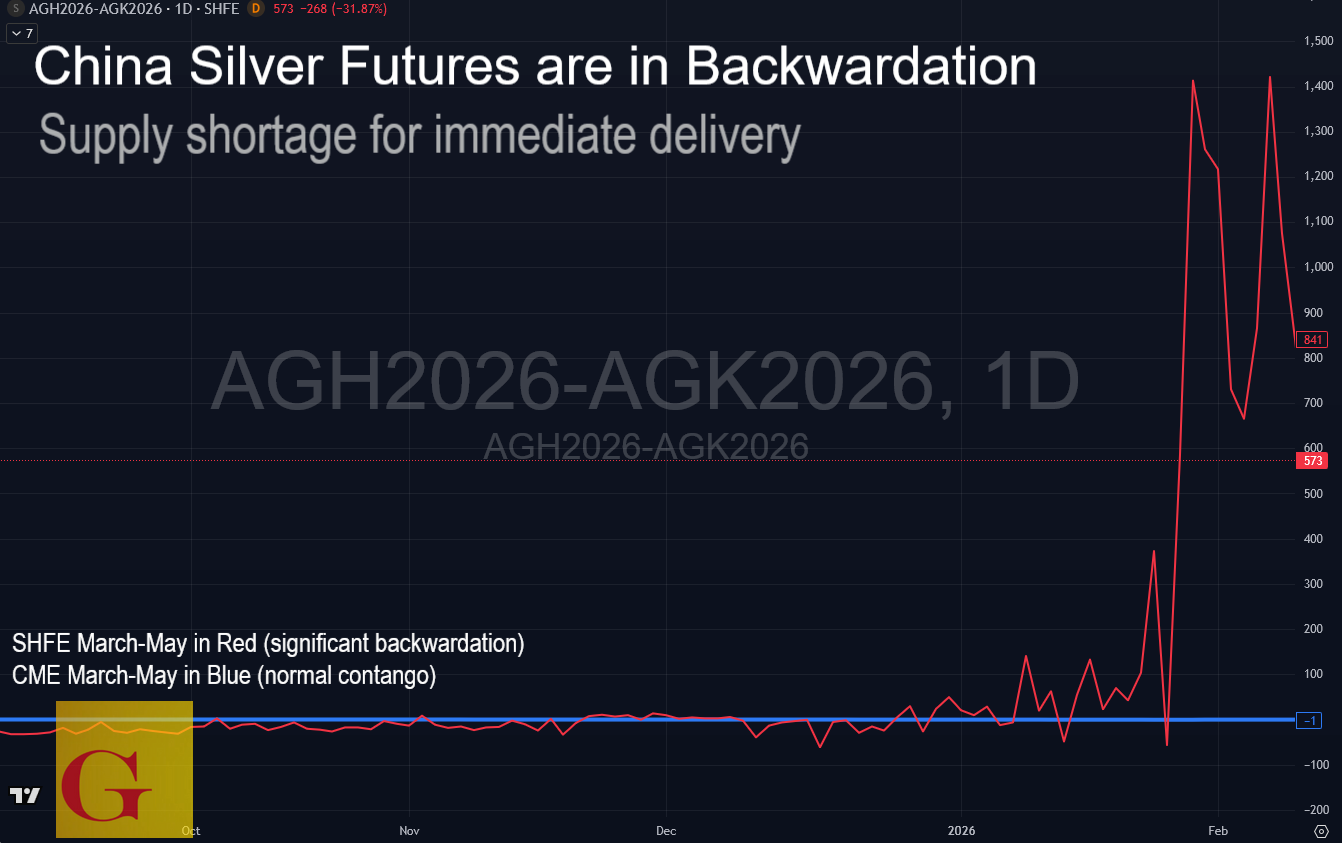

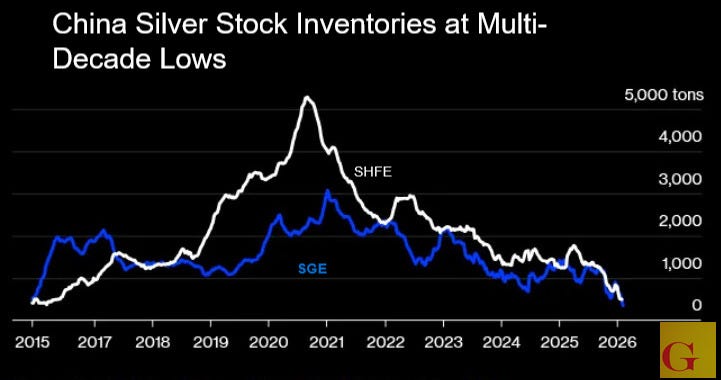

- China’s silver market remains physically tight despite stabilization in international prices, with record backwardation and decade-low exchange inventories signaling preference for immediate delivery.

- Investment bar demand and solar manufacturing procurement continue draining stockpiles, while short sellers pay deferral fees to avoid delivery, reinforcing evidence of localized scarcity.

- Speculative positioning has cooled ahead of Lunar New Year, yet structural supply constraints persist, leaving Shanghai spreads historically elevated.

- In our view, the tightening in China coincides with a broader hemispheric realignment of silver concentrate flows toward U.S. refining and banking channels, suggesting that geopolitical supply restructuring may be amplifying physical stress in Asian markets.

China’s Silver Tightness Deepens as Global Prices Stabilize

Authored by GoldFix

International silver prices have steadied following a period of extreme volatility, yet physical conditions inside China continue to reflect pronounced strain. Investment demand and industrial consumption are drawing down exchange inventories, tightening prompt supply and distorting futures spreads.

According to a February 10 Bloomberg News report, inventories across Chinese exchanges have fallen to multi-year lows while front-month contracts trade at record premiums to deferred months. The imbalance reflects a preference for immediate delivery and underscores the scarcity of deliverable material within the domestic market.

Backwardation Tells The Story

Domestic producers and traders are working through backlogs of orders as near-term prices rise relative to forward contracts. The front-month silver contract on the Shanghai Futures Exchange has climbed to a record premium over the next active month. The structure signals backwardation, a condition in which prompt metal commands a higher price than future delivery.

“Such a large backwardation is driven by an inventory crisis and the depletion of deliverable material,” said Zhang Ting, senior analyst at Sichuan Tianfu Bank Co.

“Institutions still have incentives to continue squeezing the market for profit.”

The spread between the front-month and next contract has widened to levels rarely seen in Shanghai trading. Positive spreads confirm a market paying up for immediacy.

Short sellers on the Shanghai Gold Exchange have also paid deferral fees to avoid physical delivery since late December. The payments indicate limited availability of metal to settle obligations, reinforcing evidence of tightness within exchange-linked warehouses.

From Speculative Surge to Inventory Drain

The silver market experienced a historic selloff beginning at the end of January, erasing most of the 61 percent rally registered in the opening weeks of the year. That earlier advance was fueled by heavy speculative participation in China and overseas, with silver temporarily drawing flows typically directed toward gold during periods of macro uncertainty tied to the dollar, Federal Reserve governance concerns, and geopolitical tensions.

**Silver: Emergency Halt of UBS-China Fund Tied to Global Selloff

Trading in a major China-listed silver fund was halted for a full session on January 30 as regulators moved to contain price distortions, while global silver prices fell sharply from record highs amid elevated volatility and tighter derivatives margin requirements.

Despite the price correction, physical stockpiles remain depleted. Chinese inventories had already been reduced following an autumn squeeze on global supplies. The December surge in investment demand accelerated the drawdown.

Warehouse stocks linked to the Shanghai Futures Exchange and Shanghai Gold Exchange now sit at levels last observed more than a decade ago.

Retail and Industrial Demand Remain Firm

Investment bar demand has remained elevated. In Shenzhen’s Shuibei district, the country’s primary bullion trading hub, merchants continue to transact at premium prices.

“Whenever there are stocks, they’re sold off quickly,” said Liu Shunmin, head of risk at Shenzhen Guoxing Precious Metals Co.

Industrial consumption adds a second layer of demand. China’s solar panel manufacturers, which use silver paste in photovoltaic cells, are increasing production ahead of the April 1 expiration of export tax rebates. Some firms used the recent price decline to secure material at lower levels, according to market participants.

The convergence of investment accumulation and manufacturing procurement limits the metal available for exchange delivery.

Seasonal Constraints and Cooling Speculation

Market participants note that the only potential relief in the immediate term would come from increased smelter output during the Lunar New Year period. Historically, industrial activity slows during the week-long holiday, making a production surge less likely.

Literally this: Silversqueeze Comes to China@KingKong9888 pic.twitter.com/F45C9fzC8X

— VBL’s Ghost (@Sorenthek) February 11, 2026

There are indications that speculative positioning is moderating. Aggregate open interest on the Shanghai Futures Exchange has declined to the lowest level in more than four years as traders reduce exposure ahead of the February 16 holiday start.

Broader Commodity Context

Separate commentary from Bloomberg Intelligence highlighted an expected acceleration in fundraising by Chinese miners amid an ongoing metals supercycle. Aluminum’s price behavior has shifted toward closer alignment with copper, reflecting substitution dynamics and shared macro drivers. U.S. officials also continue to monitor China’s crude stockpiling strategy, which may influence oil prices even during periods of global oversupply.

Within that broader commodity landscape, silver in China remains defined by localized scarcity and structural tightness. Futures spreads, warehouse levels, and deferral payments together indicate a market prioritizing physical immediacy over forward exposure.

Continues here