"Train Wreck" US Adds $481 Billion In Debt In 3 Months

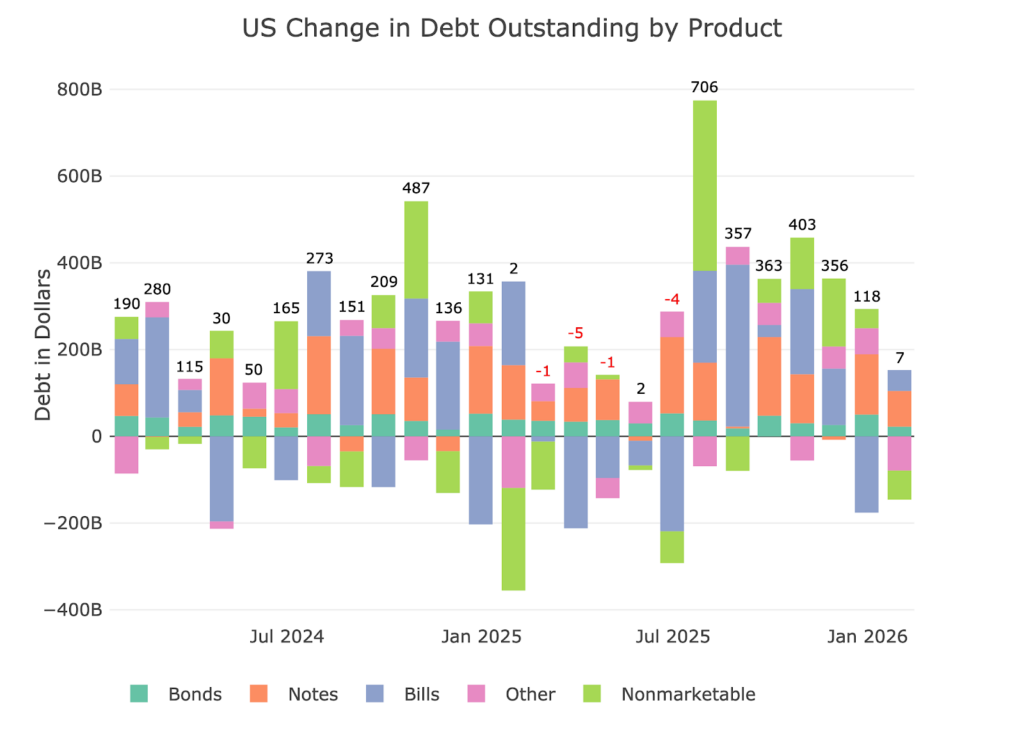

The government hit the debt ceiling back in January which blocked any net new debt from being created from January to June. Once the debt ceiling was lifted, the government wasted no time in catching up for all the months where borrowing was frozen. Over the last 7 months, the government borrowed an incredible $2.28T!

Note: Non-Marketable consists almost entirely of debt the government owes to itself (e.g., debt owed to Social Security or public retirement)

Figure: 1 Month Over Month change in Debt

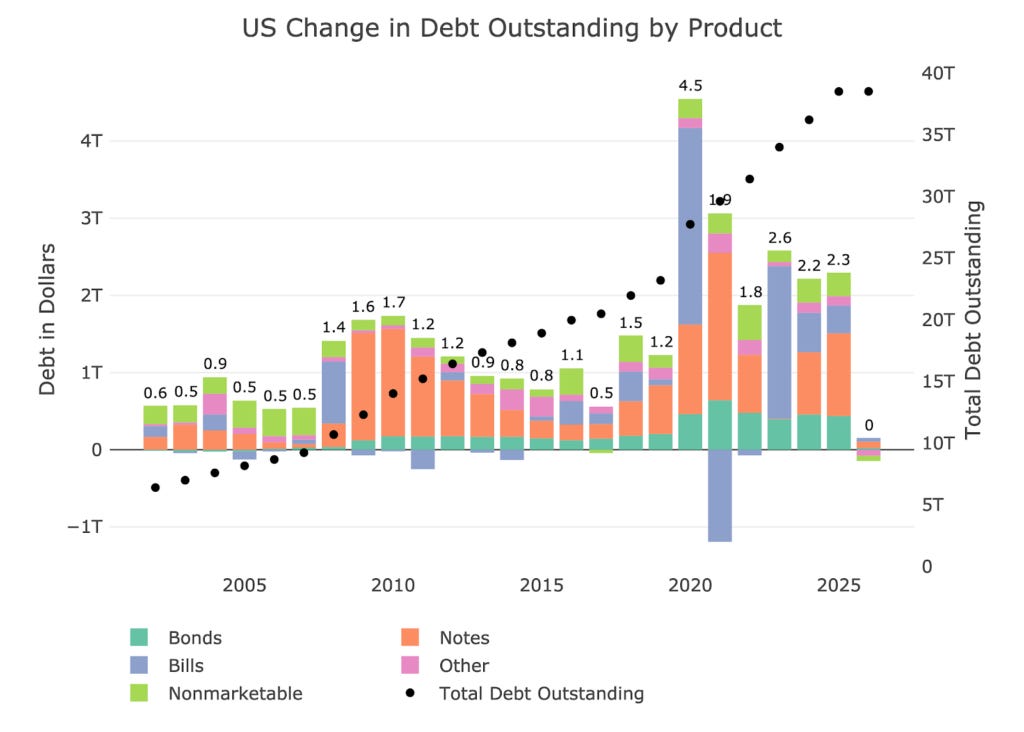

January was a very small month, but the chart below shows that $2.3T was borrowed for all of 2025. This follows $2.6T and $2.2T in 2023 and 2024. Needless to say, there seems to be a new standard of $2T+ annual borrowing. This will likely mean adding $10T every 4 years at current rates. More than likely that is going to accelerate going forward.

Figure: 2 Year Over Year change in Debt

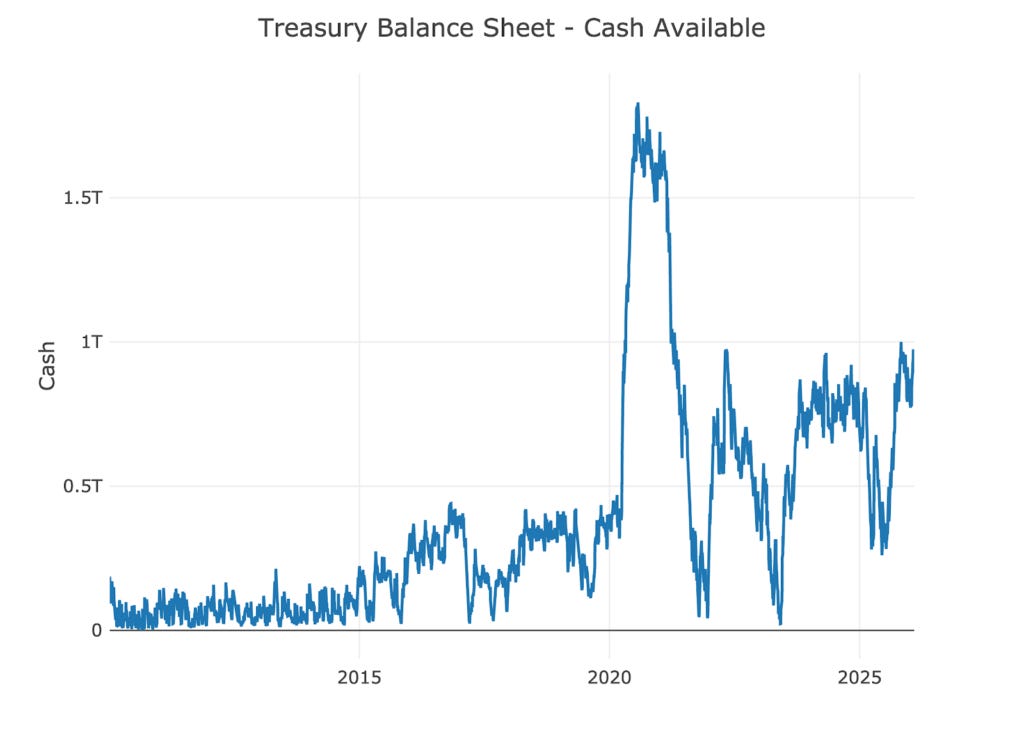

The Treasury has strengthened their cash position to $1T.

Figure: 3 Treasury Cash Balance

The chart below shows both the maturity of the debt and average interest rate. The blended interest rate has stabilized around 3.1%. More concerning is the average maturity of the debt has dropped to 5.8 years. This is the lowest average rate since 2021. Lower average maturity means the government will have to...(READ THIS FULL ANALYSIS 100% FREE HERE).