2/12/26 Market Wrap: CTA's to Sell $20bln More of Equities

Daily quantitative summaries from the TightSpreads Substack.

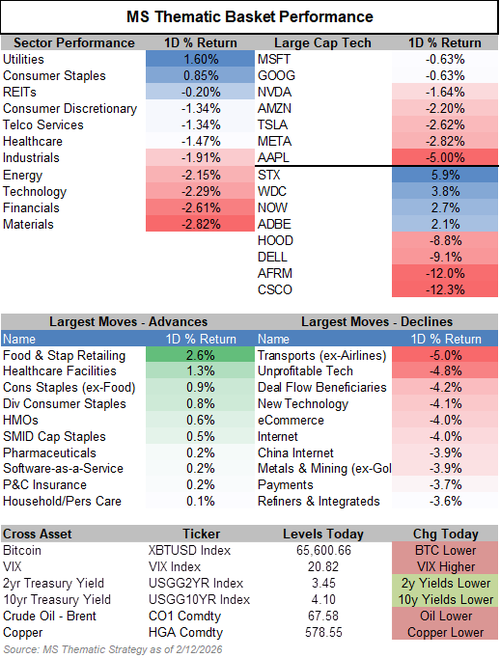

Thursday, February 12, 2026 —a rough day marking the 2nd-worst SPX performance of the year at -1.6% (SPX closed around 6,833, down sharply from recent highs amid ongoing AI angst). This was a broad, correlated sell-off driven by fears of AI disruption spreading beyond software/chips into real-economy sectors, plus mechanical supply pressures.

Morgan Stanley’s Quant Derivative Strategy team estimates systematic macro strategies (CTAs/trend-followers, vol-control funds, risk-parity) will sell $15-20bn of equities over the next week—a moderate -0.5 z-score supply event vs. the last 5 years. Roughly half (~$7.5-10bn) likely hit today, with the rest spread out—classic forced de-risking as trends turn negative and volatility spikes.

levered ETF rebalancing adds ~$12.4bn equity supply today (6th percentile vs. last year, meaning unusually heavy in the lower tail), with $8.5bn benchmarked to Tech/Nasdaq/Semis/singles—amplifying the tech unwind mechanically (levered ETFs like TQQQ/SSO rebalance daily to maintain exposure, selling into weakness, look in their prospectus to check timing and get ahead of flows).

The thematic trigger: Software to Hardware/logistics fear

AI disruption fears intensifying—spilling from software (prior weeks’ pain) into hardware/logistics. Logistics providers got hammered on a viral X post highlighting a new AI-enabled entrant disrupting transportation (Transports ex Airlines MSXXTRXA -5%—trucking/rail/freight proxies). Memory cost pressures hit hardware: rising DRAM/HBM prices (from AI demand outstripping supply) squeezed margins—MSXXMEMR (Memory Risk basket) -5.6%, AAPL -5% (driving ~1/5 of SPX’s drop via its weight), CSCO -12% (light gross margins guide tied to DRAM doubling again), Lenovo speaking to DRAM costs doubling again this quarter, and PC notebook shipment posting the largest miss in 4 years.

Broader market:

9/11 sectors lower (only Utilities/Staples up); leaders down were Materials (-2.8%, Copper -3%, Silver -10.7%, Gold -3.2%—risk-off/commodity unwind), Financials (-2.6%, Deal Flow Beneficiaries -3.5%, Payments -3.7%), Tech (-2.3%, AI Semis MSXXAISM -2.5%, Mag7 MSXXMAG7 -2.3%, Software MSXXSOFT -1.25%). Moves were highly correlated (internal ~20% vs. 10% prior 10 days)—investors in “PnL preservation mode” after 2 weeks of choppy/challenging environment, reducing risk across books.

Where people fled:

Defensives held up (MS Defensives basket up +0.9%), yields fell sharply (2y -5bps, 30y -7bps) on flight-to-safety—strong demand at 30Y auction (highest bid/cover in 8 years) confirms rotation to safety amid growth/AI uncertainty.

Kioxia (Japanese NAND/flash player) beat & raised sharply (+12% stock reaction), lifting Global Memory firms +5%—positive supply tightness read-through—but the market focused more on negative exposure to rising memory costs (hardware margins squeezed, legacy DRAM diverted to HBM/AI).

Tomorrow’s focus:

January CPI at 8:30a (delayed release)—expected ~0.3% MoM headline/core, 2.5% YoY (slight cooling from Dec). A soft print could extend yield dip/defensive bid (rate-cut pricing); hot could worsen growth fears/tighten financial conditions.

This is the AI trade’s pain trade manifesting—disruption fears now hitting disrupted sectors (logistics, hardware exposed to input costs), mechanical flows adding fuel, correlated risk-off. Defensives/yields benefiting, but broad pain for long/short hedge fund books leaning growth/tech. MS thinks there is positioning edge in shorting vulnerable cyclicals/hardware while watching CPI for macro pivot.