Market Wrap: 10bln More of CTA Selling, Funds Bullishly Added Shorts to Keep Longs

From the TightSpreads Substack.

February 13, 2026 (Friday), daily market close and weekly summary:

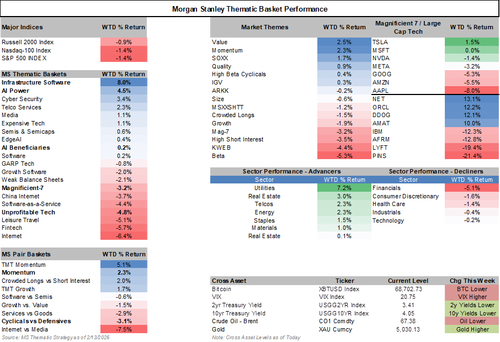

Stocks fell overall—S&P 500 (SPX) -1.3%, Nasdaq-100 (NDX) -1.4%, Russell 2000 (IWM) -0.8%—despite good economic news (strong January nonfarm payrolls jobs report and cooler January CPI inflation print). The drop came mainly from worries about AI disruption risk (how AI tools could hurt company profits long-term by replacing jobs or services) spreading beyond software to other areas like healthcare contract research organizations (CROs), insurance distributors, and logistics. The Morgan Stanley Broad AI Disruption basket (MSXXDIST, a custom index of stocks seen as vulnerable to AI replacement) fell -11% for the week. At the same time, higher memory costs (DRAM and high-bandwidth memory prices rising due to AI chip demand) hurt hardware companies—Apple -8% w/w was a big drag. PC market slowdown with Lenovo. This fear outweighed positive macro data and caused a shift to safer stocks.

Defensive rotation and yields:

Investors moved to defensives (sectors less sensitive to economic cycles)—Utilities +7%, REITs +3%, Telcos +2.3%, Staples +1.6%—while cyclicals (early-cycle like industrials/consumer) lagged (Early Cycle Cyclicals basket MSXXECYC -0.4%). Bond yields dropped (10-year Treasury -16 basis points w/w), and markets priced in slightly more Fed rate cuts (now ~1.2 cuts expected by July 2026 vs. 1.05 before)—a safety bid when growth/AI fears rise.

Hedge fund activity:

US equity long/short funds cut net leverage (long positions minus shorts, as % of capital) by ~3% on Thursday to 51%—back to lower levels and now in the ~33rd percentile over the past year (less bullish directionally). Thursday’s drop was extreme: 99th percentile one-day decline historically, the biggest HF selling day in ~6 months, with shorts added 2.5 times more than longs cut—funds protecting profits after two tough weeks. Gross leverage (total long + short size) stayed high at ~216% (near 10-year highs), so activity remained elevated but risk was reduced. YTD, average US L/S fund +90 basis points vs. SPX -10 bps (some buffer from earlier international/APAC gains).

Key themes and rotations:

AI disruption fears expanded: market repricing lower “terminal values” (long-term profit multiples) for vulnerable stocks.

Rotation to Hard Asset Intensive businesses (MSXXHALO basket +4% w/w)—companies with scarce physical assets/infrastructure (e.g., utilities, real assets) seen as safer in a world with high nominal growth/inflation potential.

North American selling broad (heaviest in Industrials, Discretionary, Materials—trimming longs + adding shorts); only modest buying in traditional defensives (Real Estate, Staples, Healthcare). Europe/APAC saw net buying—international rotation helped.

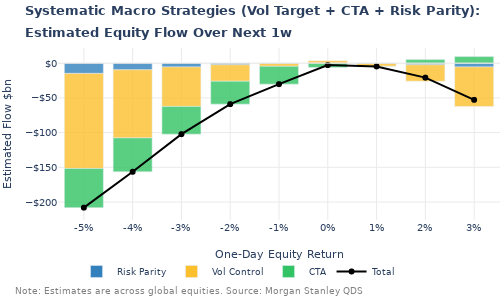

Systematic and options positioning:

Systematic strategies (CTAs/trend-followers, volatility control, risk parity) reduced leverage to 64th percentile over 5 years—NDX weakness triggered CTA selling (~$10bn global equity supply expected next week unless markets stabilize).

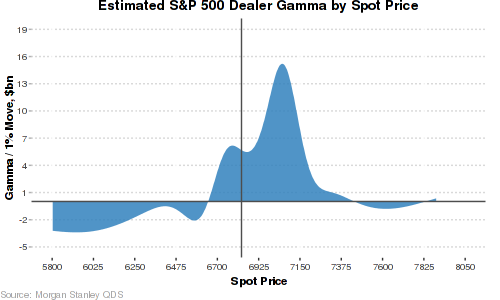

S&P dealers long gamma (they buy weakness/sell strength, capping big index moves); peak gamma at 7040-7070—limits volatility unless SPX drops materially (~-3% flip to short gamma).

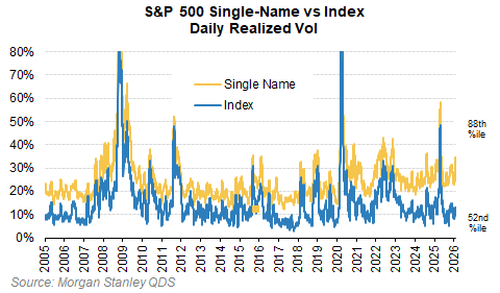

Dispersion (stock-by-stock moves) extreme (1-month S&P dispersion 95th percentile since 2005, driven by singles/themes not sectors)—index volatility low, but single-name volatility high.

Crowding and risks ahead:

- HF momentum exposure high (94th percentile since 2016), with overlap in short/medium/long-term momentum baskets; Semis positioning still stretched.

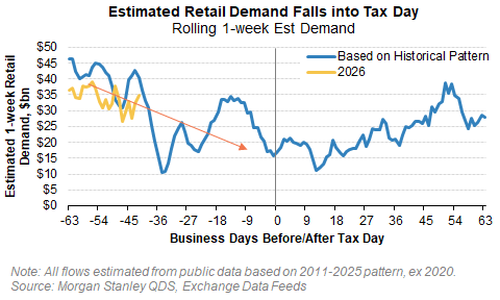

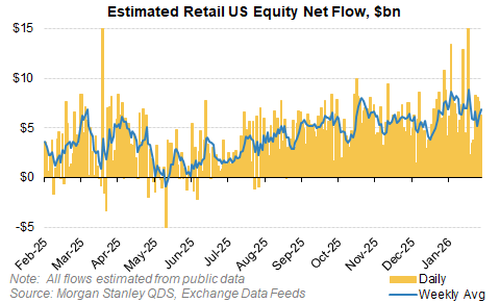

- Retail Favorites basket (MSXXRFLO) down -13% since Jan 22 (vs. SPX -1.1%)—already pricing some slowdown ahead of Tax Day; retail demand still solid (84th percentile 1Y) but expected to ease late Feb/early March.

- NVDA earnings Feb 25 could pressure momentum longs if results disappoint. Same goes for upside risk for beating expectations.

Other supportive flows:

- Corporate buybacks strong (highest weekly notional since Feb 2025, led by Financials/Software—companies ignoring AI fears).

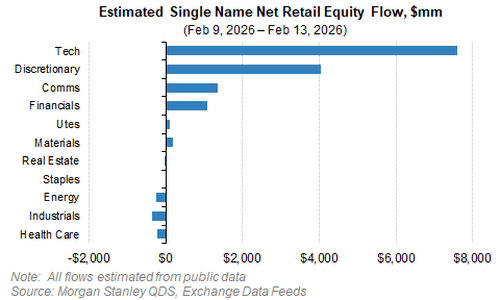

- Retail net buyers ~$31bn (high percentile); ETF inflows to international/EM, defensives (Staples/Energy), fixed income.

- Institutional selling heavy Thursday, overwhelming retail bid.

This was a positioning-driven reset—AI fears caused defensive rotation, HF de-risking (big net leverage cut), and mechanical supply. Macro remains supportive (strong jobs, cooling inflation), so likely tactical adjustment not regime change. Lower nets set up potential bounce, but crowded momentum/Semis + retail slowdown + ‘NVDA risk/surprise’ could bring more pressure or momentum late Feb/early March—MS favor dispersion plays (long defensives/hard assets, short vulnerable disrupt-ees).