The True Value of Gold Beyond Price

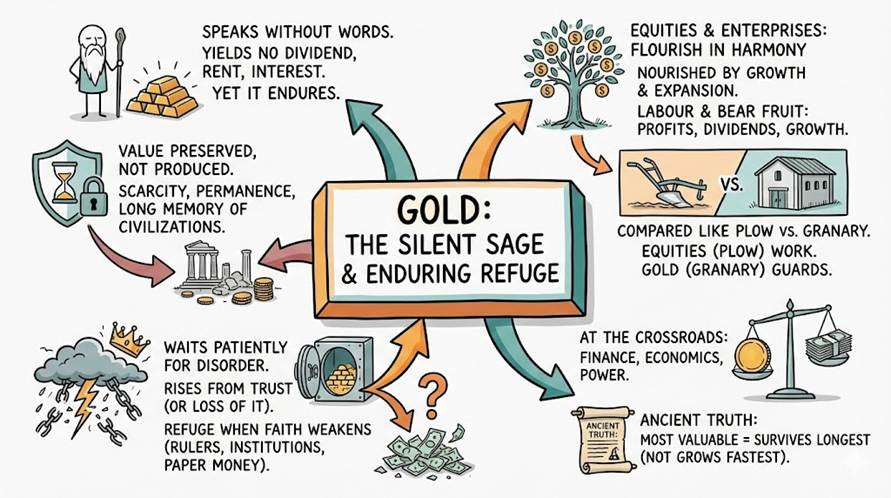

Gold stands apart from other assets, much like the silent sage who speaks without words. It yields no dividend, no rent, no interest, yet it endures. Its value is not produced but preserved, drawn from scarcity, permanence, and the long memory of civilizations that entrusted it with wealth when promises failed. While equities and enterprises flourish in times of harmony, nourished by growth and expansion, gold waits patiently for disorder. It rises not from productivity, but from trust—and more often, from the loss of it. When faith in rulers, institutions, or paper money weakens, gold becomes the refuge of the prudent. Thus, at the crossroads of finance, economics, and power, gold reflects an ancient truth: what is most valuable is not what grows fastest, but what survives longest.

To compare gold with productive assets is to compare the plow with the granary. Equities labour and bear fruit, offering profits, dividends, and the promise of growth, while gold remains still, guarding what has already been earned. Gold produces nothing, yet loses little; it preserves purchasing power when institutions weaken and paper claims are questioned.

History offers a steady lesson: in the stagflationary 1970s, when confidence eroded, gold ascended as equities faltered; in the long expansions of the 1980s and 1990s, when order prevailed, equities flourished while gold stood aside. Thus the cycle turns. Gold does not compete with productive assets—it complements them, standing watch when growth gives way to disorder and preservation becomes the higher virtue.

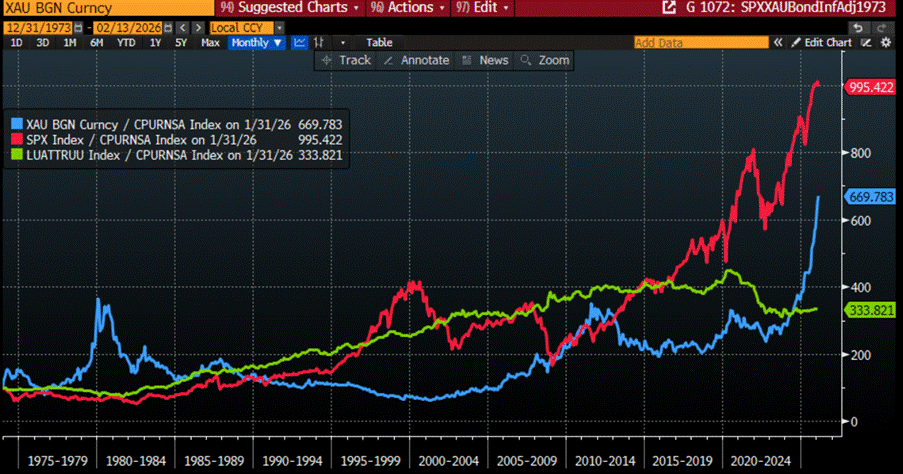

US CPI adjusted performance of $100 invested in Gold (blue line); S&P 500 (red line) and Bloomberg US Treasury Total Return Index (green line) since 1973.

Gold measures the seasons of the economy as surely as the farmer reads the sky. When times are orderly and growth is abundant, productive assets are favored; when excess, crisis, or fear take hold, gold is called upon to restore balance. Inflation weakens paper promises, yet gold remains unchanged. In the turmoil of the 1970s, as rising prices and energy shocks unsettled nations, gold rose swiftly. In 2008, when confidence in financial institutions collapsed, gold became a refuge. In 2020, amid uncertainty and unprecedented monetary expansion, it reached new heights. Thus, gold does more than track economic cycles—it reveals the strength, or fragility, of faith in fiat money itself.

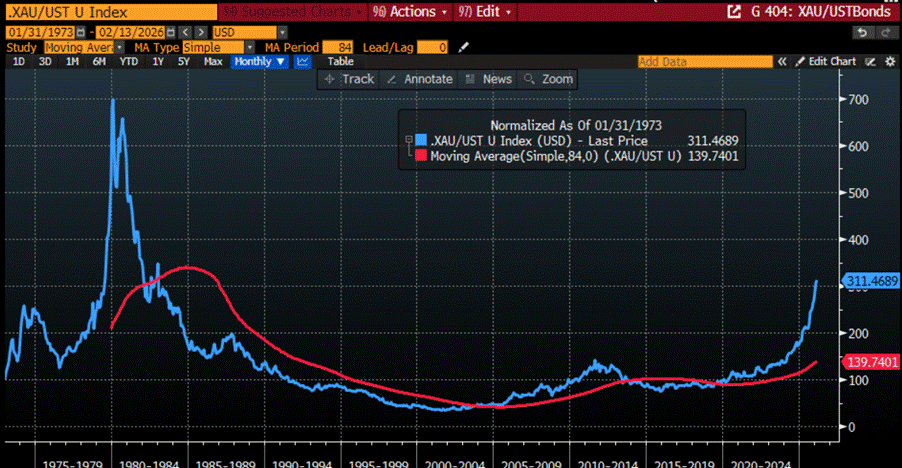

Gold to Bloomberg US Treasury Total Return Index (blue line); 7-Year Moving Average of the Gold to Bloomberg US Treasury Total Return Index (red line).

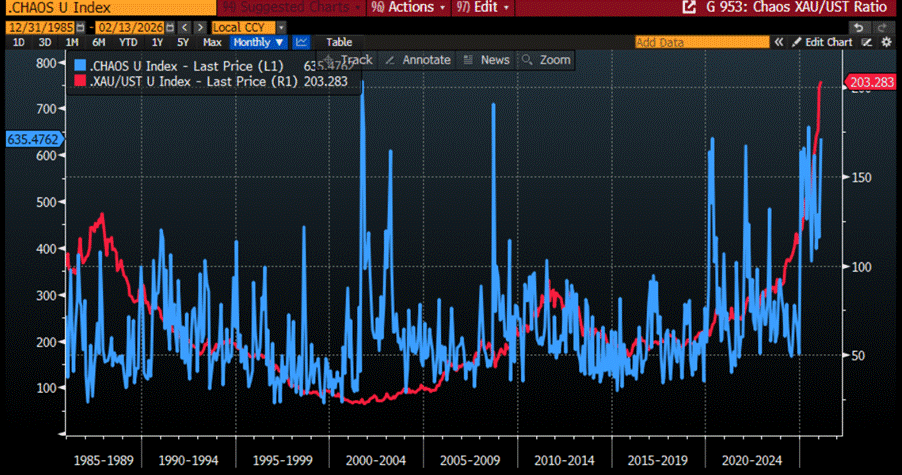

When order falters, gold awakens. Domestic discord—be it political paralysis, social unrest, or reckless stewardship of public finances—weakens faith in currency and compels wealth to seek shelter. War magnifies this instinct. In times of global conflict, as during the Second World War, gold stood as a silent refuge beyond borders. In the Middle East, repeated turmoil and oil shocks drove investors toward its certainty. In 2022, the war between Russia and Ukraine once again reminded markets that power, trade, and money are fragile constructs. History teaches with consistency: when nations clash and systems strain, capital flows not toward promise, but toward permanence—and gold endures as the hedge against chaos.

US Chaos Index (blue line); Gold to Bond ratio (red line).

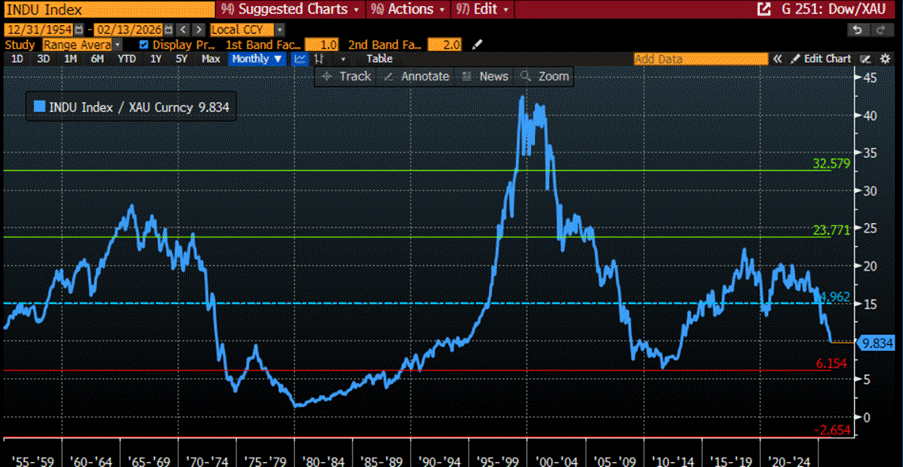

The Dow-to-Gold ratio is a quiet teacher, revealing whether faith rests with enterprise or with preservation. It asks a simple question: how many claims on industry are required to obtain one ounce of certainty? At the end of Bretton Woods in 1971, the answer was nearly forty, reflecting confidence in growth over restraint. By 1980, amid inflation and disorder, the ratio collapsed toward six, as gold reclaimed its authority. At the height of the technology bubble, it again approached forty, only to fall sharply during the financial crisis of 2008. Today, it stands in the middle ground, neither extreme nor calm. When the ratio declines, gold gains wisdom over speculation; when it rises, productivity is favoured. Those who observe this balance learn when markets are guided by excess—and when they return to prudence.

Dow Jones to Gold ratio since 1955.

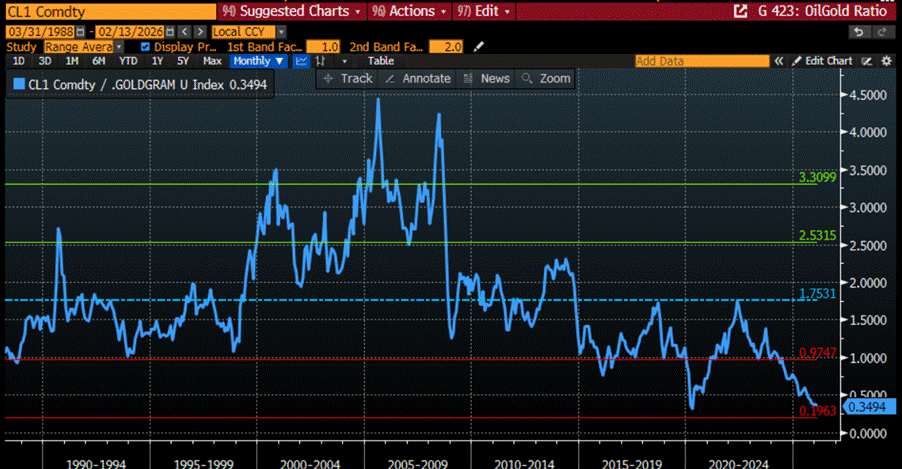

To compare gold and oil is to compare the wise tortoise with the restless hare. Oil scurries through the economy, fuelling growth, sparking industry, and vanishing as fast as it is used. Gold, patient and impervious, watches silently, untouched by flame or folly, measuring power without ever depleting it. In the 1980s, a barrel of oil demanded more than 2.5 grams of gold; by 2005, the price peaked at 4.5 grams. Since then, it tumbled steadily, dipping below 1 gram and bottoming at 0.35 gram during the Covid plandemic, before temporarily rebounding until May 2022, when the war escalates in Eastern Europe. Today, at roughly 0.35 gram of gold, one cannot help but smile: oil seems remarkably cheap when measured in gold. Yet the humour carries a lesson. With countless forces ready to lift gold’s price in dollars, the savvy investor knows that, in the coming “Trump Stagflation,” oil may race ahead, while gold, like the ever-dignified tortoise, continues its steady, eternal watch.

The Price of one barrel of oil expressed in gram of gold.

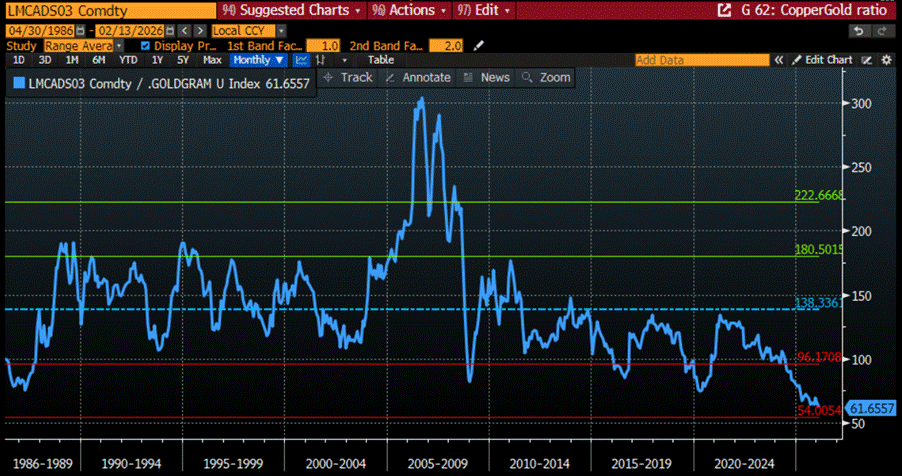

The lesson repeats itself when gold is measured against industrial metals such as copper, that restless metal tied to the heartbeat of industry. At the end of 1980, a ton of copper was worth 180 grams of gold; by 2006, it had climbed to nearly 300 grams. Since then, copper measured in gold has quietly declined, slipping below 65 grams as the Year of the Fire Horse is celebrated—a reminder that even the most industrious metal cannot outrun time. Copper leaps when factories hum and cities grow, then falters when growth falters. Gold, in contrast, walks its own path, steady and unbothered, outperforming metals when demand weakens and recessions loom. It is less a reflection of strength than a teacher of prudence: hold value when others chase growth. And now, with copper in rising demand to electrify the world, power AI, and meet the war-driven appetites of Western Malthusians, the shrewd investor knows the story: copper may sprint like a young hare, while gold, like the ever-dignified tortoise, continues its eternal, serene watch.

The Price of one ton of copper expressed in gram of gold.

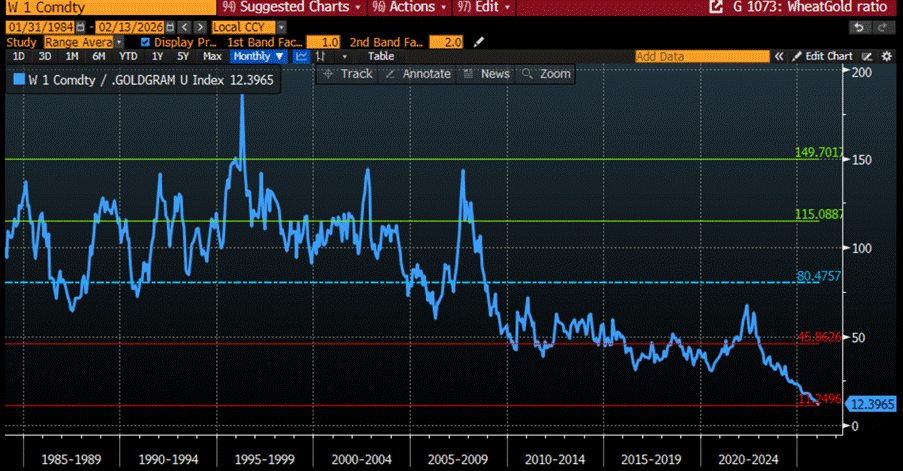

Gold, like the serene elder in the marketplace, keeps a watchful eye even over the humble bushel of wheat. In the 1980s, a single bushel demanded between 80 and 115 grams of gold, spiking to nearly 200 grams in 1996—a reminder that even bread can rise in value when the winds of history stir. Since then, the price of wheat in gold has tumbled to roughly 12 grams, making this once world-shaping commodity—capable of fuelling empires and toppling regimes—astonishingly cheap in gold terms today. That value might make the ancient granaries blush. It is as if gold chuckles quietly: while humans quarrel over fields and flour, the true measure of sustenance remains constant, eternal, and slightly amused.

The Price of one bushel of wheat expressed in gram of gold.

Looking at the price of life-giving protein, such as cattle, measured in the eternal terms of gold, one sees a story not unlike that of wheat—a tale of abundance, scarcity, and human folly. From 1980 to 1995, the price of a head of live cattle swung between 85 and 115 grams of gold, like a cow wandering freely between pastures, never quite settling. By 2001, it had reached a peak of roughly 170 grams, perhaps the proud bull strutting atop the hill of scarcity. Since then, however, the price of this humble provider of nourishment has quietly declined, as if humbled by time itself, reaching a mere 26 grams of gold at the start of 2026. One might chuckle at the thought: while kingdoms rise and fall, wars rage, and markets flail, a head of cattle can now be had for so little gold that even the ancient herders would pause, stroke their beards, and shake their heads.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/the-true-value-of-gold-beyond-pri…

Visit The Macro Butler Website here: https://themacrobutler.com/

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence