New Gold Standard: No Central Bank Required

Special: An Individual Gold Standard is Coming if you Want it

No Central Bank Required

TL; DR

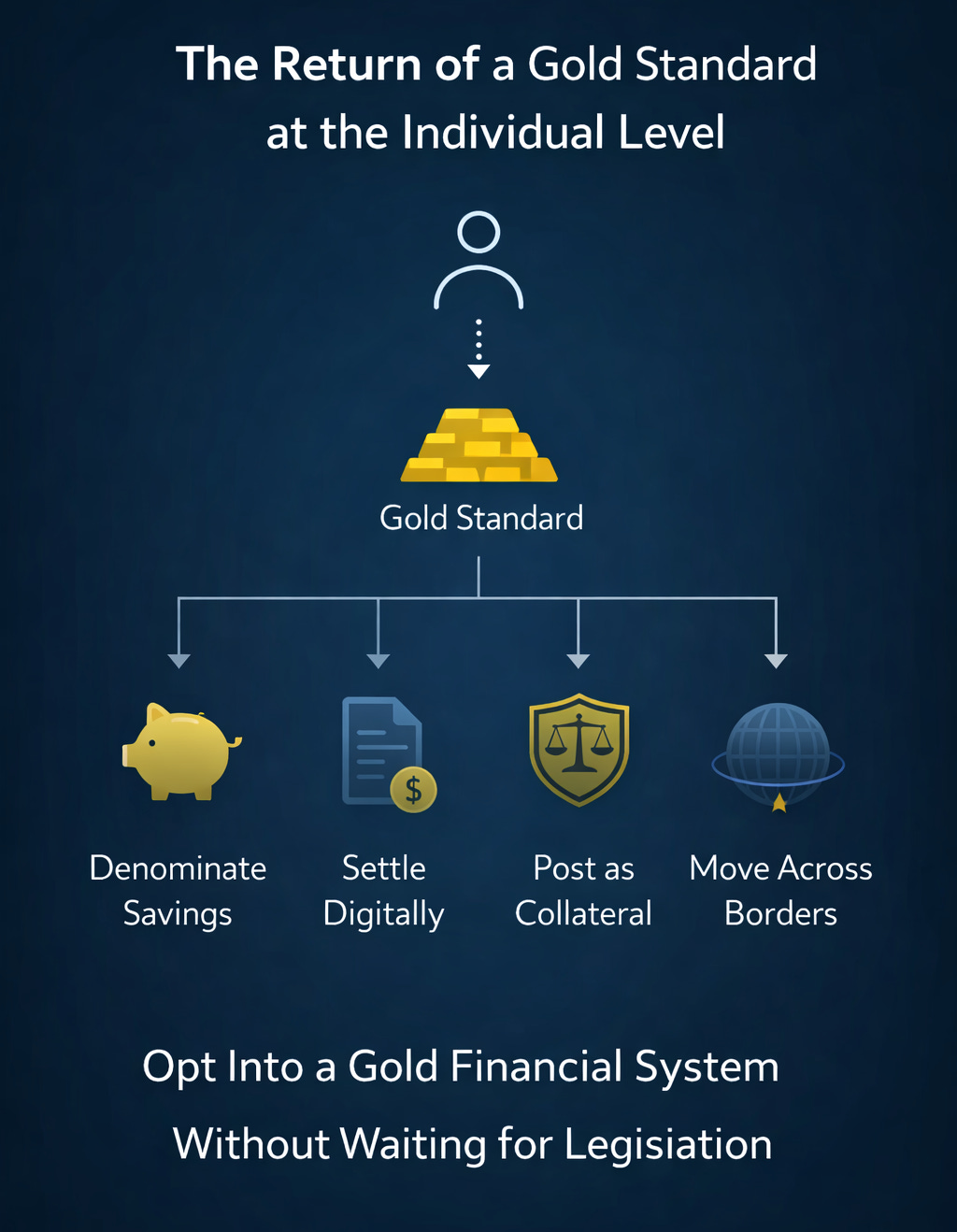

- Individuals can opt into a gold-anchored balance sheet without waiting for sovereign policy. essentially what stackers do, but with counterparty risk and collateralizability

- Tokenized gold meets the functional conditions of a modern gold standard: tight price tracking, stress resilience, and financial integration.

- The infrastructure exists; scale depends on adoption and adoption depends on Government “influence”.

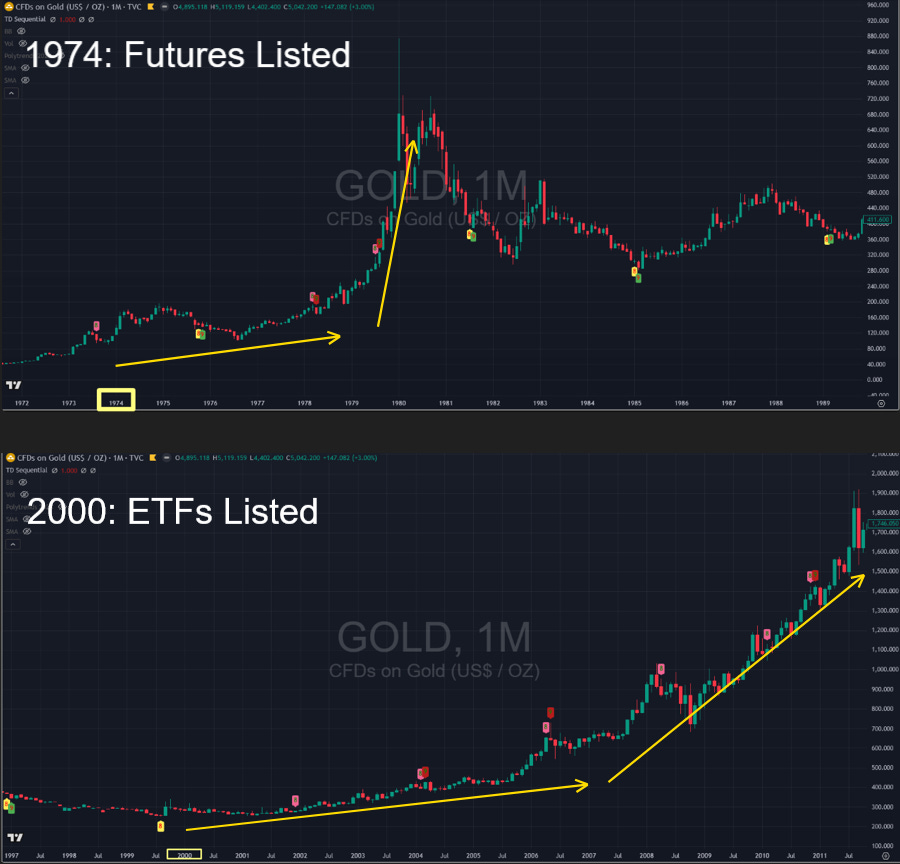

- Overall, it is a new ETF and will augur in a bigger bull market just as futures (1974) and GLD (2000) did before it. See pic…

Comment: A Gold Standard at the Individual Level

Authored by GoldFix

What makes this development described below consequential is not that governments have returned to gold. They have not. It is that individuals now can if it plays out.

A classical gold standard required sovereign enforcement of convertibility. Your currency was tied to gold because the state declared it so. In the digital form described in the paper, convertibility exists through custody, redemption, and arbitrage discipline. If you hold tokenized gold, your balance sheet is anchored to bullion regardless of what your domestic currency does.

That is monetary sovereignty at the personal level.

People can denominate savings in gold, as households in China already do legally.

Investors can settle digitally in gold, as multipolar settlement corridors such as mBridge suggest.

Buyers can post gold as collateral, consistent with our contention China will put Gold into REPO status

They can move value across borders in tokenized form, even if regulatory friction remains uneven across jurisdictions.

In effect, you can opt into a gold-referenced financial system without waiting for legislation.

Is it a perfect gold standard? No. It depends on custodians. It carries regulatory and issuer risk. It inherits gold’s volatility rather than the fixed parity of the pre-1971 era. But perfection was never the operative requirement. Functional discipline is. A parallel gold-referenced layer also introduces optionality for sovereign balance sheets, including the possibility of materially higher official gold valuations if policy direction continues to evolve.

The infrastructure now exists for a parallel monetary layer built on physical gold, continuously tradable, globally portable, and financially integrated. That changes the equation.

When viewed alongside reserve diversification, commodity securitization, digital settlement corridors, and multipolar trade experimentation, tokenized gold does not appear isolated. It appears synchronized.

A gold standard in the twentieth century was political. A gold standard in the twenty-first century may be elective.

If enough individuals, institutions, or regions choose that anchor simultaneously, the distinction between personal monetary sovereignty and systemic shift narrows.

The paper demonstrates feasibility. The market will determine scale. The case is interesting in that if you can use your gold as collateral in blockchain assets, would you not consider putting some of the bond money you have in it sepearte from your physical stacks?

Tokenized Gold and the Return of The Gold-Standard

The gold standard formally ended in 1971, yet gold never exited the monetary system. It migrated from anchor to asset; from official convertibility to voluntary reserve. The question posed by recent financial innovation is whether blockchain infrastructure allows gold to re-enter the system as a functional monetary reference without state decree. The paper’s proposition is not nostalgic. It is architectural.

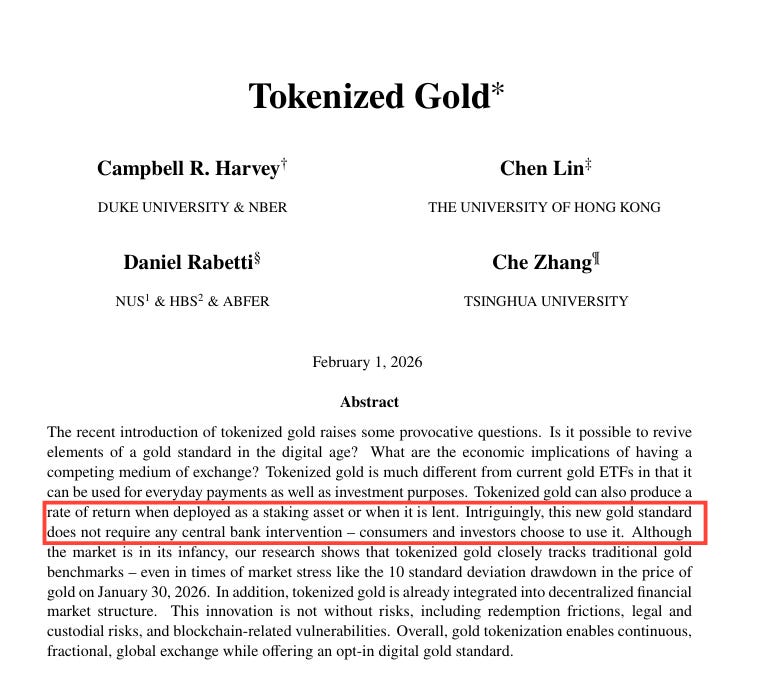

In Tokenized Gold, Campbell R. Harvey, Chen Lin, Daniel Rabetti, and Che Zhang examine whether tokenized gold instruments, specifically PAX Gold (PAXG) and Tether Gold (XAUt), satisfy the economic conditions required to revive elements of a gold standard in digital form . Their analysis focuses on pricing discipline, resilience during stress, and integration into modern financial infrastructure.

The conclusion is direct: tokenized gold enables the technical possibility of a user-selected, opt-in digital gold standard. The claim rests on evidence

I. Institutional Architecture: Gold on a Blockchain

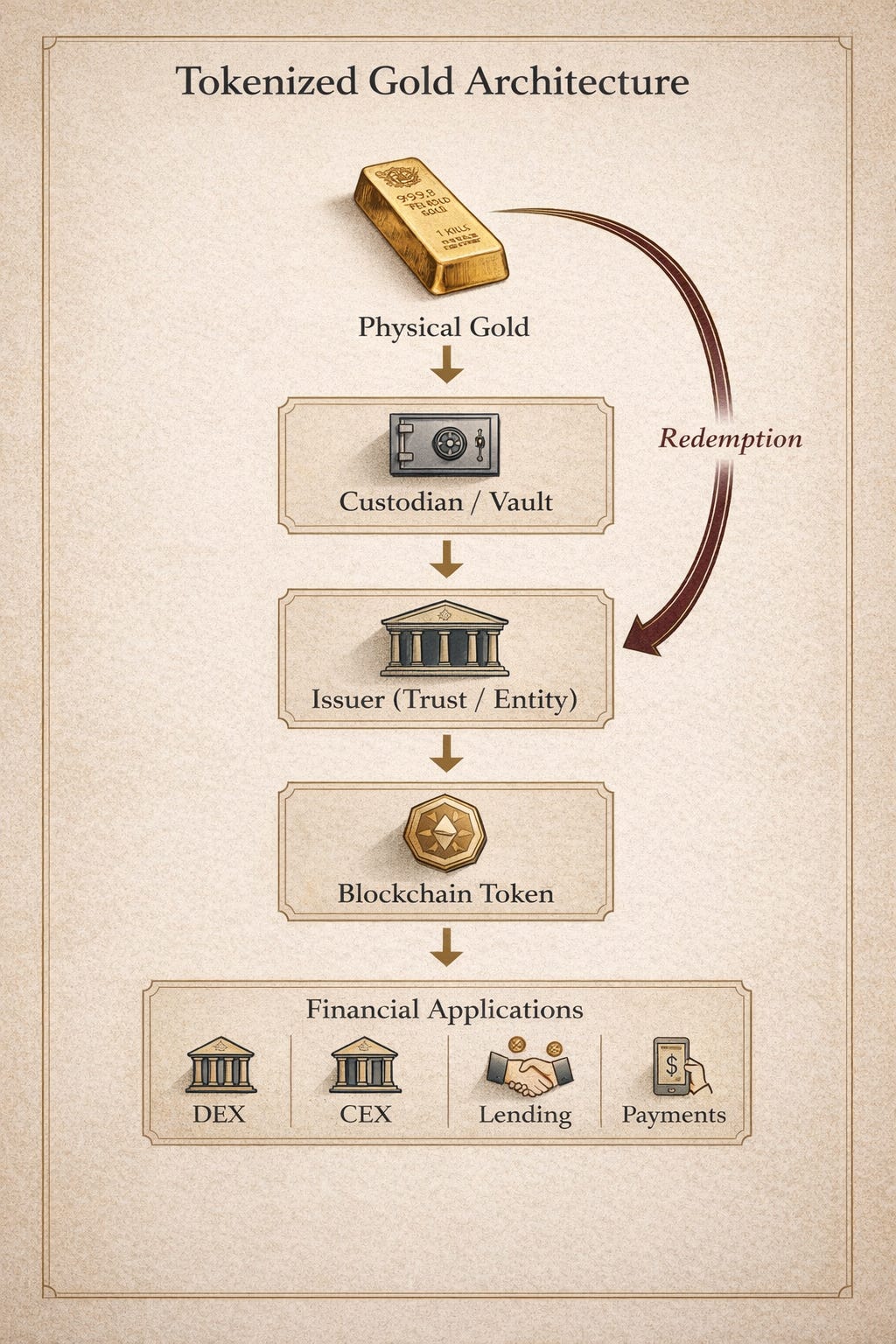

Tokenized gold replicates physical ownership through a digital wrapper. Each token corresponds to allocated physical bullion stored in vaults. Issuance and redemption mechanisms mirror those used by exchange-traded funds, though tokens circulate on blockchain networks rather than equity exchanges.

The institutional design rests on three pillars:

Custodied physical gold backing

Redemption mechanisms for large holders

Arbitrage discipline to maintain price parity

Unlike fiat-backed stablecoins, tokenized gold is pegged to a floating commodity price. Its value derives from global bullion markets rather than central bank policy. This distinction is central. Fiat stablecoins preserve currency pegs; gold tokens preserve commodity parity.

The trust structure varies across issuers. PAXG operates under a regulated trust framework with allocated bar-level ownership. XAUt relies on pooled claims governed by contractual redemption and custody arrangements. Both designs remain fundamentally trust-based. Blockchain ensures transferability; it does not eliminate reliance on vaults, audits, and legal enforceability.

This structure is the first requirement of a digital gold standard: credible backing tied to physical supply.

II. Pricing Discipline: The Peg to Gold

A gold standard, digital or otherwise, requires price integrity. If tokenized gold drifts materially from spot bullion, it cannot function as a reliable store of value or collateral base.

The paper documents strong co-movement between tokenized gold and traditional benchmarks including spot gold, COMEX futures, and GLD. Correlations of daily returns approach unity in the mature phase of the market. Tracking error remains within a narrow band, generally on the order of tens of basis points.

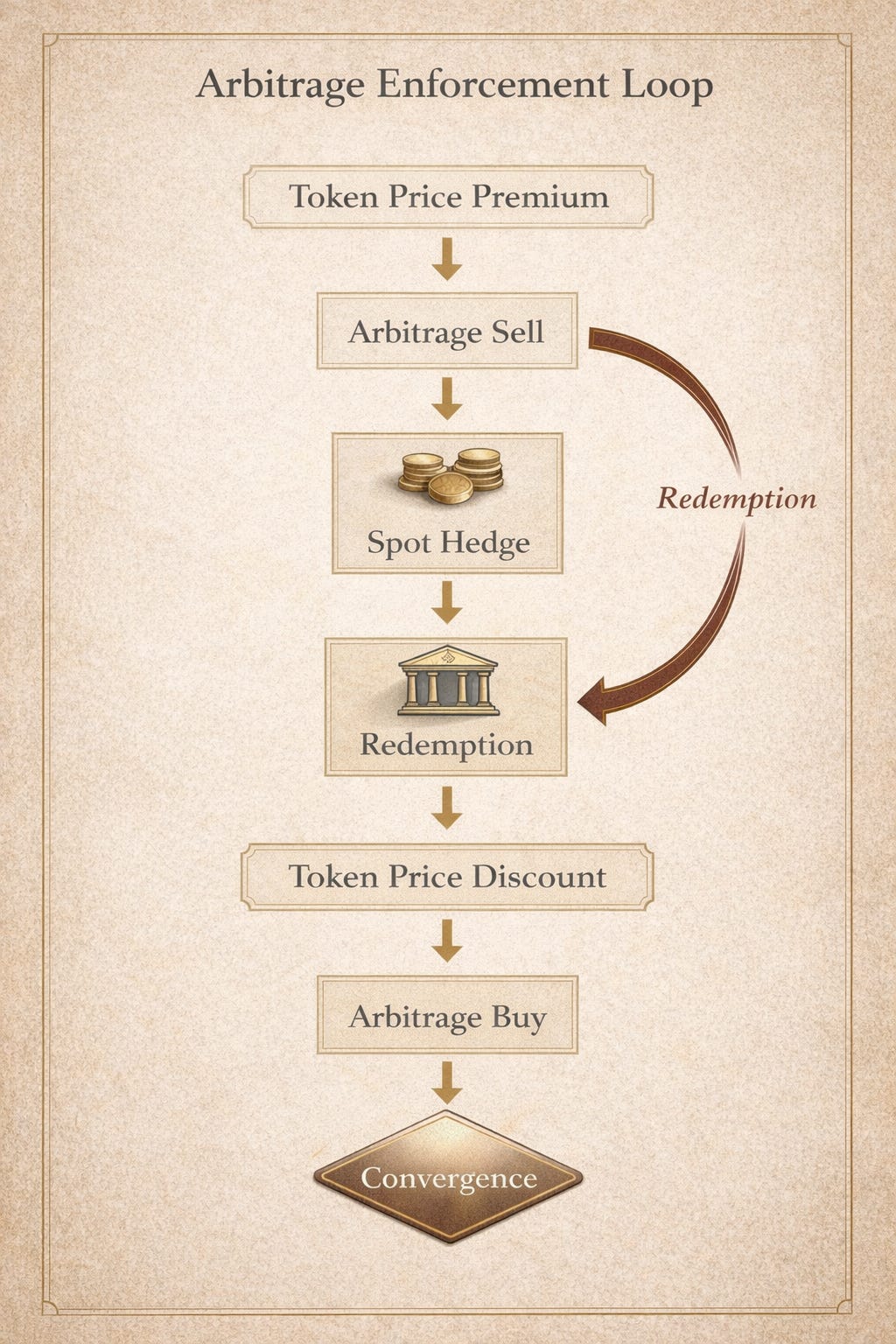

Temporary deviations occur, particularly during thin liquidity windows, yet they mean-revert. Arbitrage and redemption channels enforce discipline. When token prices trade above spot, market participants mint and sell. When below, they buy and redeem.

The authors further document an important evolution. Tracking efficiency improved materially between 2023 and 2025. Liquidity deepened. Spreads narrowed. Market microstructure matured. The digital wrapper did not detach from the underlying commodity; it became more tightly integrated with it.

Intraday analysis reinforces the finding. The tightest alignment occurs during U.S. afternoon trading hours when traditional gold markets are active. Deviations widen modestly during Asian sessions and weekend periods when off-chain hedging venues are closed.

This temporal pattern reveals something structural. Tokenized gold remains economically anchored to traditional gold liquidity. It does not fragment price discovery; it extends it.

A digital gold standard requires precisely this: continuity of price reference across infrastructures.

III. Liquidity Maturation and Market Structure

The study documents a shift from experimental micro-transactions toward economically meaningful transfers. Median transaction sizes increased dramatically in physical gold terms between 2022 and 2025. Activity concentrated in mid-sized and institutional-scale blocks rather than dust-level transfers.

Continues here