China Silver Fund "Revalued" Amidst Selloff

China Silver Fund Revalued, Investors to be Made Whole

GFN – BEIJING

In the wake of a dramatic 31.5% valuation-driven drop in China’s sole silver futures LOF earlier this month, 国投瑞银基金管理有限公司 on Feb. 15 unveiled a compensation and resolution plan aimed at addressing widespread investor losses and backlash.

The fund manager said it has devised a “special work plan” to protect investor rights, focusing on natural person holders who redeemed at the shockingly low net asset value after an extraordinary valuation adjustment. The scheme targets investors who submitted redemption orders from Jan. 30 afternoon through Feb. 2 and whose losses were magnified by the adjustment.

Under the plan, investors whose incremental loss due to the valuation shift beyond a capped 17% drop was under ¥1,000 will receive full compensation for that amount — a group that accounts for more than 90 % of redeeming holders. Those with larger losses will receive a base ¥1,000 payout plus a proportion of the excess loss, with details to be handled via an online process through an Alipay mini-program launching Feb. 26.

**Silver: Emergency Halt of UBS-China Fund Tied to Global Selloff

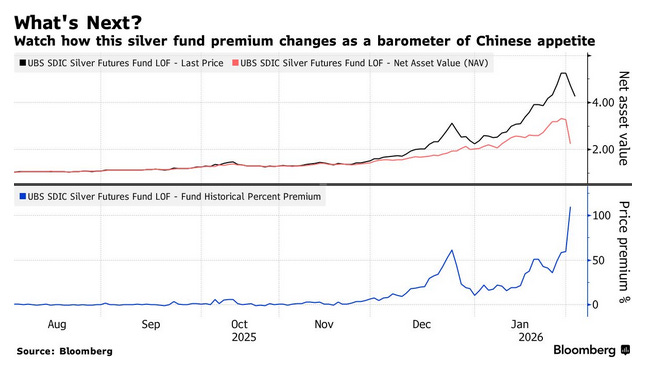

China’s Shenzhen Stock Exchange suspended trading for the entire day on January 30 in the UBS SDIC Silver Futures Fund LOF, according to an official fund announcement. The notice stated that trading would be halted from the market open through the close as part of exchange risk-control measures.

Read full storyThe turmoil began after the fund company revised its valuation methodology in response to extreme global silver price volatility far exceeding domestic Shanghai Futures Exchange limits, causing unit NAVs to plunge far beyond the expected 17 % daily limit. Multiple days of secondary-market trading halts and consecutive limit-down sessions left many investors unable to exit positions, fueling complaints and more than 17,000 collective grievances on consumer protection platforms.

Essentially the fund reaction was a rebuke of the SHFE 17% limits as those impeded its ability to execute exiting trades for investors. It is also believed by traders this situation was known and certain players with info gunned for the downside once the revaluation method was unveiled and profited from this revaluation insight by shorting global Silver futures.

UBS Silver Fund "Revalued" Amidst Silver Selloff pic.twitter.com/TZ4aeZ0ugB

— VBL’s Ghost (@Sorenthek) February 16, 2026