Ready For A Great Rotation

From AI Awe To Main Street Banks

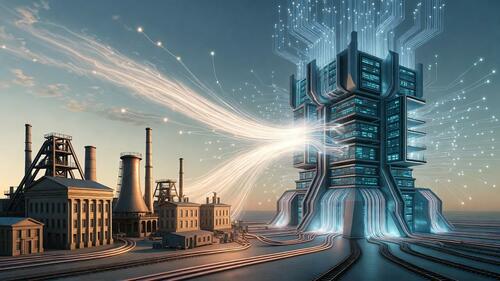

One of the most important ideas circulating on Wall Street right now isn’t about earnings beats, CPI prints, or geopolitical headlines. It’s about what finally ends the AI-dominated regime—and what takes its place.

As Michael Hartnett wrote in his latest Flow Show note (excerpted by Zero Hedge here 👉 https://www.zerohedge.com/markets/hartnett-ai-hyperscaler-announcing-capex-cut-will-trigger-next-great-rotation), the trigger for the next great market rotation may be far simpler than most investors expect:

An AI hyperscaler announcing a capex cut.

Hartnett’s argument is straightforward but powerful. The entire AI trade—Magnificent 7 leadership, asset-light dominance, and 2020s-style multiple expansion—now depends on ever-increasing capex. With hyperscaler spending projected to approach $740 billion in 2026, free cash flow is collapsing, balance sheets are levering up, and Big Tech is morphing from equity-like growth machines into credit-sensitive utilities.

Once capex growth slows, even marginally, the spell breaks.

And when that happens, leadership doesn’t just fade. It rotates.

Main Street vs. Wall Street

Hartnett’s broader framework is that 2026 is shaping up as a Main Street market, not a Wall Street one:

Small caps over mega caps

Banks over software

Materials, energy, and industrials over asset-light growth

Regions over global platforms

That rotation is already visible in relative performance. Since the October Fed pivot, assets tied to real economic activity—silver, industrial metals, regional banks, small-cap value—have quietly outperformed the icons of the prior cycle.

What’s notable is that this isn’t just a macro narrative. The tape is starting to confirm it.

The Chart With The Most Bullish Implications

That brings us to a technical observation that deserves more attention.

In a recent X article, market technician J.C. Parets argued that the single chart with the most bullish implications for U.S. equities right now isn’t AI, semiconductors, or mega-cap tech.

— J.C. Parets (@JC_ParetsX) February 15, 2026

It’s small-cap financials.

The small-cap financials index within the S&P 600 has spent nearly a decade building a base—ten years of compression, frustration, and sideways action. These are regional banks and economically sensitive lenders, the exact group that typically sniffs out trouble first when credit conditions deteriorate.

And yet they’re now pressing against the top of that long-term range.

Parets’ point is subtle but critical: If this group resolves higher, it becomes very difficult to maintain a structurally bearish view of the market. Small-cap financials don’t break out in environments of collapsing growth or systemic stress. They break out when credit conditions are improving beneath the surface.

In other words, this is not a sideshow. It’s a potential engine.

When Macro And Screens Agree

What’s interesting is that this same theme is now showing up in systematic screens—not narrative-driven ones, but quantitative filters that combine valuation, fundamentals, and technicals.

One Chartmill screen we’ve been running at Portfolio Armor—informally dubbed “Really Time To Buy”—requires stocks to meet all of the following criteria:

PEG (5Y) ≤ 1

PEG (Next Year) ≤ 1

Options traded in the U.S.

Technical Rating ≥ 6

Setup Rating ≥ 7

U.S.-listed only

Out of thousands of U.S. stocks with options trading, only ten currently pass this screen.

And three of them are small-cap banks.

That convergence matters. Screens like this are deliberately restrictive; they’re designed to surface situations where valuation, balance-sheet quality, and price action all align at the same time. When a cluster appears inside a single, economically sensitive industry—especially one that’s been left for dead for years—it tends to coincide with regime shifts already underway.

Watching The Rotation In Real Time

None of this means AI disappears overnight. Regime changes rarely work that way. Leadership fades, volatility increases, and capital starts searching for the next place where fundamentals, policy, and price trends align.

Hartnett’s macro lens says that place is Main Street. Parets’ charts say small-cap financials are waking up.

And the screens suggest that, quietly, the opportunity set has narrowed to a handful of names where everything lines up.

Later today, we’ll be placing an options trade on the strongest of those small-cap banks.

If you'd like a heads up when we place it, you can subscribe to the Portfolio Armor Substack below.

No promises, no hype—just a signal when the trade goes on.

Sometimes the biggest rotations don’t announce themselves with headlines.

They show up first in places most investors stopped looking years ago.