The Current Economic Picture

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 12,000 subscribers at MktContext.com for our weekly deep dives and analysis!

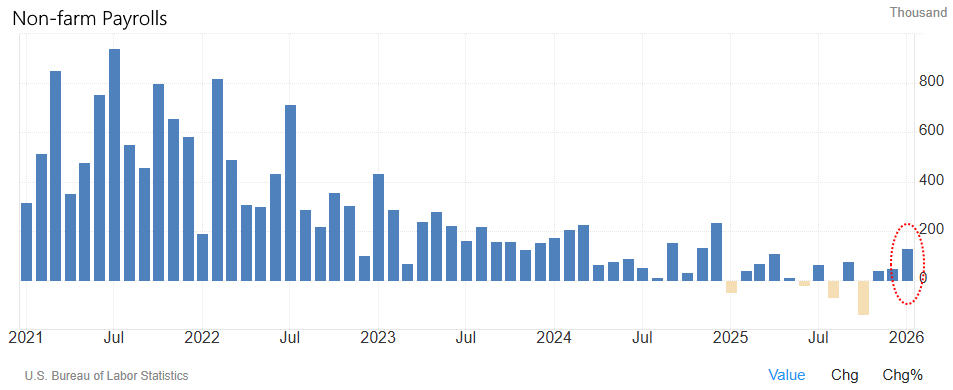

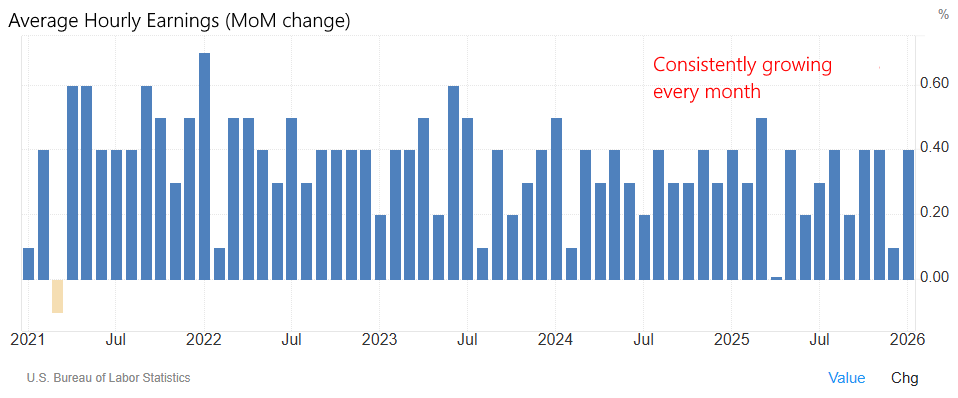

Positive economic data continued to roll in. Last week we got payrolls, unemployment rate, and hourly earnings all surprising positively.

For a long time, the market has been worried about slowing jobs data. But those figures are muddied by changes in labor supply, labor hoarding, immigration cuts, and post-Covid normalization. As a result they have been misleading economists to predict imminent recession, even as the economy proves to be resilient.

A better indicator is Average Hourly Earnings. The logic is simple — this metric captures hourly pay, which employers will cut in a downturn. Instead, AHE has been consistently growing around 0.3% every month. There hasn’t been a single negative print since 2021:

Taking this into account, all of a sudden the whole picture becomes clear: the US economy is currently experiencing a recovery. This is why recession is a very unlikely outcome at the moment.

Unfortunately, good news is bad news as positive economic data means less likelihood for rate cuts. That’s why the market sold off on the news. Rate-cut odds for the entire year 2026 fell sharply, as shown below. But we think the market has it wrong, as Kevin Warsh is likely to cut rates anyway, given his political/economic leanings. We did a deep dive on Warsh here.

For now, the Economic Surprise Index is moving higher, which is what investors want to see to confirm the economic reacceleration thesis. As long as this blue line is moving up and to the right, the economy is getting better and better.

Continue reading at MktContext.com to see our trades and portfolio.

Join 12,000+ macro investors who get these insights before the mainstream media catches on!