Goldman: Gold Dealers Gamma-Squeezed in January

Insurance Buyers, Gamma-Squeezes, and the Structural Bid Under Gold

Authored by GoldFix

The bank attributes the renewed momentum in gold to a convergence of private investors and central banks competing for limited bullion supply.

“Private investors joined central banks in competing for the same limited gold bullion.”

Two forces are identified behind private investor participation. First, Federal Reserve rate cuts reduce the opportunity cost of holding gold. Second, fiscal sustainability concerns in Western economies have revived what Thomas described as a debasement trade.

“One way of expressing this debasement risk is through buying gold call options.”

Call Options and Self-Reinforcing Rallies

Goldman: The Bullion Banks were Gamma-squeezed in January

— VBL’s Ghost (@Sorenthek) February 17, 2026

(ht ZH) pic.twitter.com/hgUXOg6fr4

“As prices are going higher and higher, dealers are buying more and more gold.”

As dealers hedge short call exposure, they purchase underlying gold, reinforcing upward momentum. This dynamic persisted until late January, when policy communication from Fed Governor Kevin Warsh eased fiscal concerns, prompting a reversal. Dealer hedging then shifted from buying strength to selling weakness, contributing to cascading stop-loss activity.

Goldman Sachs continues to see upside potential. The bank’s base case projects gold reaching $5,400 by end-2026.

“We’re still bullish gold… but we do see significant upside to that forecast.”

The forecast assumes steady central bank purchases and incremental private demand linked to rate cuts. It excludes additional diversification flows, which Thomas suggests could materially expand upside risk.

Gold Versus a Commodity Super Cycle

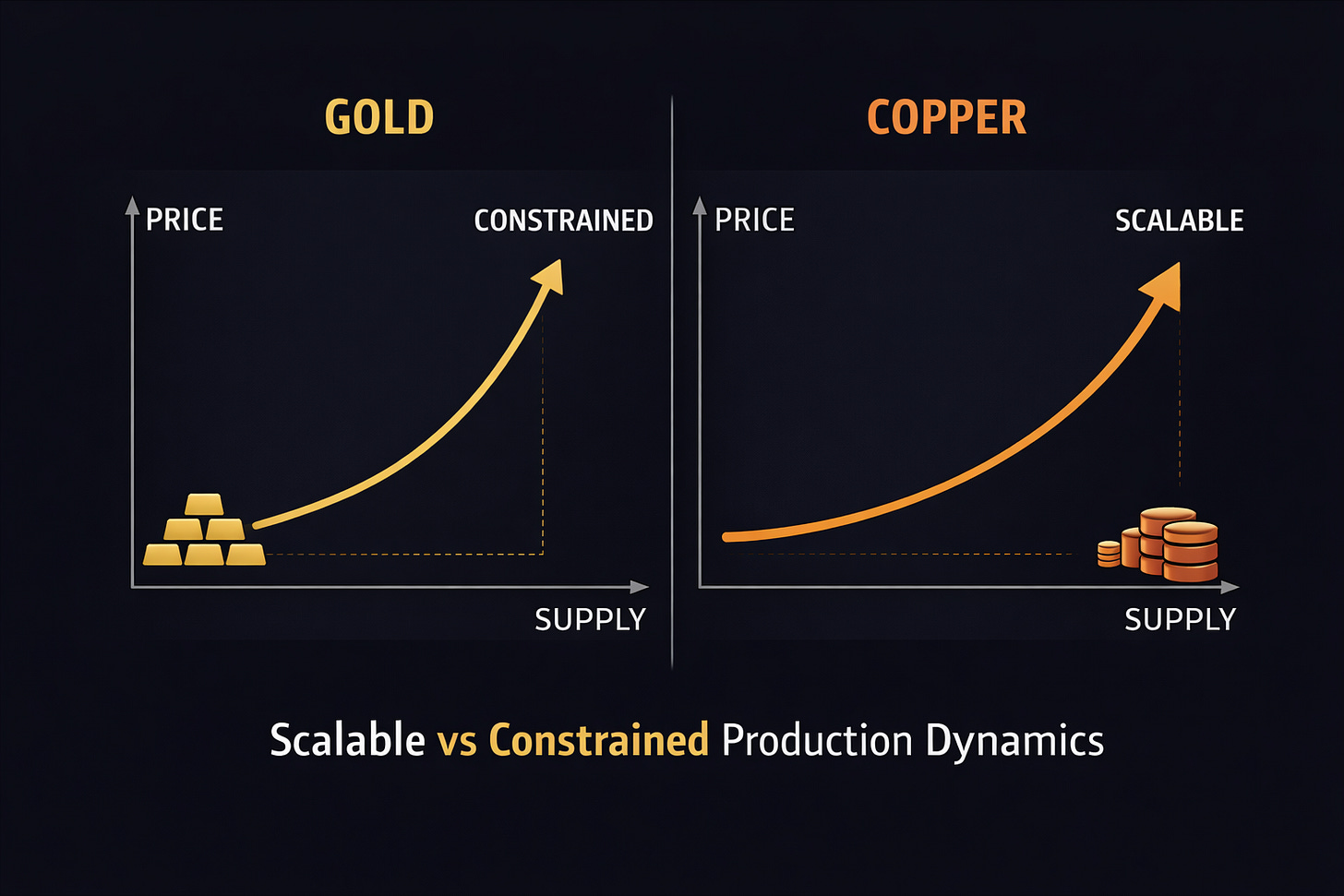

The discussion extended to copper and broader commodity markets. Thomas distinguishes gold’s rally from industrial commodity price gains.

She notes that geopolitical insurance demand, including stockpiling, tariffs, export controls, and state-backed investment, is spreading across commodity markets. These actions create fragmentation and volatility. However, she does not anticipate a sustained commodity super cycle.

Gold differs structurally.

“Gold is something that you cannot scale. Production is very constrained.”

Continues here